The Enlarged Board of Appeal has recently confirmed in G 2/24 that, after all appeals are withdrawn, appeal proceedings are terminated – even if an intervention is filed during the appeal. A party who intervenes only on appeal does not have the right to continue proceedings after the appeal is withdrawn.

The referring Board of Appeal in T 1286/23 sought clarification with the following question:

“After withdrawal of all appeals, may the proceedings be continued with a third party who intervened during the appeal proceedings? In particular, may the third party acquire an appellant status corresponding to the status of a person entitled to appeal within the meaning of Article 107, first sentence, EPC?”

Background – Interventions at the EPO

Under Article 105 EPC, a third party that is sued for patent infringement may intervene in EPO opposition proceedings – even after the normal 9 month opposition window – provided that the intervention is filed whilst opposition proceedings are pending (or a subsequent appeal is pending). This allows the third party to bring new objections and evidence into the opposition.

The Decision – G 2/24

The Enlarged Board considered the situation where an intervention was filed during appeal proceedings following opposition and then all appeals are withdrawn.

G 2/24 confirms an earlier decision in G 3/04, deciding that such an intervener could not then continue with the proceedings. The Board that referred the question in G 2/24 questioned this approach and indicated an intention to deviate from G 3/04. However, in G 2/24, the Enlarged Board concludes that the legal situation has not changed substantively since G 3/04 in respect of the relevant provisions, and that the conclusion given in that decision still applies.

The Enlarged Board confirms that an appeal is a judicial review of the decision under appeal and is not a mere continuation of opposition proceedings. The principle of party disposition is also reiterated, in that the party has the right to withdraw an appeal (and the Board itself has no right to continue). Under Article 107 EPC, an appeal can only be filed by a party to the original proceedings that is adversely affected by the decision.

This reasoning led the Enlarged Board to decide that the intervener did not have the status of appellant and did not have further rights beyond a non-appealing party in respect of continuing proceedings.

As a result, if the sole appeal is withdrawn (or, should there be multiple appellants, then if all appeals are withdrawn), an intervener that only files an intervention on appeal does not have the right to continue with the proceedings.

Strategic Implications

G 2/24 gives patent proprietors more control over appeal outcomes when they are the sole appellant. For example, if an intervention on appeal raises new issues, the proprietor may opt to withdraw the appeal if they are the sole appellant. With the appeal terminating, this may allow the proprietor to fall back on an amended form of the patent maintained after opposition.

From the intervener’s perspective, it may be more beneficial to intervene in opposition proceedings rather than only on appeal. Whilst the ability to intervene will be determined by the proprietor bringing infringement proceedings, the third party may pre-emptively file an opposition in the first place (which may be filed anonymously).

In any case, intervening on appeal may still be a useful tool. For example, this may force the proprietor to withdraw the appeal and limit the patent to narrower claims.

G 2/24 therefore provides legal certainty confirming that interveners on appeal cannot continue with appeal proceedings once all appeals are withdrawn. This has implications for strategic decision-making in both opposing and defending patents at the EPO.

If you have any questions about your opposition strategy, please contact a member of our team.

We are delighted to announce that Partners Edd Cavanna, Max Thoma and Harry Rowe have been named as 2025 Rising Stars.

The Managing IP Rising Stars guide recognises leading intellectual property practitioners across more than 50 jurisdictions and a wide range of IP practice areas. This prestigious list highlights professionals who are making significant contributions to the field and showing strong potential for future leadership in the industry.

Each year, Managing IP conducts extensive research to compile its rankings, drawing on feedback from IP practitioners, firms, and clients. The process includes detailed surveys, interviews, and an independent analysis of publicly available information, ensuring that the rankings are rigorous and impartial.

Managing IP identifies Rising Stars who have demonstrated exceptional work within their firms and in the broader IP landscape. Being named a Rising Star is a mark of recognition for consistent, high-quality performance and is considered a notable achievement.

For more information on the Mathys & Squire rankings, visit the IP Stars website here.

We are delighted to announce that Mathys & Squire has been commended in the 2026 edition of The Legal 500 in both PATMA: Patent Attorneys and PATMA: Trade Mark Attorneys categories.

Patent Partners Chris Hamer, Alan MacDougall, Martin MacLean, Paul Cozens, Andrea McShane, Dani Kramer, Philippa Griffin, James Wilding, Sean Leach, James Pitchford, Andrew White and Managing Associate Oliver Parish are all featured in the 2026 edition of the directory.

Mathys & Squire’s trade mark team also received recognition in the directory. From our trade mark practice, Partners Rebecca Tew and Harry Rowe, Gary Johnston, and Consultant Margaret Arnott have been featured in the 2026 edition.

The firm received glowing testimonials for its patent and trade mark practices:

‘The Mathys team is easy and a joy to work with. They have the experience and requisite background to digest complex scientific matters and undertake well-done patent prosecution. I quite enjoy strategizing together and our collaborative efforts. They are pleasant and appropriate in communications, as well as responsive.’

‘Dani Kramer is a pleasure to work with. He is sharp, provides excellent and cost-effective advice and professional services.’

‘I work with the team around partner Sean Leach, who is exceptionally responsive and technically highly competent, as is his team. Pleasant to work with, always transparent, flexible – highly recommended.’

‘Sean Leach is highly skilled technically, a great communicator, an excellent patent attorney, very experienced and very responsive.’

‘Paul Cozens as a standout partner, and Oliver Parish has impressive technical knowledge.’

‘Fantastic team work from an absolutely top-notch team.’

‘Very skilled and knowledgeable.’

‘They are absolutely committed to working with the customer. James Pitchford is outstanding with his knowledge and ability to apply it to IP writing.’

‘They have exceptional experience and expertise.’

‘They are a go to firm for EPO consultation.’

For full details of our rankings in The Legal 500 2026 guide, please click here.

We extend our gratitude to all our clients and connections who participated in the research, and we extend our congratulations to our individual attorneys who have earned rankings in this year’s guide.

Partner Max Thoma has recently been featured in Law360 discussing the recent proposal by the UK Government to limit AI generated design applications in ‘Sweeping UK Reforms A Mixed Bag For Simplifying Designs’.

In the article, Max discusses how applicants have previously been able to apply for IP protection on design that have solely been created by AI. The new ruling would aim to prevent the UK design system becoming overwhelmed by a large number of applications, and ensure human-created designs do not have difficulty in being validly registered as a result.

Read the extended press release below.

The UK Government is proposing to change the law to prevent a flood of requests for the registration of completely AI generated designs says intellectual property (IP) law firm Mathys & Squire.

The proposal comes as part of a wide-ranging consultation launched by the Government on the intellectual property laws related to designs. Registering designs with the Intellectual Property Office can protect the appearance, shape or decoration of a product from being copied.

Unlike in other areas of intellectual property, UK design law contains provisions that allow protection for designs entirely generated by computer and without a human “author”.

Max Thoma, Partner, of intellectual property (IP) law firm Mathys & Squire comments: “The Government is worried by the possibility that the UK design system could be flooded with thousands of AI generated design applications. In theory AI tools churning out designs that are then registered could block new products from entering the market and make it more difficult for human-created designs to be validly registered.”

The consultation also proposes the introduction of an examination process for registered design applications in some circumstances. This would mean that some design applications will need to be reviewed and approved by the Intellectual Property Office.

Max Thoma says that this change is being proposed as some designs were being registered when they were invalid. In some cases businesses had been using those invalid design registrations to request the removal of a competitor’s product from online shopping sites.

There are number of other proposals in the consultation document including a proposal to make it easier to register animated designs.

Head of Trade Marks and Partner Claire Breheny has been featured in The Grocer providing insights on the growth of the non-alcoholic drinks industry in publication, ‘Non-alcoholic beer and cider trademarks on the increase’.

In the article, Claire provides commentary on how the preferences of the younger generation is a significant factor in the growth of the non-alcoholic drinks industry, and how recent trade mark applications is a direct indicator of this shift.

Read the extended press release below.

The number of new UK trade mark filings for non-alcoholic beer and cider surged 20% to 1003 from 833 and 19% to 515 from 433 respectively in the last two years*, says Mathys & Squire, the leading intellectual property law firm.

Mathys & Squire says that the number of new alcohol-free trademarks and brands being launched reflects the growing importance of the segment to the drinks industry.

In 2024, non-alcoholic beer trade marks accounted for 37% of all 2737 beer trade marks and 66% of all the 782 filings for ciders.

These figures show that non-alcoholic brands are on the rise as beverage companies continue to respond to demographic shifts around alcohol consumption.

This surge in non-alcoholic drinks reflects a decline in alcohol consumption by Generation Z (those born between 1997 and 2012), which has a higher proportion of individuals who prefer alcohol-free options.

Many young people in Generation Z are choosing non-alcoholic options to align more with their healthy lifestyles spurred on by celebrity influencers such as Spiderman actor Tom Holland.

Also, the UK’s growing diversity means many consumers abstain from alcohol for cultural or religious reasons. These lifestyle and demographic shifts are increasing demand for alcohol-free beers and ciders.

People often choose non-alcoholic beers and ciders, as opposed to standard soft drinks, as they allow them to socialise with others who are drinking alcohol without feeling excluded.

Beverage companies are innovating in the non-alcoholic sector to meet this new demand and protect profit margins amid slower growth in the alcoholic beverage market. In the last two years, alcoholic beer and cider trade mark filings grew 7% and 6%, respectively.

Claire Breheny, Head of Trade Marks at Mathys & Squire says: “The surge in trade marks for alcohol-free drinks underlines how quickly businesses are responding to the shift in consumer priorities. By drinking less alcohol, the younger generation are redefining the R&D and marketing spend of the drinks industry. You can see the impact of that in any supermarket.”

“Companies that fail to innovate in this emerging alcohol-free space fear missing out on one of the fastest-growing areas of the industry.”

New 0.0% branding allowing big brewers to advertise at prime time

Leading brewers such as Heineken, Carlsberg, and Guinness have all launched 0.0% ranges. Alcohol-free drinks give these brewers access to prime-time advertising and sports sponsorships that are off-limits to alcoholic products under current advertising rules.

Retailers and hospitality venues have responded to the alcohol-free surge by expanding shelf space and boosting visibility for alcohol-free products in stores, bars and restaurants.

Adds Claire Breheny: “The surge in trade mark filings suggest where the market is heading.”

We are delighted to announce our partnership with MassChallenge UK, a global network for startups and innovators. Through this collaboration, we will provide our intellectual property expertise to assist with the development of patent strategies for early-stage businesses.

MassChallenge UK is an international zero-equity startup accelerator, enabling businesses to make a meaningful impact in their industries. Our partnership will bring our specialist knowledge to the impressive network of entrepreneurs at MassChallenge UK, helping to foster innovation and support the startup ecosystem.

Through our involvement with MassChallenge UK, we will encourage the growth and development of each business through vital intellectual property advice, helping founders to avoid common IP pitfalls and create strong foundations for long-term value creation.

We will deliver tailored workshops, provide 1:1 guidance for specific patent-related challenges across a diverse range of sectors, and, beyond individual support, offer thought leadership and strategic insights to the wider MCUK community.

Partner Paul Cozens said: “We’re delighted to be supporting MassChallenge UK and its inspiring cohort of founders. Protecting and leveraging intellectual property is essential to long-term innovation, and we’re proud to help startups build resilient businesses underpinned by strong legal foundations.”

David Kinsella, Managing Director at MassChallenge UK, added: “We’ve seen firsthand how crucial IP understanding is for early-stage startups. This partnership with Mathys & Squire brings invaluable expertise into our programme, enabling our founders to make confident, informed decisions about their innovations and the impact they’re creating.”

Find out more about the partnership on their website here.

As London hosts DSEI UK, one of the world’s largest defence trade shows, a look at how the patent system deals with matters of national security.

Each year, a very small number of patent applications are classified as secret and vanish into the patent system without trace, re-emerging perhaps only years later, if at all. What does that mean in practice? How can the idea of such secret patents be reconciled with the rationale for having patents? And can there continue to be a place for secret patents given the ways of modern innovation?

A not so secret history

Britain in the 1850s. The time of the Great Exhibition and the Crimean War. The government, having only recently set up the Patent Office, moves to halt publication of John Macintosh’s patent application for “Incendiary materials for use in warfare”, which proposes means for attacking the port at Sevastopol. The application is eventually allowed to publish, but only after the war concludes with a peace treaty. The appetite for secrecy having been whetted, the government soon passes an Act formalising the process of restricting publication of certain patent applications. And then for good measure establishes the first Official Secrets Act.

Secret patents (strictly, only ever applications) have existed ever since. Over the subsequent decades, restrictions were issued for various military innovations: artillery fuses, rifled ordnance, explosives and, somewhat alarmingly, mechanisms for synchronising a machine gun to fire through aircraft propeller blades. Later restrictions were applied to radar, atomic weapons and the hovercraft. We know of some of these secret patents because they were subsequently declassified. Many others have not been. Some perhaps never will be.

The usual reason given for preventing publication of certain patent applications was, and is, that they describe inventions which would be problematic for national security should they ever become public. This also prevented details of sensitive inventions moving abroad; no country would wish to cede a potential technological advantage to a foreign adversary. But another reason was that successive governments wanted to bolster their own national arms manufacturing industries.

This led to some friction between the Patent Office, which had initial access to the patent applications and insisted on maintaining inventor confidentiality, and the military, which wanted access to the inventions as early as possible.

Caught in the middle, inventors would sometimes be frustrated that commercial opportunities were lost because a patent had been classified. At other times patriotic (or commercial) offers of inventions would be ignored or rebuffed by the government. Compensation, when offered, was sometimes generous but not always.

All the while, the attitude to secret patents was evolving. World events influenced what was invented as much as what the government considered necessary to keep secret and for how long. The net effect tended to a ratcheting up of restrictions.

The 1930s saw arguments for abolition of secret patents entirely. Perhaps, it was argued, it would be more effective to publish all patent applications and so confuse adversaries as to what was actually being adopted. Or perhaps full disclosure would serve to suggest that there must be something even better being kept secret. Such thinking was scuppered by the onset of another world war, which prompted additional defence regulations, and the subsequent Cold War which saw a further tightening up of secrecy laws.

Once something makes it into law it can be difficult to remove. When the UK Patents Act was last fundamentally revised, in 1977, the Lords proposed removing security provisions from the Act altogether, only for the relevant sections to be promptly re-inserted by the Commons. “We can go on living with it for the time being,” was one legislator’s observation. And so we do.

Secret patents in practice

The process at the UK IPO for handling secret patents is governed by sections 22 & 23 of the UK Patents Act (1977), which allows for patent applications deemed “prejudicial to national security” to be withheld from publication. Not only the application, but the information disclosed within it. The process is both universal and unusual, in that all UK patent applications are subject to it, at least initially, but the latter stages are so rare that most patent attorneys are unlikely ever to encounter them.

Every patent application filed at the UK IPO – whether national, European or international PCT applications – is routed via “Room GR70”. There, one of a small team of patent examiners reviews the contents of the application and consults a document provided by the Ministry of Defence. In the vast majority of cases, patent applications proceed as normal. Very occasionally, however, an application takes a different path.

These applications are marked according to their perceived sensitivity (Official, Official Sensitive, Secret or Top Secret, with possible additional caveats) and subsequently searched and examined in the usual way, but otherwise, while the restrictions are in place, they remain in a form of patent purgatory: they cannot be published, so they cannot be granted.

While the decision to issue a secrecy direction lies initially with the UK IPO, ultimately it is for the government to decide whether or not to maintain it. Reviews are done periodically, but for the applicant the process is opaque; the restrictions may simply be lifted at any time.

Once a section 22 direction has been issued, the resulting restrictions are onerous and the overheads considerable. Patent attorneys require the relevant level of security clearance to work on such applications, and their offices need to be suitably secure. It is forbidden to communicate the content of the application to others without permission. Breaching the restrictions is a criminal offence, punishable by fine and/or up to 2 years imprisonment. Permission must be sought to discuss the subject matter for commercial purposes or for filing related patent applications abroad.

Unless the government sees fit to declassify a secret patent the restrictions remain in place, essentially in perpetuity. The only way to discharge the responsibility for keeping secret the related papers is to withdraw the patent application.

Secret patent technologies

The term “prejudicial to national security”, which determines which patents become secret, is not precisely defined. Some technologies (such as those relating to nuclear, chemical and biological weapons) are self-evidently problematic, but others become so as technologies and threats evolve. Previous concerns about IEDs are now worries about drones and AI. A partially redacted version of the list made public over a decade ago detailed over 40 categories of technology, some likely expected (“fighting vehicles”), some somewhat vague (“specialist surveillance devices”), others remarkably specific (“accelerometers of accuracy better than 10-3g”). The contents of the full list, however, are classified.

Despite the seemingly broad scope of the restricted technologies list, the bar for an application to be classified appears to be high. Even a brief search of a patents database will show many applications with an explicitly stated military purpose, albeit an applicant simply stating that an invention is of relevance to the military does not necessarily make it so. And some applicants, wary of the restrictions which might be imposed, deliberately avoid describing their inventions in ways which may result in their patent applications being classified.

Secret patents by numbers

Inevitably, there is limited information on the number of secret patent applications. From the limited statistics reported by the UK IPO, it issues a secrecy direction on average once a week, a tiny fraction of the approximately 20,000 patent filings it handles each year (so unlikely to be a good metric for assessing the current state of innovation in the defence industry). Unsurprisingly, the vast majority of applications issued with such directions are filed by defence industry applicants, directly to the secrecy office.

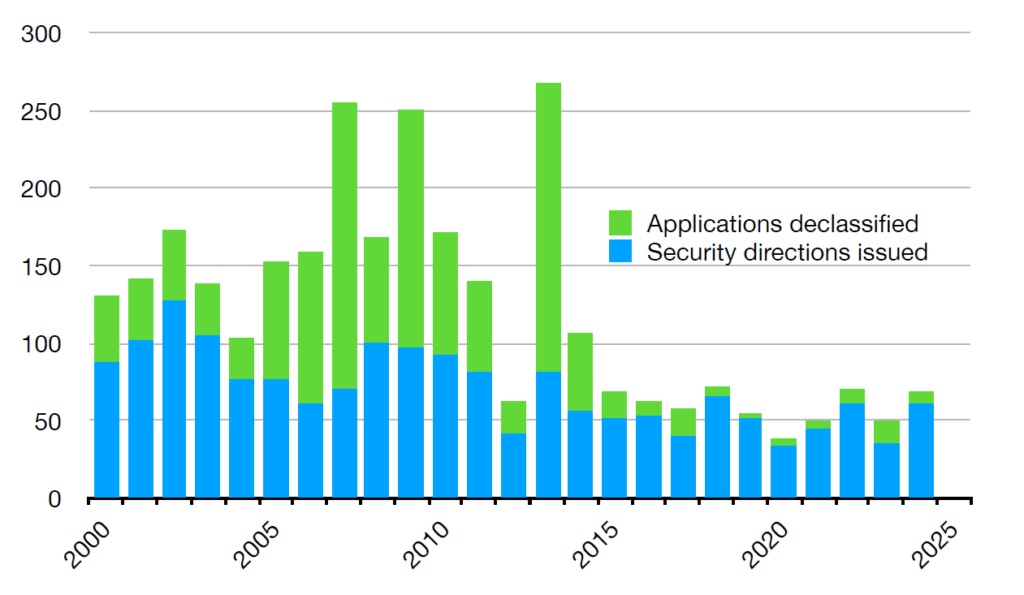

Of all the patent applications filed since 2000, 1,755 were subject to secrecy directions, of which 1,100 of these directions remain in force. Meanwhile, 1,255 applications were declassified. The rate of declassification has evidently decreased sharply over the last couple of decades. However, since the total number of secret patents, including those which pre-date 2000, is not publicly known, it is unclear whether this decrease is because off an increased emphasis on secrecy or simply a result of fewer secret patents remaining to declassify. Restrictions on some particularly sensitive applications, such as those relating to the development of nuclear weapons, have reportedly been in place for over 80 years and are expected to remain so indefinitely.

The future of secret patents

Secret patents have a long history. But is there a place for them in the present world? The style and pace of military innovation has changed greatly since secret patents were first introduced. Barriers to entry are lower. There is less reliance on bespoke heavy engineering, more on software and AI. Many technologies are dual-use rather than exclusively military. What is proving most “prejudicial to national security” is now often based on commercial off-the-shelf products, many of which are cheap, easily available and able to be rapidly deployed in response to changing circumstances. Digital technologies have also allowed technology to be easily, widely distributed. There has been a democratisation of military technology. Innovation is (yet again) outpacing and side-stepping legislation.

So what purpose do secret patents serve? How effective have secret patents been in preventing the dissemination of technology? They are, in a sense, an attempt by governments to prevent genies from escaping their bottles. The list of proscribed technologies is very broad. There are very many bottles; is it realistic to expect to stopper them all? Historically, the significance of some inventions has been under-appreciated. In truth, while we may wish that certain inventions should not be widely available (see nuclear weapons), it is probably wishful thinking that they will remain so (see nuclear proliferation). Neither do secret patents prevent independent invention. Or espionage. What they do provide is a sense that a tide is being held back. More reassurance than reality.

Secret patents are an anachronism and are becoming increasingly irrelevant. They exist despite their inherent contradiction. The foundation of the patent system is a deal between the state and the applicant, wherein the state grants an exclusive, time-limited commercial rights in exchange for the public receiving a full description of how the invention works. Patents ostensibly exist to encourage the dissemination of inventions. Secret patents run counter to this ethos. Yet despite minor revisions over the years, and serious proposals to abolish the secrecy provisions altogether, secret patents persist. It seems we will need to go on living with them for the time being.

Sources

- Inventions and Official Secrecy: A History of Secret Patents in the United Kingdom, T. H. O’Dell,

Oxford University Press (1994) - UK IPO Facts and figures (2024)

- UK IPO Guidance Guidance: Technology prejudicial to national security or public safety

As explored in “The Line Between Beauty and Science I: Patent Strategies for Biotherapeutic Cosmetics”, in the field of bio-cosmetics, “use” claims are a valuable tool for protecting innovations involving known biotherapeutic molecules that have been found to serve a new cosmetic purpose. However, as this article explores, patent applications for such use claims must be carefully drafted to avoid falling within the European Patent Office’s (EPO) exclusions for therapeutic methods. Below, Partner Samantha Moodie and Associate Clare Pratt examine relevant EPO case law and offer practical guidance for drafting successful patent applications in this evolving area.

Cosmetic use claims: The importance of distinguishing between therapeutic and non-therapeutic effects

Under the European Patent Convention (EPC), patents cannot be granted for methods of treating the human or animal body by surgery or therapy, or for methods of diagnosis practised on the human or animal body (Article 53(c) EPC). Nevertheless, the EPO has allowed Applicants to navigate around such exclusions and protect new and innovative medical treatments by means of purpose-limited product claims (i.e. “compound X for use in the treatment of disease Y”), wherein the use of compounds or compositions in therapeutic methods determines patentability.

Crucially, cosmetic uses or treatments are not excluded under Article 53(c) EPC.

When a known compound is identified as having a new cosmetic use, non-therapeutic method claims (rather than purpose-limited product claims) can be pursued at the EPO. For example, claims may be directed towards: “Use of compound X in the cosmetic treatment of Y,” “cosmetic use of X for purpose Y,” or “non-therapeutic use of X for purpose Y.”

The EPO has acknowledged that reciting “cosmetic use” or “non-therapeutic use” in such cosmetic use claims excludes (or disclaims) any therapeutic effects that could be considered to fall within the scope of the claim, and which would otherwise render the claim unpatentable under Article 53(c) EPC. However, as confirmed in the EPO’s Board of Appeal decision T 36/83, this disclaimer language is only allowable where products have a cosmetic effect that is clearly distinguishable from any therapeutic effect. In the case in question, a claim directed to “Use as a cosmetic product of thenoyl peroxide” was found to be allowable. The Board considered that the “cosmetic” disclaimer was allowed because the medical use of thenoyl peroxide to treat acne could be distinguished from the cosmetic use of thenoyl peroxide to cleanse healthy skin.

Drafting tip: When drafting ‘cosmetic use’ patent applications, it is advisable to include basis for disclaimer wording, such as “cosmetic use” and/or “non-therapeutic use”, to clearly exclude non-patentable therapeutic effects from falling within the scope of the claims.

Cosmetic use claims: The challenge of inextricably linked effects

Difficulties arise when a molecule exhibits both therapeutic and cosmetic effects that are inextricably linked and cannot be clearly separated. In this situation, where a cosmetic method has an underlying (even if unintended) therapeutic benefit, the exclusions under Article 53(c) EPC are often applied, even if the Applicant does not intend to cover any therapeutic application.

For example, in T 290/86, a cosmetic treatment relating to the removal of plaque from teeth was considered unpatentable as this method was held to inevitably prevent tooth decay, which has a therapeutic effect. A key factor in the Board’s decision was the discussion in the description of the beneficial effects of removing plaque. The Applicant had described that plaque is a dominant etiological factor in caries and periodontal disease and that the removal of plaque was beneficial in those conditions. The Board therefore took the view that cleaning plaque from teeth will always inevitably have a therapeutic effect which could not be separated from any cosmetic effect, and which rendered the use claims unpatentable.

Similarly, in T 780/89, claims to the use of certain compounds for non-therapeutic immunostimulation (stimulation of the body’s own defences) were not allowed. The Board of Appeal took the view that immunostimulation constituted a prophylactic treatment because infection is prevented.

In these instances, since the therapeutic use could not be separated from the non-therapeutic, cosmetic use, the inevitable therapeutic effect of the biological molecule could not be excluded by the use of the “cosmetic” or “non-therapeutic” disclaimer language.

Drafting tip: If protection is only sought for a non-therapeutic, cosmetic use, Applicants should avoid including statements in the description that relate to or describe any alleged therapeutic benefit of the cosmetic molecule. Such discussions may undermine any arguments that the claimed use is purely cosmetic.

Cosmetic use claims: When dual effects are acceptable

Despite these decisions, there are some useful examples of cases at the EPO where Applicants have successfully argued that a cosmetic use is patentable, even though the method potentially has a therapeutic effect alongside the claimed non-therapeutic effect.

In T 144/83, claims were granted to a method of weight loss using an appetite suppressant. The Board acknowledged that weight loss methods could have a therapeutic purpose for treating obesity but could also have a cosmetic purpose for enhancing appearance, and that in some cases, these therapeutic and non-therapeutic uses can be adjoined “without a sharp distinction”, meaning that it could be difficult to distinguish between them. However, in this case, the Applicant’s claim specified weight loss “until a cosmetically beneficial result is achieved,” without referring to obesity treatment. As a result of this wording, the Board held that the claim was limited to a cosmetic purpose, and the exclusion under Article 53(c) EPC should not apply.

Drafting tip: If it is difficult to distinguish between cosmetic and therapeutic effects, including carefully crafted disclaimers (“until a cosmetically beneficial result is achieved“) can be sufficient to exclude any potential overlapping therapeutic effect.

More recently, T 1916/19 provided further guidance on situations where cosmetic uses are patentable even when there is a potential overlapping therapeutic effect. The application related to a composition with antimicrobial effects. At first instance, the EPO rejected the application on the ground that the antimicrobial effect would inherently provide a prophylactic treatment for pathogenic bacteria. The Board of Appeal however reversed this decision and held that there were some realisations of the claimed method that were not therapeutic. In particular, the Board took the view that the removal of bacteria from healthy skin is not necessarily prophylactic, and that the presence of pathogenic bacteria on the skin of a healthy individual does not necessarily lead to a pathological state. Further, they also acknowledged that the removal of non-pathogenic bacteria could provide a cosmetic effect by reducing unpleasant body odour. As a result, the application proceeded to grant with both a non-therapeutic method claim, covering the cosmetic use, and a purpose-limited product claim, covering the therapeutic use.

A key persuading factor in this case was the argument that the prophylactic aspect of the claimed method would not be encompassed when the method was performed on a “healthy individual”.

Drafting tip: For those inventions involving compounds that have both a therapeutic and non-therapeutic effect, whether these are considered “inextricably linked” will depend on the information provided in the application. Where there is more than one use, these different uses should be clearly distinguished in the application. If there is a possibility of the use being considered to involve therapeutic and non-therapeutic effects that are linked, it is advisable to include separate definitions of the patient group or consumer for each use. For example, when claiming a non-therapeutic, cosmetic use, it may be useful to define the user as a “healthy individual”.

When Applicants are interested in claiming therapeutic uses alongside cosmetic uses, a clear definition of the diseases that can be treated should be included alongside data that demonstrates the intended therapeutic effect. In addition, user groups relevant for the cosmetic use and separate data demonstrating the cosmetic effect should also be included.

Conclusion

Given the blurred line between cosmetic and therapeutic effects in cosmetics containing biological molecules, precise and careful drafting is essential. Where dual effects are possible, patent applications should distinguish uses, define user groups, and support claims with appropriate data. With the right approach, both cosmetic and therapeutic claims can co-exist within the same application, offering robust and flexible IP protection.

Following the release of her album ‘The Life of a Showgirl’, Taylor continues to demonstrate that intellectual property (IP) is not just a legal asset, it’s a keystone of brand power and control. Taylor has relentlessly protected her IP through several trade mark filings and reclaiming control over her master’s by re-recording her albums and branding them as ‘TAYLOR’S VERSION’. She has turned IP protection into both a business strategy and a form of artistic empowerment, but it doesn’t stop there.

Just days before announcing The Life of a Showgirl, her company, TAS Rights Management, LLC, filed a series of US trade mark applications including ‘THE LIFE OF A SHOWGIRL’, ‘TLOAS’, and ‘T.S’. These applications span a wide range of goods and services, from music and live entertainment to merchandise like jewellery, stationery, bags, and even fan clubs. It’s a clear indication that a larger rollout likely including a tour, extensive merchandise, and fan experiences is already in the works. By securing these marks early, Swift ensures she has full control over the commercialisation of her new era, while simultaneously safeguarding her brand from unauthorised use. This level of foresight highlights the strategic value of IP in the entertainment industry, not just for protection, but for monetisation and brand integrity.

This offers a timely reminder of how critical IP awareness is in any commercial venture. IP filings aren’t just a box to tick after launch, they’re part of the launch. Timing is everything as filing too early can tip off competitors, but filing too late can leave valuable assets exposed. Strategic trade mark control therefore allows artists to own their narrative, manage market timing, and prevent exposure and unauthorised use. For Taylor Swift, it’s not just about music, it’s about owning every piece of the story.

Click here to read our first article following the IP protection of Taylor Swift.

In the rapidly evolving world of cosmetics, biotherapeutic molecules, which were once confined to medical and pharmaceutical settings, are now making their way into skincare products, reshaping the landscape of anti-ageing treatments, skin repair and regenerative aesthetics.

Recent trends include the use of stem cell extracts, exosomes, polynucleotides, collagen and endonucleases in skincare products to stimulate the body’s natural healing processes. Moving beyond traditional fillers and Botox, new treatments are harnessing the body’s own biological pathways to restore skin vitality, volume and health. The credibility of using biotherapeutics in cosmetic applications has been bolstered by the formation of the Royal Society of Medicine’s Section of Aesthetic Medicine and Surgery (SAMAS), which was formally established on 1 October 2024. This development signals a growing acceptance of aesthetics within the wider medical community.

In this article, Partner Samantha Moodie and Associate Clare Pratt look at some of the key biotherapeutic molecules gaining traction in cosmetics and provide guidance on effective strategies for protecting these innovations in Europe through the patent system of the European patent office (EPO).

What are the latest trends in biotherapeutic cosmetic products?

Stem Cells

Stem cells have become a buzzword in premium skincare. They are used in cosmetics primarily for their regenerative and anti-ageing properties, although the products typically contain stem cell-derived ingredients such as conditioned media or extracts, rather than live stem cells. Stem cell therapies are being explored for skin rejuvenation, scar reduction, hair restoration and breast reconstruction, among other areas. Stem cell extracts and conditioned media can be applied topically (either alone or in combination with other treatments such as microneedling or laser ablation) or delivered via injection to achieve targeted regenerative effects.

Exosomes

Exosomes are extracellular vesicles, typically 30–150 nanometres in diameter, secreted by a range of cells including adipose-derived stem cells (ADSCs), mesenchymal stem cells (MSCs), immune cells, epithelial cells and even plant cells, referred to as plant-derived extracellular nanoparticles (PDENs). These vesicles carry bioactive cargo such as proteins (e.g. growth factors and cytokines), peptides, lipids, RNA (including mRNA and microRNA), and DNA. Crucial to intercellular communication, aesthetic medicine is increasingly harnessing exosomes as a natural means of restoring skin volume and promoting regeneration to rejuvenate the skin, reduce inflammation, enhance elasticity and hydration, and diminish fine lines, wrinkles and pigmentation. Typically administered via topical serums or creams, they are often combined with microneedling or laser treatments to enhance transdermal penetration and support post-procedural recovery.

Polynucleotides

Polynucleotides (PNs) are increasingly being used in aesthetic dermatology and high-end cosmetics. PNs are long chains of nucleotides derived from DNA or RNA and when injected or applied topically, are thought to promote tissue repair, increase hydration, and improve skin elasticity by stimulating fibroblast activity and collagen synthesis. Originally developed for wound healing and orthopaedics, polynucleotide technology has expanded into aesthetic dermatology.

Collagen

Collagen is the most abundant protein in the skin and connective tissues, providing structure, firmness and elasticity. Its natural decline with age leads to wrinkles, sagging and thinner, drier skin. To address this, topical collagen is often used to hydrate the skin and form a moisture-retaining film, creating a smoother, plumper appearance. Some products use collagen fragments (peptides) or compounds that stimulate collagen synthesis, such as retinoids, vitamin C and peptides (acetyl hexapeptide-3). A growing trend known as “collagen banking” promotes early intervention through skincare, treatments and lifestyle habits to build and preserve collagen reserves, aiming to delay the visible effects of ageing.

Endonucleases and genome-editing enzymes

Endonucleases and genome-editing enzymes, including CRISPR-associated nucleases, are a class of enzymes that can cut DNA strands at specific sites. While primarily known for their gene-editing potential in medicine, certain DNA repair enzymes are now being explored in cosmetics to correct UV-induced DNA damage in skin cells, positioned as anti-ageing or post-sun exposure treatments. Commercial products using liposome-encapsulated endonucleases claim to support DNA repair mechanisms, although the field remains nascent and scientifically complex.

Why is patent protection important in the cosmetic industry?

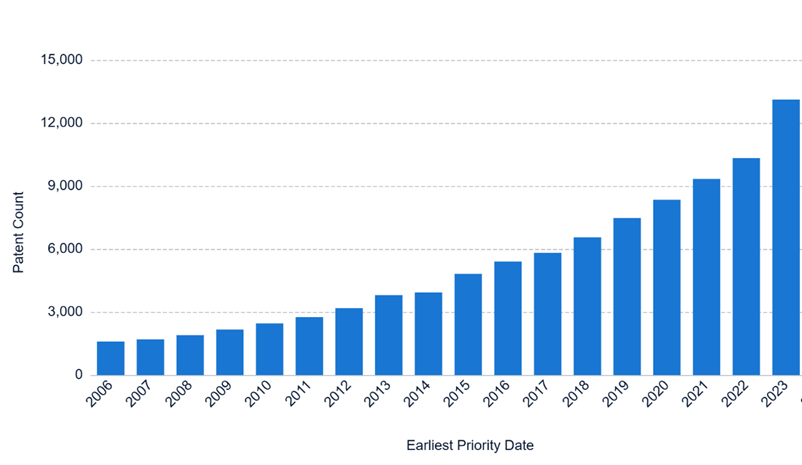

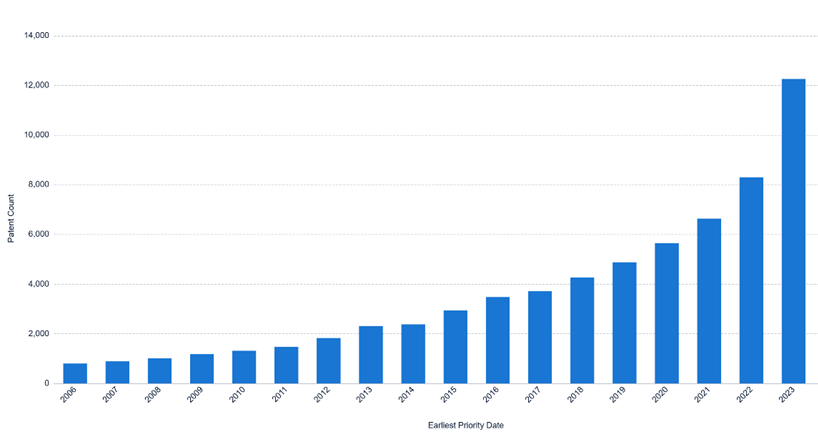

Research and development in the cosmetics industry can be costly, especially research relating to the use of biotherapeutic molecules. Patents play a crucial role in helping companies recover these investments by granting them the legal right to prevent others from making, using, selling or importing their inventions without permission. In addition to protecting innovation, patents offer a competitive advantage, discourage imitation, and can generate commercial value through licensing agreements. Securing intellectual property is often a prerequisite for attracting investment. Recent trends indicate that cosmetic companies are increasingly relying on patents to safeguard their innovations. The number of active patent applications filed globally in the field of cosmetics has grown year on year in the period between 2006 and 2023 (see Figure 1), and there has been a recent surge in the number of active patent applications relating to biotherapeutic cosmetics (see Figure 2).

Figure 1: Active published patent filings, including granted patents, in the field of cosmetics worldwide. The bar chart displays patent families between 2006-2023 for IPC codes relating to “cosmetics” (see methodology).

Figure 2. Active published patent filings, including granted patents, relating to biotherapeutic cosmetics worldwide. The bar chart displays patent families between 2006-2023 for IPC codes relating to “biotherapeutic cosmetics” (see methodology).

What aspect of biotherapeutic cosmetics can we protect in a patent?

Patents can be obtained to protect various aspects of biotherapeutic cosmetics, including the products per se, and their formulations, manufacturing processes and cosmetic uses. The incorporation of biotherapeutics into cosmetics blurs traditional boundaries between medicinal and cosmetic products. This grey area requires careful consideration during patent drafting and prosecution. Therefore, a key question for inventors working in these developing areas of technology is how best to gain patent protection. The optimal patent strategy will depend on whether a product, its formulation or the process for its manufacture is new; whether a new use for a known product has been discovered; and whether the intended use is purely cosmetic or also has a therapeutic effect.

Product claims

Product claims protect the composition or structure of a novel cosmetic product, such as a newly identified plant extract or a newly developed stem cell extract. Product claims are useful in a patent because they grant the Applicant the right to prevent others from making, using, selling or importing the claimed product. To obtain a product claim, the Applicant must demonstrate that the product is novel and inventive. Sufficient information should be provided in the patent application to enable preparation of the claimed product. For example, a product claim may be directed towards an anti-wrinkle cream containing a novel plant-derived molecule that achieves an improved anti-wrinkle effect.

Process claims

Process claimsprotect the method of making a cosmetic product, using, for example, a chemical, biotechnological or mechanical procedure. A process claim in a patent grants the Applicant the right to prevent others from using the claimed process and from using, selling or importing a product obtained directly by the claimed process. To obtain a process claim, the Applicant must demonstrate that the process is novel and inventive, and sufficient information should be provided in the patent application to enable the claimed process to be carried out. For example, a process patent may cover a new method of extracting a natural compound from a plant and incorporating it into a cosmetic product, or a new process for preparing a stem cell extract with improved cosmetic effect.

For many biotherapeutic cosmetics, innovation often stems from discovering new uses for known biological molecules. In this situation, the molecules themselves are not novel and the best approach for obtaining patent protection is to seek protection for the newly identified use. Use claims, therefore, protect a new or improved effect of a cosmetic product, and they grant the Applicant the right to prevent others from using the product for the claimed use.

To obtain a use claim, the Applicant must demonstrate that the claimed use is novel and inventive. Furthermore, sufficient information should be provided in the patent application to enable preparation of the product and use of it to achieve the desired cosmetic effect. The Applicant may also be required to demonstrate that the claimed cosmetic use does not involve an inextricably linked therapeutic effect, which would be considered unpatentable at the European Patent Office (EPO). (See Appendix 1)

To prove infringement of a use claim, the Patentee must demonstrate that an alleged infringer is using the product for the claimed cosmetic use. Use claims can therefore be more challenging to enforce than product or composition claims.

Composition claims

Composition claimsare another useful claim category for protecting a cosmetic product when thebiological molecule itself is known, but the formulation of the product is novel. Composition claims grant the Applicant the right to prevent others from making, using, selling, or importing the claimed formulation. To obtain a composition claim, the Applicant must demonstrate that the composition (or formulation) is novel and inventive, and sufficient information should be provided in the patent application to enable preparation of the claimed composition. Composition claims may need to include reference to the specific concentrations or ratios of the components that are required to achieve the desired cosmetic effect to be considered patentable. Composition claims are easier to enforce than use claims because infringement can be determined based on the composition of the alleged infringing product, rather than how it is used.

Conclusion

Hence, there are a range of ways in which innovations in the field of biotherapeutic cosmetics can be patented. In addition, current trends in patent filings indicate that cosmetic companies are increasingly leveraging the patent system to safeguard their inventions.

In our next article, we will take a closer look at ‘cosmetic use’ claims. As noted in this article, such claims must be drafted with particular care to avoid falling within the EPO’s exclusions relating to therapeutic methods. We will explore the relevant EPO case law on cosmetic use claims and provide practical guidance for drafting robust and compliant patent applications in this evolving area.

Appendix

- (Under the European Patent Convention (EPC), patents cannot be granted for methods of treating the human or animal body by surgery or therapy, or for methods of diagnosis practised on the human or animal body (Article 53(c) EPC). The exclusion under Article 53(c) EPC does not apply to cosmetic uses or treatments. When a compound is identified as having a new cosmetic use, non-therapeutic method claims can be pursued at the EPO. For example, claims may be directed towards: “Use of compound X in the cosmetic treatment of Y”, “cosmetic use of X for purpose Y” or “non-therapeutic use of X for purpose Y”. In such claims, the “cosmetic use” or “non-therapeutic use” language serves as a disclaimer to exclude any effect that may be therapeutic in nature and would otherwise fall under the exclusion from patentability set out in Article 53(c) EPC. However, this disclaimer language is only permissible if the claimed cosmetic effect is not inextricably linked to a therapeutic effect that is achieved when the molecule is used as specified in the claim. In Part 2 of this article, we will further consider the relevant EPO regulations and case law governing cosmetic use claims, offering practical drafting guidance for patent applications in this area.)

Methodology

The data presented in this article was obtained using Patsnap by comparing active patent “simple patent families” between 2006 and 2023 related to specific IPC codes. A simple patent family is a collection of patent documents that are considered to cover a single invention. Patent applications that are members of one simple patent family will all have the same priorities, and continuations and divisionals will be placed in a patent family with the parent application. The IPC codes used to filter the searches were: “field of cosmetics” A61Q and A61K 8/00 in comparison with “biotherapeutic cosmetics”: A61Q and A61K/8/02, A61K/8/03, A61K/8/04, A61K/8/06, A61K/8/11, A61K/8/14, A61K/8/18, A61K/8/64, A61K/8/65, A61K/8/66, A61K/8/67, A61K/8/72, A61K/8/73, A61K/8/88, A61K/8/97, A61K/8/98, and A61K/8/99.