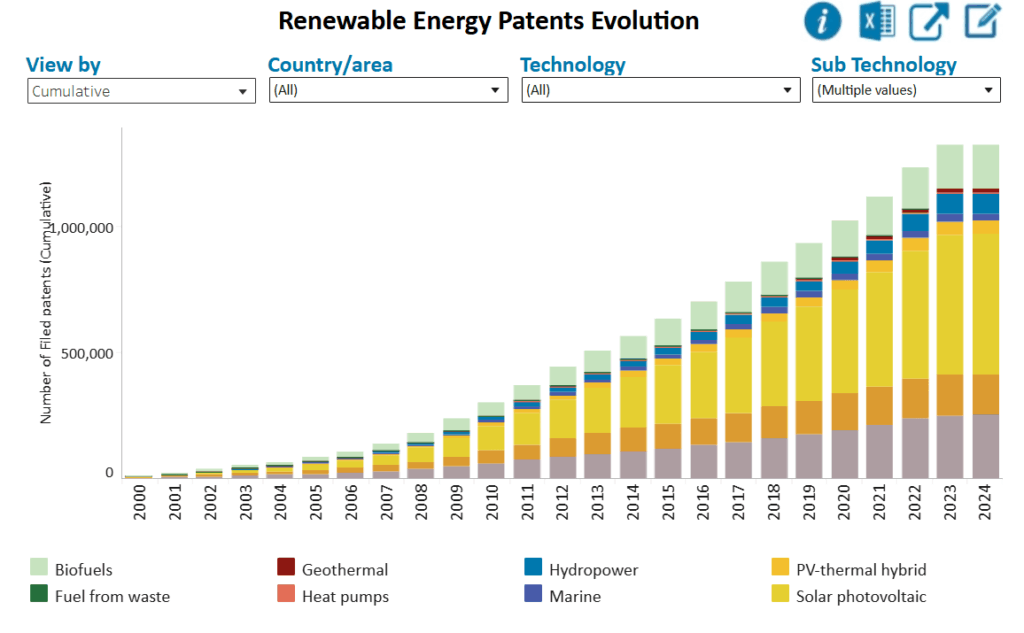

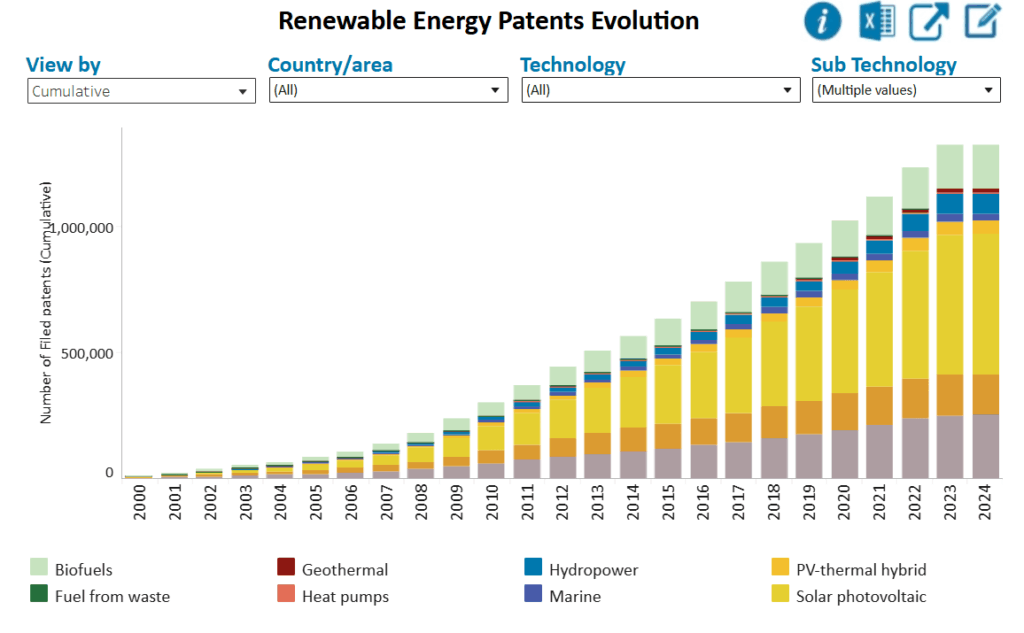

Solar and wind continue to dominate patent filings, accounting for 58% and 19% of renewable energy patents filed in 2024, respectively (See adjacent graph; source).

In celebration of our 115th anniversary, we are proud to have planted 115 trees in partnership with Trees for Life. Each tree symbolises a year of growth, resilience, and our continued commitment to building a better, greener future.

As we celebrate our 115th anniversary, we have a valuable opportunity to reflect on our history and acknowledge the people, milestones and moments that have helped shape our firm. It is also a time in which we can look ahead with purpose, recognising the vital role that we play in shaping a more sustainable world and promoting positive change for future generations.

At Mathys & Squire, we firmly believe that protecting the environment is not just a responsibility, but a necessity. Through initiatives like this, and through the continued integration of environmentally conscious practices in our day-to-day operations, we are committed to contributing to a more sustainable world.

Click here to find out more about our CSR initiatives.

World Environment Day, held each year on 5 June and led by the United Nations, raises awareness of the threats facing our planet — and what we can do to address them. In recognition of this day, we explore how the dream of limitless clean energy may be closer than we think. While solar and wind have laid the foundation, newer technologies like hydrogen and nuclear fusion are gaining momentum — and at the heart of their progress lies innovation and intellectual property (IP).

Global energy demand is soaring — driven by the rise of electric vehicles, energy-intensive manufacturing, and the rapid expansion of AI, data centres and digital infrastructure. Electricity demand alone has grown at twice the rate of overall energy consumption over the past decade. By 2030, it is projected to rise by 6,750 terawatt-hours — more than the current combined usage of the US and EU. Data centres alone could account for 20% of that growth.

On top of this, electricity production remains the largest source of global CO₂ emissions. Without a rapid shift to cleaner energy sources, meeting climate goals over the next five to twenty-five years will be all but impossible.

Fortunately, change is in motion. As we discussed in our 2025 Clean Tech Trends report, the renewable energy sector is accelerating. Global leaders — from policymakers to scientists — are striving to decarbonise the energy system while also tackling energy poverty, aiming to deliver clean, affordable power for all.

Solar and wind continue to dominate patent filings, accounting for 58% and 19% of renewable energy patents filed in 2024, respectively (See adjacent graph; source).

But despite their success, intermittent supply and grid strain limit their scalability. The question now is: what comes next?

Hydrogen is emerging as one of the most promising alternatives. Hydrogen fuel cells produce electricity by combining hydrogen and oxygen — emitting only water and heat. These cells can be integrated into existing infrastructure, making them highly adaptable.

Beyond cutting emissions, hydrogen offers an opportunity to decentralise power generation, which could ease grid pressure and benefit regions lacking reliable solar or wind resources. Companies like GeoPura argue that hydrogen could be the answer to both the AI energy boom and the electrification of transport, especially in the face of projected grid connection delays of up to 15 years.

Government and industry support is also growing. A 2024 white paper from Bosch, Centrica, and Ceres outlined hydrogen’s role in decarbonising UK power through solid oxide fuel cells (SOFCs). And yet, a challenge remains: while hydrogen fuel cells are green, the hydrogen used to power them often isn’t. As of 2024, only around 1% of global hydrogen is produced via low-emission methods like electrolysis — the rest is derived from fossil fuels. Scaling up ‘green hydrogen’ production will be crucial.

Momentum is building. In 2024, the UK committed £2 billion to fund 11 commercial electrolytic hydrogen projects, attracting an additional £413 million in private investment. In the US, Electric Hydrogen is delivering a 100MW electrolyser system capable of producing 45 tonnes of hydrogen per day with minimal emissions. According to the International Energy Association’s Global Hydrogen Review 2024, annual production of low-emissions hydrogen could reach 49 Mtpa H2 by 2030, up from 1 Mtpa H2 in 2024.

The pace of innovation is clear — but sustained progress requires more than technology alone.

Looking ahead, nuclear fusion could become the ultimate clean energy source. By fusing light atomic nuclei — typically deuterium and tritium — fusion releases vast amounts of energy without carbon emissions. One gram of fuel can generate the same energy as 20 tonnes of coal. With deuterium abundantly available in seawater and new tritium breeding techniques in development (e.g. by the likes of Oxford Sigma), fusion promises safe, scalable, and virtually limitless power.

Compared to nuclear fission, fusion produces significantly less radioactive waste, with materials becoming safe in around 100 years — not thousands, and carries a much lower risk of catastrophic failure.

Once considered a far-off fantasy, fusion is now edging closer to reality. In 2025, the EU unveiled its Competitiveness Compass, a roadmap that includes a new fusion strategy and public-private partnerships. The ITER project in France continues to make progress, while the UK has committed £410 million to develop the STEP prototype fusion plant, expected to be operational in the 2040s.

As hydrogen and fusion technologies scale up, the role of intellectual property becomes more critical than ever. Both fields face substantial barriers: long R&D timelines, high capital costs, and complex global supply chains. In this environment, IP provides innovators with a strategic advantage — helping protect their ideas, attract investment and support market growth.

In the hydrogen sector, around half of international patent families in the period 2011-2020 related to hydrogen production technology, with most of the patents filed in 2020 shifting toward greener hydrogen production methods.

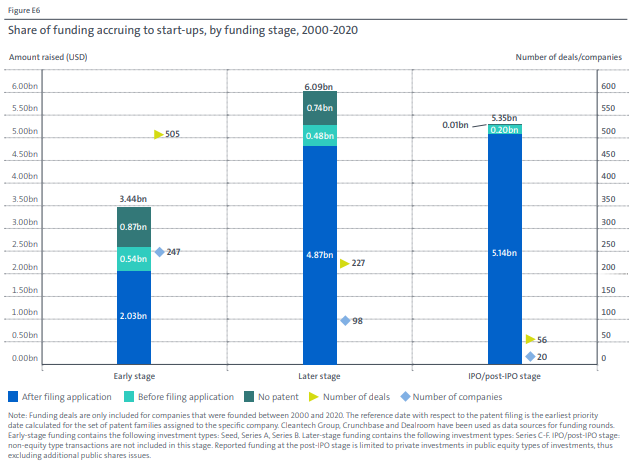

It has been found recently that over 80% of late-stage venture capital funding in the hydrogen sector has gone to companies with existing patent applications. (See above graph; source)

In comparison, in the fusion space, innovators have commonly eschewed the pursuit of patents, believing commercial fusion to be too far off for a 20-year patent term to be relevant. That logic is now shifting, particularly as US-based fusion firms with robust patent strategies dominate funding rounds.

IP does more than protect inventions — it creates the legal scaffolding that enables meaningful collaboration. In frontier technologies like hydrogen and fusion, where development costs are high and technical expertise is globally dispersed, innovation increasingly happens across borders and between sectors. Whether it’s a private company building on public R&D or international teams co-developing fusion reactors, clear and enforceable IP rights are essential to align incentives, manage shared risk and ensure fair returns. In this way, IP acts not as a barrier, but as a bridge — fostering the trust needed to turn bold ideas into shared progress.

In emerging clean energy sectors such as hydrogen and fusion, IP will serve as a key instrument of market confidence. Hydrogen and fusion technologies are often capital-intensive, complex, and years away from profitability. For investors, robust IP portfolios will provide assurance that a company’s innovations are both unique and defensible — that they are not merely speculative science projects, but investable propositions. Patents thus have a key role in transforming R&D into tangible, protectable assets, offering a degree of certainty in an otherwise uncertain innovation landscape. With greater certainty provided, IP in turn can help channel private capital into high-impact green technologies, accelerating their path from lab bench to power grid.

This World Environment Day, we find ourselves at a turning point. Hydrogen and fusion have the potential to reshape the global energy landscape — but realising that promise will require coordinated innovation, investment and policy support.

IP will play a central role. Not just as a tool for protection, but as a foundation for confidence, cooperation and commercialisation. To fully unlock its potential, we must also embrace IP models that support responsible licensing, open innovation and global access. If we succeed, IP may become one of our most powerful tools in the fight against climate change.

Managing IP has published its 2025 edition of the IP STARS legal directory. The directory acknowledges the most exceptional practitioners across a range of IP practice areas and more than 50 jurisdictions.

IP STARS is the leading specialist guide showcasing the legal practitioners best-equipped to handle contentious and non-contentious issues within intellectual property law. The research analysts determine the annual ranking using firm submissions, client interviews and online surveys.

We are delighted to announce that Partners Paul Cozens and Hazel Ford have been named as ‘Patent Stars.’ Out of our Trade Mark team, Partners Gary Johnston and Rebecca Tew have been recognised as ‘Trade Mark Stars.’ In addition, Consultant Partner Jane Clark and Partners Philippa Griffin, Nicholas Fox, David Hobson, Martin MacLean and Andrew White have been praised as ‘Notable Practitioners.’ Partner Laura Clews has also been newly featured as a ‘Notable Practitioner.’

The 2025 Rising Star rankings are due to be released in September 2025.

The firm is also pleased to have maintained its ranking ‘Trade mark prosecution’ in the 2025 directory. The firm rankings for ‘Patent prosecution’ will be announced at the end of the month.

For more information and to view the rankings in full, visit the IP STARS website here.

We are delighted to announce the appointment of senior trade mark attorney Claire Breheny as our new Head of Trade Marks.

Joining from Stobbs, where she served as an IA Director and Head of Support, Claire has nearly two decades of experience working across trade marks, registered and unregistered designs, copyright, and cross-border portfolio management and enforcement.

Recognised in leading industry rankings such as the World Trademark Review 1000, Legal 500, World Intellectual Property Review Leaders and Thomson Reuters’ Stand-out Lawyers 2024 and 2025, Claire has consistently been acknowledged for her expertise, and she is widely regarded as being at the top of her profession, both by peers and clients.

Claire is also a member of the Intellectual Property Regulation Board’s Joint Disciplinary Panel, reflecting her status as a trusted figure in the profession.

Claire is known for her strategic insight and ability to manage complex multi-jurisdictional disputes, including strategic use of litigation where needed, and leading global settlement negotiations for her clients. She has worked extensively with clients with a worldwide presence, and specialises in acting for UK brands with international portfolios and US clients targeting UK and EU markets.

Partner Gary Johnston says: “We are progressing our strategy to further develop and grow our trade mark capabilities to attract more top-tier clients and enhance our reputation as a leading player in the IP legal space. Claire’s appointment is the next big step in this process.”

Claire says: “I am delighted to join Mathys & Squire at an exciting time for the firm. I bring a wealth of experience advising on global trade mark portfolios, managing complex multi-jurisdictional disputes, and developing commercially focused IP strategies.”

“I am looking forward to helping strengthen the firm’s reputation in the trade mark space, growing the team, and deepening relationships with clients across key international markets.”

This press release has been featured in The Trademark Lawyer, World IP Review, Commercial Dispute Resolution and Managing IP .

We are delighted to announce that we have received the ‘Intellectual Property Law Firm of the Year – London 2025’ award, granted by Legal Insider.

The Legal Insider Awards celebrate firms that demonstrate outstanding legal expertise, client service and contribution to the legal sector. The awards are decided by an expert panel of judges who evaluate all of the available data to make the most fair and suitable decision for each category.

To be selected for this award is an honour and a great reflection of the exceptional work of our team. This recognition also highlights our ongoing commitment to excellence and leadership in the field of intellectual property law.

Find out more about our award here.

Our Trade Marks team share their advice on managing your trade mark portfolio to avoid revocation after the changing regulations post-Brexit.

Following Brexit, EU registrations ceased to protect trade marks in the UK after “IP Completion Day” on 31 December 2020, the end of the 11-month period after 31 January 2020 during which the UK continued to be subject to EU rules. To address this, the UKIPO, under the Withdrawal Agreement Act, automatically created comparable (cloned) UK registrations for all EU trade marks registered before 1 January 2021.

This created a split in protection across jurisdictions, with a need for duplicated efforts to maintain enforceable trade mark rights. In the UK, a registered trade mark must be used in the UK within 5 years from the date of registration in respect of the goods/services it covers. An EU trade mark must be used in the EU within 5 years of its registration.

Before Brexit, use in the UK of a mark registered in the EU would typically constitute genuine use of an EU registration. Similarly, use in the EU before IP Completion Day is relevant when assessing use of a UK cloned right.

However, following Brexit, any use of a UK cloned mark in the EU after 31 December 2020 no longer counts as use of the UK registration. Similarly, only use of a mark within the EU (i.e. not the UK) would constitute genuine use of an EU registration for that mark.

As such, cloned UK registrations created due to Brexit may be at risk of revocation after 31 December 2025 if they have not been used prior to this date in the UK for the goods/services covered by the registration. Moreover, owners of UK cloned registrations will no longer be able to rely on use of the mark in the EU when proving use of those registrations in opposition proceedings directed to UK applications filed after 31 December 2025.

We therefore recommend that clients review their UK and EU trade mark portfolios to determine whether their registered marks have been used in the UK or EU, respectively.

We can assess your UK and EU trade mark portfolios, and discuss with you the extent of use in relevant jurisdictions for all registered goods and services.

We can advise on the benefit of filing new trade mark applications where a registered mark has not been used for specific goods or services in either the UK or EU. Such advice would be provided on the basis that trade mark owners should mitigate the risk of new applications being considered to have been filed for the purposes of “evergreening”, i.e. filed for the purpose of circumventing the requirement for proving use of registrations. (See our article on Hasbro’s trade mark filing strategy which was ruled as an abuse of law: “No Get out of Jail Free Card for Hasbro.”).

Visit our dedicated trade mark page here to learn more and meet our team.

Ascending to Gold Tier this year, Mathys & Squire is thrilled to be ranked in the 2025 edition of IAM Patent 1000: The World’s Leading Patent Professionals.

IAM is known for being one of the most important tools for ascertaining world-class private practice patent expertise. The directory identifies leading firms and individuals based on extensive qualitative research, from their abilities and market presence to the complexity of their work. Only those with exceptional skills and deep insights into patent matters are featured in the directory.

This year, our firm has been ranked in the gold tier for the first time. This reflects the positive feedback we have received from clients upon meeting their complex demands with deftness and efficiency.

We have been recognised as a “solid and reliable firm that is absolutely first class.” Our team has also been praised: “The team are not only helpful and attentive but also go above and beyond to meet client needs. They offer extensive legal and technical expertise, and possess a deep understanding of the entire spectrum of intellectual property. This enables them to provide comprehensive, strategic and high-quality advice.”

In addition to our firm ranking, thirteen Mathys & Squire attorneys have been recognised as “Recommended Individuals.” This continues their acclaim from last year.

You can see our ranking on the IAM website here.

Mathys & Squire Partner Edd Cavanna has been featured in Practical Law with an article on the restrictive nature of the UK’s patent assessment framework in the field of AI and quantum computing.

Read the article below.

This article first appeared in the June 2025 issue of PLC Magazine.

In recent years, the IT sector has grown rapidly, with two strong drivers being AI and quantum computing (see box “What is quantum computing?”). In June 2017, PwC’s Global Artificial Intelligence Study estimated that AI could boost the world economy by $15 trillion by 2030 (www.pwc.com/gx/en/issues/analytics/assets/pwc-ai-analysis-sizing-the-prize-report.pdf). In April 2024, McKinsey & Company’s Quantum Technology Monitor reported that the quantum computing industry alone could add around $2 trillion to the world economy within a decade (www.mckinsey.com/capabilities/mckinsey-digital/our-insights/steady-progress-in-approaching-the-quantum-advantage).

While it is easy to view this growth solely through a financial lens, the implications reach much further. It is no exaggeration to say that the IT sector is on the cusp of a paradigm shift. The UK needs a robust strategy to capitalise on its strong academic sector. Driving innovation in the IT sector is important both for national security and to position the UK as a world leader. Part of this strategy will involve ensuring that innovators are able to corner the market in their respective fields.

While there are many social and political factors that may contribute to this strategy, this article focuses on the interplay between intellectual property law and the IT sector. In particular, the ability to patent technological inventions is a core factor in the attractiveness of both investment in, and the operation of, innovative technology solutions.

The current UK framework for patenting AI and quantum computing inventions risks falling out of date and making the UK less attractive for innovators. The UK must take steps to update the patent assessment framework in order to realise the benefits of these exciting technological advances.

A historical view

The present situation can be traced back to 1977, when the UK was heavily involved in negotiating the European Patent Convention (EPC), which is the legal text that provides for patents to be granted centrally by the European Patent Office (EPO) and validated across Europe. The EPC required each signatory to harmonise its law so that there could be no disagreement regarding the national validity of the centrally granted patents.

Patent law in the UK was last substantially updated by the Patents Act 1977 (1977 Act), a large part of which was intended to harmonise UK patent law with the EPC. It was also at this time that the question arose of whether, and to what extent, software should be patentable. Essentially, the 1977 Act sought to delimit generic software, which was intended to be excluded from patentability, from software that is directed to some technical purpose, which could be protected.

At that time, it was not possible to predict that the IT boom of the 80s and 90s was just around the corner, let alone foresee the more recent progress made in AI and quantum computing. Software was reasonably perfunctory and seemed to be adequately protected by copyright law. Nevertheless, the drafters of the EPC did consider that there might be future developments and included a proviso that software would only be excluded from patentability to the extent that the patent application related to software “as such” (see feature article “Artificial intelligence: navigating the IP challenges”, www.practicallaw.com/w-015-2044).

Over the following years, both the UK Intellectual Property Office (IPO) and the EPO developed case law to try to delineate the boundaries of the “as such” clause. While each body went through periods of greater or lesser enthusiasm for software patents, and each developed its own framework for assessing compliance, the two systems remained in remarkably close agreement on what should be allowed at any given time. This was crucial in order for patent holders and their competitors to have reasonable certainty in the validity of patents in the UK, irrespective of whether they were granted by the IPO or the EPO.

The current situation

From the perspective of patent attorneys using the system, it has felt like the IPO and the EPO have been diverging on their approach for the past few years. This divergence came into sharp focus with the explosion of innovation in the fields of AI and quantum computing.

When a new technology causes rapid developments, it is understandable that patent offices become more conservative, as has happened in this case. In short, they are concerned that patents will become too easy to obtain if patent offices become dazzled by shiny new technology which, as it achieves what was previously impossible, can seem more technical at the time of invention than it may later seem with hindsight.

As each new technology gains importance, it is vital that patent offices play their core role in encouraging innovation. Both the IPO and the EPO have, in essence, attempted to fit these new technologies into their existing frameworks for assessing software. They are necessarily bound not just by their (nominally harmonised) legislation, but also by the nearly 50 years of case law interpreting the legislation. In each case, the view appears to be that inventions in AI or quantum computing can be protected. However, the European framework has seemingly led to a more receptive system where it appears that, for the time being at least, there is better engagement with new technologies from the patent examiners.

This has meant that applicants are more attracted to the European patent system than the UK system. In addition, the European system allows for protection in up to 45 jurisdictions. Furthermore, as highly technical fields such as AI and quantum computing tend to rely on international talent, the conclusion is clear: in order to become a world leader in these technologies, the UK will need to persuade talent to come, and to stay. The UK must provide its businesses with legal certainty and protection.

During 2025, the Supreme Court is due to hear arguments about the patentability of software in the long-running proceedings in Comptroller-General of Patents, Designs and Trade Marks v Emotional Perception AI Ltd ([2024] EWCA Civ 825; see News brief “Artificial neural networks: Court of Appeal examines patentability”, www.practicallaw.com/w-044-2469). In this case, the IPO refused a patent application on the grounds that the relevant technology, which recommended music tracks based on an “emotional similarity” with other music tracks, was mere software.

Emotional Perception is interesting because the arguments presented cast doubt on the meaning of “a program for a computer” in section 1(2)(c) of the 1977 Act. In cases where the invention is, or is implemented in, a neural network, a part of the invention is encapsulated in the weights learned by the nodes of the network. It is not wholly apparent that this is best viewed as either software or hardware. It is encouraging that the IPO has engaged with the judicial process to help bring clarity to the situation.

While no corresponding case is working through the courts for quantum computing, in January 2025, the IPO updated its guidance to simply state that quantum computers should be treated in the same way as classical computers (www.gov.uk/government/publications/examining-patent-applications-relating-to-artificial-intelligence-ai-inventions).

While this may be true in a very broad sense, in that the quantum computing system is performing technical processes to qualify for patentability, it largely discounts the core features that make quantum computing so powerful, such as parallelism and superposition states. In practice, this could result in significant restrictions for patenting quantum computing software.

The difficulty of patenting quantum computing software is demonstrated by some recent Hearing Officer decisions at the IPO in which the special quantum processes were given short shrift (River Lane Research Ltd, BL O/130/22; Odyssey Therapeutics UK Limited, BL O/1193/23; 1QB Information Technologies Inc, BL O/935/22). This is not to say that the IPO is refusing to accept this new technology, but that the patent examiners are just as constrained by the assessment framework as the applicants.

It is not just the EU that the UK is competing with in this field. Major markets, such as the US and China, will also be forming their own pathway. For now, the US appears to be caught in a particular swing of the pendulum to being more restrictive about software in general, following the US Supreme Court decision in Alice Corp v CLS Bank International (573 US 208 (2014)). By contrast, China appears to be a welcoming market for these advanced technologies, at least in terms of patentability.

Where next?

The antidote to this competitive threat lies in ensuring that the IPO’s patent application guidelines are regularly updated in a pragmatic and fair manner. Training patent examiners to assess these new technologies, both from a technical and a legal point of view, is also critical. In addition, as Emotional Perception reaches its conclusion, some clarity should arrive regarding the patentability of software in general in the UK.

However, the UK should go further than this. It is currently operating within a framework in which software is assessed by rules that were created to deal with highly procedural classical software. The changes in the past 50 years in this field have been phenomenal and it is no surprise that the legal framework has struggled to keep up.

This naturally leads to the view that the UK should consider changing how it treats inventions in the fields of AI and quantum computing to make it easier to patent this technology. Such inventions are not mere software in line with the simplistic view that anything running on a computer is necessarily software; they show remarkable ingenuity by performing in genuinely new and technical ways. The existing UK framework is general enough to be interpreted to achieve this change without overturning any case law. The remaining question is whether it is brave enough to go first.

What is quantum computing?

Quantum computing is a technology that is based on the principles of quantum theory. It seeks to harness the subatomic physics of quantum mechanics where particles can occupy more than one value or state. In data processing, binary digits (bits) have one value (0 or 1) or occupy one of two states (on or off). A quantum computing bit (qubit) can simultaneously have more than one value or be in more than one state. Quantum computing increases the number of computations that can be processed concurrently, therefore enhancing the speed of computer processing.

Mathys & Squire Partner Andrew White has been featured in articles by The Telegraph and the World IP Review with his commentary surrounding the significant global increase in drone patent applications, and the major contribution that China has to these emerging figures.

Read the extended press release below.

The number of patents granted in relation to drone technology has increased globally by 18% to 7,890 in the last year, up from 6,686 in the year previous, shows new research from leading intellectual property (IP) law firm Mathys & Squire.*

Increased innovation in drone technology has partly been driven by greater investment in defence R&D as well as an increasing range of uses for drones in the broader economy.

Manufacturers are rushing to corner as much of this rapidly growing market by registering patents to protect their R&D investments.

Developments in AI have also driven the substantial growth in drone inventions as companies look to integrate the two technologies .

Andrew White, partner at Mathys & Squire says: “There is now an almost universal acceptance that drones are going to be an important part of defence sector investment and defence companies, conventional drone companies and universities are all looking to out-innovate their competition in order to secure part of that market.”

“Innovations within the defence sector are also spilling over into the conventional drone sector – such as the use of AI to allow real-time data analysis, correction to navigation systems and object detection and avoidance.”

6,217 Chinese patents were granted last year relating to drone technology, accounting for 79% of all drone patents granted last year. This was up from 4,859 or 73% of all drone patents the year before.

Notable Chinese filers of drone patents include drone manufacturer DJI, who filed 64 patents in the last year alone. The state-backed People’s Liberation Army National University of Defence Technology also accounted for 73 patents in the last two years.

Russia also remained in the top 4 filers of drone patents (behind China, the US and South Korea), and were granted 239 patents last year, a 78% increase from the 134 patents granted the year before.

Commercial applications continue to drive growth in drone innovation

*Source: Patentscope data from the Information Commissioners’ Office (year-end December 31)

Mathys & Squire Partner Andrew White was recently featured in ‘Apple’s $502M License Bill May Draw SEP Owners To UK’ by Law360, providing commentary on the impact of the Optis v. Apple SEP decision on further SEP rulings in the UK, and even worldwide.

The article highlights how technology companies may avoid the UK for licensing disputes after Apple has been ordered to pay $502 million for a suite of 4G patents, an increase from the original order of $56 million, but might attract more SEP holders.

To read the full article click here.