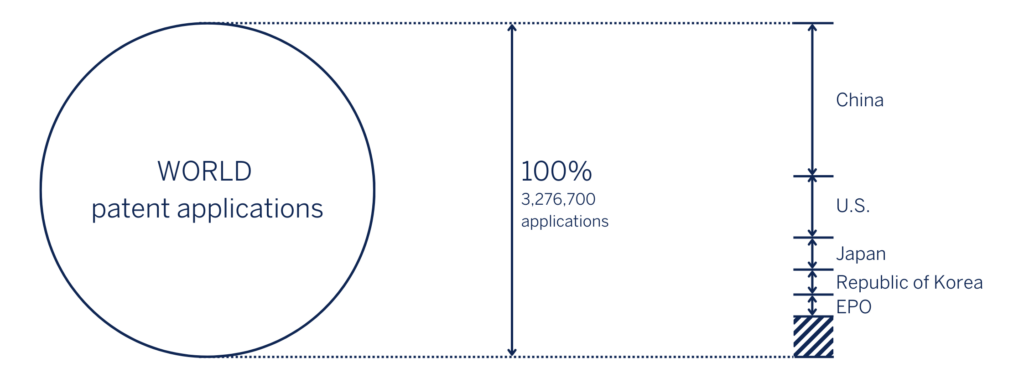

According to the WIPO Statistics Database, in 2020, the China National Intellectual Property Administration (CNIPA) received 1.5 million patent applications, accounting for 45.7% of the world’s total filings (see Fig.1). From a quantity perspective, China has become the top filer of patent applications in the world. However, it is clear that this is merely a stepping stone, with new targets for high-value invention patents being part of the latest five-year plan for the period from 2021 to 2025.

What are high-value invention patents?

The CNIPA considers the following invention types as high-value:

- A patent in the strategic emerging industries;

- A patent with overseas patent family member(s);

- A patent maintained for more than 10 years after grant;

- A patent that realises a higher amount of pledge financing; or

- A patent that wins State Science and Technology Awards or the China Patent Awards.

The 14th five-year plan

China’s five-year plans have been known for their importance to the nation’s economic growth, development, corporate finance, and industrial policies. In the most recent plan (2021 to 2025), China has defined a new indicator as one of the main 20, highlighting the number of high-value invention patents per 10,000 population:

| Category | Indicator | 2020 | 2025 |

| Innovation-driven | 5. Number of high-value invention patents per 10,000 population | 6.3 | 12 |

The number of high-value invention patents is considered to be an objective measure of its innovation performance and its position in global innovation competition. By 2025, it is expected that the number of high-value invention patents per 10,000 people in China will reach 12, which would improve the nation’s innovation performance, hopefully providing powerful support for economic development.

China Patent Awards

Ever since The China Patent Award’s debut in 1989, the award has become the most prestigious and highest award available in the field of patents in China. Winners of the awards are selected in different categories to celebrate innovation across various industries and technologies. Up for grabs are patent awards including 30 Gold Awards, 60 Silver Awards and a number of Excellence Awards, as well as 10 Gold Awards, 15 Silver Awards and numerous Excellence Awards for registered design owners.

According to the CNIPA, during the 13th five-year plan (covering the period of 2016 to 2020), 130 Gold Awards were awarded, and the inventions covered by those awards created sales accounting for more than 1 trillion RMB. Nowadays, the awards are becoming more valuable and competitive, as the winners’ inventions automatically become considered high-value invention patents.

Faster but stricter patent examination in China

On 21 March 2022, the CNIPA also released the ‘Annual Guidelines for Facilitating High-Quality Development of Intellectual Property 2022’. The target for the examination period of an invention patent application has been reduced to 16.5 months, three months less than that for 2021. The target set for an evaluation of a high-value invention patent application has been reduced further to 13.8 months. CNIPA has clearly already taken into consideration its new indicator when examining patents and it is expected for their examination to be more efficient and timelier than that of standard applications.

In practice, however, the reduced examination period may put more pressure on the examiners’ shoulders to make a rushed decision on whether to grant or reject an application. Therefore, the patent applicants may be given fewer opportunities to defend the applications to avoid rejections in the examination process, and instead might have to further pursue the invention in a less ideal re-examination process, with the unintended consequence of reducing patent quality.

With the latest five-year plan underway, businesses in China are already adjusting. The introduction of the new indicator may promote high-value patent filings; however, the new stricter examination process might pose a hurdle to this goal. As per the definition of ‘high-value’ patents, Chinese companies have become keener to build patent portfolios abroad both to establish a foundation for maximising competitiveness as well as eligibility to the ‘high-value’ label. With that in mind, many businesses have resorted to reaching out to patent attorneys, who are able to guarantee the highest chance of ensuring grant of a patent both locally and abroad.

(C) Naomi Korn Associates & Mathys & Squire 2022. Some Rights Reserved. These case studies are licensed for reuse under the terms of a Creative Commons Attribution Share Alike Licence.

The following case study has been taken from the “Implications of Covid-19 on SMEs – reassessing the role of IP in multiple sectors and industries” report written by Naomi Korn Associates and Mathys & Squire Consulting, November 2021. This case study reviews the impact on SMEs (small, medium enterprises) of the COVID-19 pandemic since its appearance in early 2020 through the first quarter of 2021. It focuses on the industries most affected by the crisis and whether intellectual property (IP) and IP management may have helped mitigate its impact through adaptation and change.

Sector overview

The manufacturing sector has been hard hit by COVID-19. A recent report suggested that due to staff furloughs and job losses, customers are likely to curtail spending except for groceries, medicines, and home entertainment. This has a knock-on effect for the manufacturing sector including cars, apparel, textiles, furniture, and appliances as well as the broader business to business industry. Furthermore, the report estimates that across Europe, up to 25% of jobs in the manufacturing sector may be at risk, which equates up to almost eight million jobs across several manufacturing industries. This figure can be multiplied many times over looking at the challenges facing the global manufacturing sector.

Analysis

In the earlier days of the pandemic, there was a global shortage of ventilators, required for treating COVID-19 patients. Similar shortages were observed for PPE, alcohol hand sanitiser and anti-COVID-19 drugs. These challenges resulted in existing producers ramping up production, and many businesses and inventors coming up with innovative solutions and alternative technologies. One technology area that benefited from increased innovation as a result of the pandemic driven demand increase is additive manufacturing and 3D printing. The digital technique allows extreme flexibility in production and easy customisation, meaning that prototypes for new products can be easily generated. As such, this technique has been used to generate specialist parts to help fight the pandemic. Italian company Isinnova produced a 3D printed Charlotte valve capable of connecting to snorkelling equipment, allowing for production of positive air pressure devices from standard snorkelling kit. Likewise, 3D printing has been used to produce mask filters and face shield parts [1]. In this context, German multinational Siemens enabled access to its additive manufacturing network for any parties needing assistance in medical device design and manufacture. Being a partially digital tool, complex 3D printing designs were shared globally online. An obvious issue in this context is infringement of IP rights such as patents, designs or copyright, however, initially it was assumed that good intentions and an ethical approach would prevent potential legal actions or wilful IP theft.

At the beginning of the pandemic, countries across the world experienced severe shortage of hand soap and alcohol sanitisers, caused by a boom in consumer demand and the supply chain unable to cope with it. In the case of PPE, this shortage was caused by panicked bulk buying of unsuitable equipment. Many manufacturing facilities were faced with a level of demand they were not designed for and never intended to deliver for, however it has been noted that many operational changes occurring in manufacturing due to COVID-19 were already underway and the arrival of the pandemic has simply accelerated these processes. This challenge has had several interesting consequences, many of which have impacts on IP rights moving forward.

In the case of ventilators, numerous governments and regulators, temporarily reduced requirements to enable non-medical industry manufacturers to produce ventilators and promoted production under forced collaborative manufacturing arrangements. In the UK, the VentilatorChallengeUK Consortium, comprising businesses across multiple industries was established to meet the increasing and urgent demand for ventilators. The UK government indemnified participants from accidental infringement of IP rights, competition and procurement law and aspects of product failure. Consortium designers and manufacturers were offered an IP indemnity by the UK Government, thus allowing the various partners to push forward with the task of producing ventilators without worrying about potential infringement. While the level of indemnity was not released, it was believed that the government undertook a contingent liability in excess of £3m, which gave consortium members confidence to partner with other firms.

Several governments, such as Chile or Canada, have also gone as far as issuing compulsory licences to produce PPE or ventilators, as well as anti-COVID-19 medication, such as Kaletra in Israel [2]. These compulsory licences have been issued with the caveat that the product being produced is free of charge for emergency use only and future commercial production would require the appropriate licence agreement [3]. The demand for PPE and hand sanitiser has also caused a number of manufacturers to modify their business models, including moving towards ecommerce and teleworking environments, as well as modifying their supply chain and using existing facilities to produce new products to meet demand. Going digital has not simply meant a move to online sales, but the development of a robust digital plan, which offered many SMEs the chance to streamline and automate many aspects of their business, resulting in improving efficiency and reducing costs. This digitalisation, along with new working patterns and shaking up of existing supply chains will create many new offerings for SMEs, especially those who have also carefully managed their cash flows during this period.

In addition to changes in business models, many businesses have also pivoted towards completely new goods and services offerings. Textile manufacturers such as Zara or Prada have produced face masks, while perfume manufacturer LVMH has used their facilities to make hand sanitisers. Many of these expansions into new markets by established companies have been successful in their new activities by growing their existing brand recognition and trade mark portfolios.

Some companies have sought to assist during the pandemic through a more direct use of their IP. The Open Covid Pledge providing a patent pool offering use of COVID-19 related patents is a good example. Under the pledge, companies with patents covering COVID-19 related inventions offered the open COVID-19 standard or open COVID-19 compatible licences to external businesses. The licences are offered royalty free for use by their owners for the duration of the pandemic until one year after its official end, as declared by the World Health Organization.

However, for companies producing crisis critical innovations such as PPE, sanitising gel and medications, the boom in demand has caused an increase in passing off and counterfeiting. In March 2020, a joint international police operation (Operation Pangea XIII) made 121 arrests and confiscated over 34,000 counterfeit surgical masks, ‘corona spray’, coronavirus packages and counterfeit medicines [4]. Similarly, in May 2020, the Italian Guardia di Finanza seized 900 counterfeit children’s masks [5]. With the innovation and licensing programs seeking to exploit all available technologies in the fight against COVID-19, innovative companies may find their IP being infringed, their products being copied, as well as a loss of enforceability of IP where compulsory licences have been granted. These companies will need to ensure that they do not miss out on potential commercial opportunities, but also that they remain sympathetic to the harsh economic and health circumstances, whilst understanding the potential reputational damage suing an infringing party during the pandemic might cause. For example, the non-practicing Labrador diagnostics sued the practicing company Biofire for alleged infringement of two of its patents. However, this misfire from Labrador has caused reputational damage and it delayed the development of potentially useful critical crisis technologies. Labrador diagnostics has since announced a royalty free licence to anyone developing COVID-19 tests, as well as extending the deadline for potential infringing parties to come forward. In another more positive example, truck manufacturer Scania provided some of its manufacturing experts to Swedish company Getinge to enable them to ramp up their ventilator production. In doing so, the company clearly improved the production capacity of Getinge, and thus the fight against COVID-19, without risking the core technology IP of Scania.

The European Commission is also putting in place an action plan to help SMEs impacted by COVID-19 by introducing new licensing tools and a system to co-ordinate compulsory licences [6]. In addition to this, the Commission is aiming to simplify the sharing of information and introduce mechanisms for quick pooling of patents, in order to efficiently meet the needs of those fighting COVID-19. Action points include backing of the Unitary Patent system, optimisation of the use of supplementary protection certifications, as well as the revision of EU legislation surrounding designs and plant variety protection. Furthermore, to directly assist EU based SMEs, IP vouchers will be available for one year to help such businesses manage their IP portfolio. Importantly, the Commission will also investigate methods of support for IP backed financing and seek to support SMEs in this context, in a similar manner to the Japanese government’s support on IP securitisation.

In the context of the current pandemic, when a company believes it is infringing someone else’s IP right, it should contact the relevant IP owners with the aim of securing a licence (potentially royalty free for the duration of the pandemic). Alternatively, companies may decide to drop enforcement of specific patents for the duration of the pandemic, similarly to AbbVie not enforcing Kaletra patents. However, companies failing to be flexible with their IP enforcement and licensing policy during the pandemic may find their products being reverse engineered and alternative, non-infringing products, being developed, thereby causing both reputational damage and loss of market share.

[1]Choong, et al (2020): The global rise of 3D printing during the COVID-19 pandemic, Nature Reviews Materials

[2] Tietze, Frank et al. (2020): Crisis-Critical Intellectual Property: Findings from the Covid-19 Pandemic, University of Cambridge

[3] Baker McKenzie (2020): COVID-19: A Global Review of, Baker McKenzie

[4] International Chamber of Commerce (2020): Disruptions caused by Covid-19 increase the risk of your business encountering illicit trade risks, ICC

[5] Verducci Galletti, S (2020): Challenging times: anti-counterfeiting in the age of covid-19, WTR

[6] European Commission (2020): Communication from the commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions- Making the most of the EU’s innovative potential, European Commission

Naomi Korn Associates is one of the UK’s specialists in copyright, data protection and licensing support services.

Mathys & Squire Consulting is an intellectual property consulting team that can support all businesses in capitalising intangible assets.

Naomi Korn Associates and Mathys & Squire Consulting are working in partnership across multiple industries to provide innovative consultancy IP support services.

Leading intellectual property law firm Mathys & Squire has announced a series of Partner promotions and two new Managing Associates. The promotions form part of the firm’s growth strategy and reflect the firm’s commitment to professional development and career progression.

Alan MacDougall says: “We are delighted to announce these promotions following a very strong year for Mathys & Squire. Our new Equity Partners, Partners and Managing Associates have all played a crucial part in Mathys & Squire’s recent growth and successes. They have the proven knowledge and experience to deliver for our clients and help continue the growth of the firm.”

In recognition of their contribution, the following Partners have been promoted within the equity partnership:

- Dani Kramer (London) – Dani manages the international patent portfolios of large corporates, focusing on fields such as software, AI and machine learning, as well as electrical and electronic engineering.

- Catherine Booth (Manchester) – Catherine works across the technical fields of healthcare, engineering, and telecoms. Her practice includes the creation and management of IP portfolios, litigation and other disputes.

- James Wilding (London) – James’ practice includes European Patent Office prosecution and opposition work in the life sciences sector. He has particular expertise in immunology, vaccines and gene editing.

- Andreas Wietzke (Munich) – Andreas has significant experience in obtaining, defending and enforcing national and international patents, with technical expertise spanning the fields of software, telecoms, medical devices and mechanical engineering.

The firm is also pleased to announce two Partners have been promoted to Equity Partners:

- Andrew White (London) – Andrew manages international portfolios in the medtech, software, telecoms and automotive fields. He is an expert in deep tech inventions in fields such as AI and blockchain, as well as technologies related to consumer healthcare.

- David Hobson (London) – David has a background in biochemistry and advises clients within the biotechnology, pharmaceutical and food & beverage sectors. He has extensive experience in patent drafting and multi-jurisdictional prosecutions.

Annabel Hector and Alexander Robinson have been promoted and are now Partners. Annabel has experience in litigation with her technical expertise spanning the fields of mechanical and structural engineering. Alexander’s experience includes the defence of commercially significant patents against multi-party oppositions. His technical expertise lies in chemical sciences and pharmaceuticals. Both Annabel and Alexander are London-based.

Edward Cavanna and Thomas Fraser are newly promoted Managing Associates in Mathys & Squire’s London office. Edward is experienced in drafting and prosecuting UK and European patent applications, especially in the fields of software, materials and green energy. Tom’s technical expertise lies in IT and electronics, including AI and machine learning. His practice includes drafting and prosecuting patent applications in the UK, Europe and US.

Alan MacDougall says: “We are passionate about providing our employees opportunities to maximise their potential and are delighted to offer them a promotion and the recognition they deserve. Mathys & Squire is proud to have them on our team and is looking forward to continuing to grow our practice together.”

Serving legal proceedings can be a necessary, but potentially troublesome legal requirement – and using the usual methods of service (personal service, first class post, leaving at a specified place, or via electronic communication) can be particularly tricky in situations where potential defendants are being purposely evasive. A recent decision from the UK High Court offers an alternative method, albeit one that is applicable only in very specific circumstances.

In this decision (D’Aloia v Binance Holdings & Others [2022]), Fabrizio D’Aloia has been allowed to serve proceedings via non-fungible tokens (NFT) airdrop to a digital wallet. The background to the case is that Mr D’Aloia had transferred a large number of cryptocurrency tokens to a purported trading account, which he later realised was fraudulent. Mr D’Aloia was able to trace these tokens to digital wallets associated with Binance (among other exchanges). Thereafter, in an attempt to recover these assets, D’Aloia sought an injunction and also sought – and was granted – permission to serve the (unknown) owners of the digital wallets via NFT airdrop to those digital wallets as well as via email.

This ruling thus enables the contacting of parties of unknown identity or address in a straightforward manner via NFT airdrop. At the present time, there seem to be rather limited circumstances in which this method might be applicable, specifically in cases of cryptocurrency misappropriation. However, if blockchains become more pervasive through society in the coming years – and more people have links to known digital wallets – this method of service might become more widely applicable. One could imagine a future in which various types of legal proceedings are served by NFT Airdrop to a wallet associated with a defendant. And this sort of rapid and undeniable service of proceedings via NFT, which would leave an immutable record on a blockchain, would offer immediately apparent benefits over the slower and more difficult to evidence service of proceedings via post.

A similar ruling was made earlier this year in the US in LCX AG, -v- John Does Nos. 1 – 25, so perhaps more countries will follow soon.

Although these cases are of course not relevant to the patenting of blockchain technology, these decisions do at least indicate that blockchains are being used for an increasingly diverse range of purposes and are increasingly finding acceptance from governmental bodies. One slightly tangential takeaway then from a patent point of view – that is particularly relevant in the UK (which currently takes a harsher view of blockchain applications than other jurisdictions) – is that it is worthwhile for applicants to think about potential (non-cryptocurrency) uses of blockchains and to describe these uses in any patent application. Linking blockchain technologies to practical uses will often be helpful for avoiding subject matter objections in patent applications.

Data provided by Mathys & Squire has featured in articles by The Manufacturer, The Resource, Circular Online and The Patent Lawyer providing an update on Chinese companies leading the charge for ‘holy grail’ of clear recycled PET.

An extended version of the release is available below.

A record 2,149 patents for plastic recycling were filed last year, up 7% from 2021 and an eightfold increase since 2016, says Mathys & Squire, the intellectual property firm.

Mathys & Squire says the plastic recycling industry is competing to develop technology that will produce clear recycled plastic. Current recycled plastic has a yellow or grey tinge, unlike the clear colour that consumers expect of a premium product.

A vast range of methods for separating and sorting clear recycled PET is being tested, including the use of fans, centrifuges, lasers and optical lenses. The main priority is to achieve a higher quality ‘feed’ of recycled plastic that will provide the desired lack of colour.

Global brands are searching for a source of clear recycled plastic due to consumer and regulatory pressure to reduce or even eliminate virgin plastic from their supply chains. Coca-Cola and Pepsi have each pledged to use at least 50% recycled PET by 2030.

85m tonnes of PET plastic is produced globally per year. Mathys & Squire says that given the pressures on corporates to use more recycled PET, the company that perfects clear recycled plastic stands to generate very large revenues from licensing its technology.

Chris Hamer, Partner at Mathys & Squire said: “The race is on to develop the holy grail of cost-effective, clear recycled PET. That is the key driver behind the surge in innovation we have seen in this area.”

“Stakeholders are increasingly demanding low-carbon products, which in turn is creating a huge market for recycled plastics.”

“Whoever can develop a cost-effective method of producing clear recycled plastic will be able to tap into what some major players estimate to be a potential £100 billion market.”

Last year Chinese companies filed 1,970 patents relating to plastic recycling, 1,937 more than second place India. China is leading the way in patent filings as the country is in the middle of a single-use plastic crackdown.

In July of last year, China’s National Development and Reform Commission which oversees economic planning of mainland China published a “five-year plan” to boost plastic recycling and incineration capabilities. The five-year plan also commits to greatly reducing the use of single-use plastics.

(C) Naomi Korn Associates & Mathys & Squire 2022. Some Rights Reserved. These case studies are licensed for reuse under the terms of a Creative Commons Attribution Share Alike Licence.

The following case study has been taken from the “Implications of Covid-19 on SMEs – reassessing the role of IP in multiple sectors and industries” report written by Naomi Korn Associates and Mathys & Squire Consulting, November 2021. This case study reviews the impact on SMEs (small, medium enterprises) of the COVID-19 pandemic since its appearance in early 2020 through the first quarter of 2021. It focuses on the industries most affected by the crisis and whether intellectual property (IP) and IP management may have helped mitigate its impact through adaptation and change.

Sector overview

While many industries and sectors have seen consumer demand plummet and have been faced with furloughing and layoffs, the wider healthcare and medical sectors have faced extremely high demand for services. Requirements for social distancing and minimising contact have seen the rise of new innovations surrounding robotics and telehealth solutions. Transformative developments using blockchain technology, allowing for exchange of information across products, services and medical practitioners have also experienced an increase in innovation. This is evident thanks to the announcement of Healthcare Innovator Philips that it is investing in a pivot towards telehealth. In the post-COVID-19 world, a permissioned and private blockchain will have a pivotal role in the digitisation of the healthcare industry and creation of new digital health solutions.

Analysis

While telehealth technologies were already present, it has been estimated that the level of telehealth visits has increased by 50-175 times the pre-COVID-19 levels with many patients now viewing the technology favourably. Many institutions have retrained their staff to provide innovative telehealth services, including virtual patient waiting rooms, robotics, connections to peripheral devices for remote diagnostics, cloud based clinical trials and electronic prescriptions services. This represents a change in the business model used in the sector, with up to 76% of surveyed patients indicating that they would use telehealth technology moving forward. For example, the Singapore-based startup Homage, matches families and caregivers, providing home visits, telehealth consultations and medications delivery, through an integrated platform accessible by patients, medical staff, and other care providers, and keeping medical information, and prescriptions all in one healthcare management tool. The US company Radiologex offers a blockchain-based healthcare ecosystem, called R-DEE – a dedicated industry product for global healthcare that enables easy and secure communication and collaboration for all users.

The present pandemic has catalysed interest in contact-free continuous monitoring (CFCM) devices and approaches, such as the virus screening platform Clearstep, which allows patients a user-friendly way to check their symptoms, exposure and risk levels, and receive tailored advice and routes for potential care. Such approaches allow for a limitation of physical contact, reduction in in-person contact and the need for medical staff to gown up. It is estimated that 5% of COVID-19 patients may require ICU treatment, and with an ever-increasing infection rate, and coping with a reduced workforce, telehealth technologies offer medical staff a route to treat those infected, while reducing the chance of further transmission or quarantine requirements. The Israeli company Earlysense has developed CFCM technology for continuous patient monitoring, including heart rate, respiratory rate and motion monitoring, as well as dashboards for overview of activity per patient or even per facility. We note that in February 2021 this technology was acquired by US-based technology company Hillrom, with the company licensing the technology back to EarlySense who will continue to make new developments, including next-generation AI based sensing technologies for remote patient care.

Tele-ICU technology has enabled remote consultations, thereby taking off some of the pressures associated with limited staff and PPE shortages. Research has shown that such systems may result in a reduction in mortality rates by 15%-60% and a significant reduction in the length of hospital stays[1]. This advantage continues beyond this point with telehealth allowing continued monitoring of recovered COVID-19 patients once they have left medical facilities. This seismic impact of COVID-19 on the healthcare sector has resulted in a telemedicine market worth more than $49.9 billion, expected to increase by a CAGR of 40.4%, reaching a value of $194 billion in 2023. The United States represents the largest market, followed by Asia Pacific and Europe.

In this sector, numerous companies, medical facilities, and inventors have developed novel solutions. Prior to the pandemic, a US-based company had developed a cloud-based, HIPAA-compliant platform called Vidyo to conduct patient consultations and to communicate between physicians and hospitals. However, with the arrival of COVID-19 several healthcare providers in the US found that with additional hardware, this already approved system could be easily rolled out across the hospital. French company Tessan has developed a connected telemedicine cabin, which has been already installed in several pharmacies in France. These cabins are fitted with several medical devices and remotely connected to doctors, who can act based on the output when required, without the need for the patient to enter the hospital. The pandemic has also sparked the development of Iceland’s SidekickHealth, a gamified digital therapeutics platform combining clinical validation with gamification, behavioural economics, and AI to deliver a personalised patient experience. Companies have also stepped up to offer royalty free licensing of patented technologies to healthcare providers through the Open Covid Pledge to aid in the fight against COVID -19. This includes patents relating to a variety of technologies including network-based healthcare information systems from AT&T, Wi-Fi enabled open-clinics from Hewlett Packard Enterprise, disease diagnostics technologies from Fujitsu, and protein detection technologies from Sandia.

A recent lawsuit filed by Teladoc Health against American Well over infringement of robotics and real time connection patents is a testament to the increase in patent litigation amongst telehealth companies and providers. It also highlights the importance of securing suitable protection of intellectual property assets from the beginning, especially when regulations are being relaxed to ease provision of care for patients.

The technical innovations used to provide telehealth services are rich in data, with the AI models they contain being trained on data generated by sensors, apps, and patient interactions. One of the main points of concern in the use of these technologies relates to data protection and its secure storage, as well as many innovations being developed in their own right just to deal with these issues. Telehealth solutions and the related data provide a wide range of intellectual property assets, which should be suitably protected.

A well-known telehealth platform may be recognised through a known trade mark or logo, while the software behind the platform may be copyright or in some cases patent protected. Algorithms behind a certain telehealth software are likely to be protected as trade secrets, whilst user interfaces or layouts may be protected by design rights. In all cases, such telehealth platforms represent a mix of intangible assets, which must be carefully managed by any business operating in this sector. Furthermore, the move towards telehealth and blockchain enabled systems, represents the formation of new business models, leaving existing players needing to strategically pivot their strategies to focus on more innovative opportunities[2].

[1] Naik, Gupta, Singh, Soni, & Puri, 2020, pp. Real-Time Smart Patient Monitoring and Assessment Amid COVID-19 Pandemic – an Alternative Approach to Remote Monitoring

[2] Morgan, Anokhin, Ofstein, & Friske, 2020, p. SME response to major exogenous shocks: The bright and dark sides of business model pivoting

Naomi Korn Associates is one of the UK’s specialists in copyright, data protection and licensing support services.

Mathys & Squire Consulting is an intellectual property consulting team that can support all businesses in capitalising intangible assets.

Naomi Korn Associates and Mathys & Squire Consulting are working in partnership across multiple industries to provide innovative consultancy IP support services.

Following the launch of a consultation on intellectual property (IP) and artificial intelligence (AI) towards the end of last year, the UK Government have now released their formal response summarising the outcome.

The consultation was designed to seek opinions on the issues surrounding IP – in particular copyright and patents – and AI as a tool for innovation and creation.

Three key areas were looked at:

- Copyright protection for computer-generated works without a human author. These are currently protected in the UK for 50 years, but the consultation looked at whether they should they be protected at all, and if so, how.

- Licensing or exceptions to copyright for text and data mining, which is often significant in AI use and development.

- Whether and how AI-devised inventions should be protected by patents.

Several options were presented for each area and respondents were asked to indicate which of three options they would prefer, where “option 0” for all three areas represented “no legal change”.

Based on the results of the consultation, the UK Government are not planning any changes to UK patent law or copyright laws relating to computer-generated works, though notes that they will keep these areas of law under review.

The UK Government is, however, planning to introduce a new copyright and database exception which allows text and data mining for any purpose. Rights holders will still have safeguards to protect their content so they can choose the platform where they make their works available, and charge for access.

We will continue to monitor for updates and will of course provide more information relating to any changes as we become aware of it.