Intellectual property (IP) is a key asset for life sciences companies, especially in the form of patents. Valuation of these crucial assets requires a deep understanding of how the industry works and its characteristics.

Drug development and healthcare innovations require significant financing and long timelines to get to the market. Alongside this, the industry’s development milestones are defined by the regulatory process of approval, and due to the very uncertain nature of life sciences research, the outcome is binary. Either the project is a success and brings hundreds of millions to billions of dollars of revenue, or it is a failure, with an average of 92.1% of developments in the pharmaceutical sector not succeeding. Companies mitigate this risk by working on a diverse portfolio, and once one project is successful, its revenues cover the losses incurred by other projects (similar to the venture capital model).

Understanding the value of IP and projects in the life sciences sector allows the owners to make better strategic decisions about its prioritisation, budgeting, licensing or even abandonment.

Valuing the IP in life sciences businesses is complex as there are several factors to be considered, each with its own intricacies, complexities, and uncertainties. These include:

- The reason for valuation – this can be for licensing, fundraising, asset backed lending, mergers and acquisitions, litigation, or accounting purposes.

- The stage of the IP being valued and its details.

- The cashflow forecast attributed to the IP, its timing and success rates. These can be further split into:

a. Costs required to take the innovation (protected by the IP) to market;

b. Sales generated once the product (protected by the IP) reaches the market;

c. The likely timeline for development and sales; and

d. The probability of success for the innovation at each stage/key milestone. - The discount rate to be used when calculating the present value of the future cashflows.

The purpose of the valuation has impact on what type of valuation model is used. Similarly, the details of the IP, its stage, and what product it protects influence the factors involved in the valuation – modelling of the potential sales, discount rate, costs of development, probability of success.

For pharmaceutical companies, patents are the most important type of IP, and one would look at least at the following to get an understanding of the asset – ownership of IP and any outstanding contractual provisions, stage of prosecution, remaining useful lifetime, patent landscape/freedom to operate, any legal actions, examination of the patent and opinions from the examiner(s), and what product it protects or is likely to protect (especially in early stages of life sciences developments, as it is very difficult to pinpoint the exact designation of the drug). The reason patents are so important in the pharmaceutical industry is that once a drug comes out of patent protection, sales plummet drastically due to generic drugs taking market share and offering lower prices than the drug previously protected by a patent.

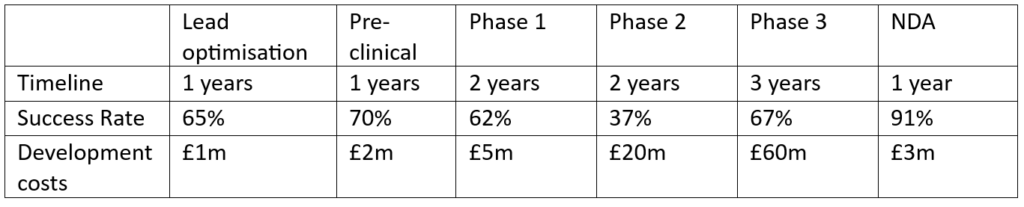

The life sciences development process is very well defined, from lead drug candidate to Phase 3 and New Drug Application, but the timelines, costs, success factors, and potential sales, all depend upon disease area and specifics of the IP/technology. The development information required for an IP valuation is outlined in the table below with some hypothetical numbers.

Once the drug candidate reaches the market, it starts generating sales to cover the development costs of all the failed projects and begins to produce profits for the company. The revenue can be modelled with a sales curve as the drug enters the market and the peak sales, which are the highest sales number a drug will reach during its patent protection lifetime. They can be determined from existing data about average or median sales numbers for a certain disease category, or with a bottom-up approach. The latter approach estimates the peak sales number based on the patient population numbers for the drug (population for geographies of interest, epidemiology, symptomatic population, diagnosed patients, access to health care, treatment rate, etc.), market share (indication, strength of the company in the disease area, brand power, etc.), and price.

There are four main methods that are used for valuing life sciences IP – the discounted cash flow method, the risk adjusted discounted cash flow method (decision tree), Monte Carlo valuation and real options valuation. We will demonstrate the different methods in a future article, further exploring the life sciences IP valuation process.

Mathys & Squire Consulting has experience in valuing life sciences and biotech related IP. Please get in touch with any IP valuation enquiries you might have.