The start date for the Unified Patent Court (UPC) will be 1 June 2023. This will also be the date on which the Unitary Patent (UP) system comes into effect. Thus, many patent holders are currently considering the merits keeping their EP patents ‘opted in’ to this system.

Our UPC brochure outlines reasons why a you may wish to ‘opt out,’ but also includes some advantages of remaining ‘opted in.’ The purpose of this article is to expand on the latter, to assist weighing up the pros and cons of adapting your patent strategy such that future litigation would be through the UPC, instead of solely through the individual national courts across Europe. Thus, five advantages of remaining ‘opted in’ are outlined below.

1. Pan-European enforcement

Naturally, the first advantage of the UPC to note is that its jurisdiction covers numerous European territories (initially 17, likely extending to 25 in the coming years). Thus, relief for infringing activities across all of these territories can be sought via a single action.

Advantages include:

- Mitigating the complexity and cost of infringement proceedings, compared to pursuing proceedings at each individual national court. This may also avoid a scenario in which the national courts reach conflicting opinions on the issue of infringement.

- Relief for infringing activities occurring across the contracting member states, even in those states where an applicant may not have considered validating a ‘traditional’ EP patent or may have avoided for the purpose of infringement proceedings (e.g. a territory lacking a litigation track record in the field of the patent).

- The possibility of a Europe-wide injunction enforceable against a third party in each contracting member state, avoiding commercial confusion in scenarios where injunctions are ordered by only a selection of national courts, with the third party being (at least theoretically) free to continue their activities in other European states.

- Damages that may reflect the size of the market defined by the at least 17 (and counting) contracting member states, which is anticipated to be considerably more lucrative than damage obtainable from a single (or limited selection of) national court(s). This is particularly attractive for seeking damages in territories where the law on damages is less patentee-friendly.

- Enforcement of a single patent ‘pan-Europe’ is anticipated to be cheaper than separate litigation actions in the various European territories. This may be particularly attractive for patents covering technology sold widely at high volume, but at low value.

2. A system ‘born for’ patents

Although a number of European territories have excellent patent courts, such courts tend to be a smaller ‘part’ of a wider (e.g. civil) court system, with judges potentially selected for their broad IP knowledge across different types of IP. In contrast, the UPC is a court system dedicated to patent matters and is the outcome of years of meticulous planning by patent experts toward optimisation for patents. Furthermore, given the importance of this new system to the patent profession, numerous knowledge bases have been/ are being generated on a regular basis as the UPC is being rolled out. Thus, an interested applicant/ patentee can enjoy access to a wealth of information on the UPC system at their fingertips.

Advantages include:

- a patent court system designed to operate efficiently, with a first instance trial intended to be scheduled for within 12 months from the commencement of proceedings (versus a more typical period of about two years in some national courts). This should deliver more rapid resolution, and thus more rapid commercial certainty.

- Trial days are to be minimised (e.g. one trial day only, where possible), thus saving costs.

- Access to a talented pool of judges (85 of which have already been appointed), selected for their excellence in patent matters from over a thousand applications, and expected to deliver consistent decisions.

- Uniform court management systems (optimised for patent matters) across the divisions available to hear a case, leading to clarity and consistency in terms of timelines and costs. Indeed, each division, independent of its territory, will follow the same Rules of Procedure that govern how litigation is conducted before the UPC.

3. Flexibility in forum selection

Given that the EU is a single market, it is not uncommon for an infringing activity in one territory to also be taking place in multiple (or even all) other territories. A claimant may therefore have a choice of litigation venue, chosen from one of the local/regional divisions present in any of the territories where infringement occurred. This opens the possibility for patentees to make strategic venue choices.

Advantages include:

- The option to select a venue considered desirable for your technical field. For example, the background of the judges at the different divisions could be analysed to identify a panel with strong knowledge in the technical field of the invention, reducing the need for and cost of expert witnesses.

- For a territory lacking a litigation track record (e.g. in the technical field of the patent), litigation could instead be opened in a territory with a more established track record, such as in Germany. In this scenario, proceedings could be sought in German, or indeed even in English (both languages of the German local divisions).

- A single litigation team can be brought on board, to manage a single litigation action conducted through the UPC. This contrasts with the traditional system where it has been necessary to recruit litigators in each territory.

4. The best of both worlds

It is also possible to adopt a strategy that makes use of both the UPC and the traditional national validation system. For example, a patent portfolio could be analysed to select members of the portfolio suited to the UPC e.g., for patents anticipated to be widely infringed across the EU (incl. in territories lacking a litigation track record). Other members of the portfolio could instead be ‘opted out’ of the UPC and proceed via traditional national validation e.g., where widespread infringement is not anticipated, and it is desirable to avoid the risk of central revocation.

Furthermore, creative ‘divisional’ application filing strategies may allow both systems to be pursued in parallel. For example, a broad ‘parent’ patent may be ‘opted out’ to be maintained via the traditional national validation system. Separately, a narrower ‘divisional’ patent (e.g. more particularly focused around a key commercial embodiment) could be set up for the UPC. This could provide a scenario where the parent patent provides a broad deterrent to infringers, and although broader it would not be at risk of central revocation, a feature of the UPC. The narrower ‘divisional’ patent, on the other hand, may have reduced risk of central revocation due to its narrow nature that could resist validity attacks.

5. Stay ahead of the curve

Eventually, the UPC will have exclusive jurisdiction over all patents granted by the EPO, irrespective of whether the patent is pursued as a Unitary Patent, or is ‘classically’ validated. This situation will begin at the end of the transitional period, lasting seven years (extensible to 14 years) after the Unitary Patent system comes into effect on 1 June 2023.

Thus, by engaging in the system as it rolls out, it would be possible to begin developing experience and expertise in a system that will eventually become the status quo. By getting involved now, early users could be in a position to provide vital feedback as the system beings, playing a hand in helping to shape it. Perhaps even more appealing would be the possibility to help shape the development of case law under the UPC, for example toward establishing patentee friendly case law.

Conclusion

The UPC is set to be a significant commercial tool for organisations in the years to come. Our dedicated UPC and UP Hub has been created to provide updates on current developments in the UPC landscape, and to identify the potential implications for your patent portfolio.

Please contact your usual Mathys & Squire attorney or email us at [email protected] to discuss your UPC strategy in more detail.

It has been confirmed that the UK’s accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has been approved. This means that the UK will soon join a free trade area including Australia, New Zealand, Canada, Singapore, Japan, Mexico, Vietnam, Malaysia, Brunei, Peru and Chile.

The Intellectual Property (IP) Chapter of the CPTPP includes an obligation for parties to that treaty to provide a 12-month grace period for patent applications. This means that public disclosures of information should be disregarded as prior art if those disclosures were made by the patent applicant or by “a person that obtained the information directly or indirectly from the patent applicant” during a period within 12 months prior to the filing date of the patent application.

That obligation had proven controversial since it is at odds with current practice in the UK which – in line with the European Patent Convention (EPC) – applies a strict ‘absolute novelty’ test. Under the current UK and European approach, parties’ own disclosures can count as prior art against their patent applications, with no grace period provisions except in very limited circumstances such as disclosures in breach of confidence.

In fact, questions had even been raised in some quarters as to whether a UK grace period would be compatible with the UK’s continued participation in the EPC. Article 2(2) EPC, which requires EPC contracting states to commit to the requirement for European Patents to “have the effect of and be subject to the same conditions as a national patent granted by that State.”

It was questioned whether the introduction of a grace period in the UK – without a parallel grace period in the EPC – would have been consistent with that requirement (despite the fact that a handful of other EPC states already provide 6- or 12-month grace periods for national patent applications and/or national utility models).

In the event, any difficulties in reconciling the UK’s membership of both the EPC and the CPTPP have been avoided, as the UK negotiating team has successfully secured a derogation from this part of the IP Chapter. The grace period provisions of the CPTPP have been set aside in the UK “until the necessary amendments to the relevant international conventions have been made”, with an agreement that the UK will “promote international harmonisation on the grace period and will report annually to other CPTPP members regarding progress on this matter.”

This means that UK patent practice remains unchanged in this respect, and in contrast to other CPTPP states, patent applicants will not be able to rely on a 12-month grace period when filing UK patent applications.

The European Patent Office (EPO) has so far demonstrated no intention to introduce a grace period of its own, and a recent EPO study suggested relatively little support for doing so. The prospect of a change of position in light of the UK’s obligation to ‘promote international harmonisation’ thus seems rather remote at present. According to the Chartered Institute of Patent Attorneys, any adoption of a grace period in the UK may also require amendment of the Strasbourg Patent Convention of 1963, a forerunner to the EPC which is still in force, and to which thirteen EPC member states, including the UK, are signatories.

Any developments with respect to amendment of the EPC or the Strasbourg Convention will be monitored with interest, but the adoption of a grace period in Europe seems unlikely for the time being.

The Enlarged Board of Appeal has issued a preliminary opinion suggesting that it is minded to approve something close to the so-called ‘PCT joint applicants approach.’

As explained in our earlier article, the Enlarged Board has essentially been asked to decide whether, firstly, the EPO has the power to determine whether a priority right has been validly transferred to a successor in title, and secondly, whether naming the applicant for a first filing as applicant for the US only in a PCT application claiming priority thereto is enough for the purposes of introducing priority rights into the European designation. Oral proceedings have been scheduled for 26 May 2023 and the Enlarged Board has now issued its preliminary opinion on the issues.

First question

The Enlarged Board considers the first question admissible as it touches upon fundamental questions of law. This in itself is interesting because the tribunal could have taken the position that the first question did not require an answer in view of established case law and practice, according to which the EPO does have the power to decide entitlement to priority.

The Enlarged Board further addresses the scope of the first question and considers that it encompasses all situations where the applicant claiming priority is not clearly identical to the applicant of the priority application. This is because entitlement to priority issues are also said to arise outside the context of succession in title.

As regards how the first question should be answered, the Enlarged Board merely identifies a number of further questions that might usefully be discussed at the hearing. These are summarised as follows:

- Has the case law always implicitly or explicitly supported the EPO’s competence to assess entitlement to priority?

- Does the provision governing the EPO’s lack of competence to determine entitlement to a European application have any impact on the interpretation of the provision governing entitlement to priority?

- Should the EPO assess entitlement to priority ex officio during examination proceedings?

- Could entitlement to priority be assessed on the basis of the autonomous law of the EPC, i.e. without invoking national law?

- If the EPO has the competence to assess an applicants’ entitlement to priority, is it also competent to assess their entitlement to the priority application?

These further questions suggest that Enlarged Board is far from making up its mind. Indeed, the tribunal notes that opinion is also evenly divided between ‘yes’ and ‘no’ in the amicus curiae briefs and among the parties to the proceedings.

Second question

The Enlarged Board considers the second question admissible because it is relevant in many proceedings before the EPO and is a matter of ongoing discussion in the case law.

As regards how it should be answered, the Enlarged Board says that it tends to support an affirmative answer (assuming there is an affirmative answer to the first question) on the basis that the joint filing of a PCT application (“i.e. with the consent of all applicants”) could serve as evidence implying an agreement on the sharing or transfer of the priority right. This approach seems to align closely with the PCT joint applicants approach, although problems could presumably arise if there is evidence proving the absence of any agreement, or worse, a disagreement between the PCT applicants vis-à-vis the sharing or transfer of priority rights.

The Enlarged Board further notes that the written submissions have almost unanimously supported an affirmative answer to the second question. An affirmative answer would certainly be good news for many patentees!

We will provide further updates as the Enlarged Board referral progresses.

The Department of Health and Social Care recently published a Medical Technology Strategy report which outlines how the UK health and social care system can access innovative medical technologies, so called ‘medtech’, to deliver high-quality care.

The strategy provides a framework in which the NHS is to develop and select medtech products. The aim is to provide continuity in the medtech supply chain to ensure innovative products reach patients quickly and to develop an infrastructure to enable this.

The report also highlights the importance of medtech, to the UK healthcare system, with the NHS alone spending an estimated £10 billion per year on medtech as well as the industry itself accounting for 31% of all turnover in the UK life sciences sector. The medtech sector is broad, varied and competitive with just under two million products registered for use on the UK market and over 4,000 UK medtech businesses in the UK.

The report also emphasises the important role that patent protection plays with medtech patents making up 1 in 12 patent applications from the UK to the European Patent Office. As a practical commercial matter, due to product development and regulatory approval requiring significant time and investment, patent and design protection in this sector offers a major strategic benefit. Companies in this industry value their IP rights very highly and as a result are prepared to invest to defend them. The latest strategy highlights government’s understanding of the importance of the future of medtech, as well as the trust in innovation and IP protection required.

The recent spring budget also provided positive news for UK medtech companies with an announcement of a new R&D tax credit scheme for SMEs and a commitment from the UK Government to support the Medicines and Healthcare products Regulatory Agency to provide simple, rapid approvals for medicines and technologies.

For more information on how best to protect your medical technology, please contact our medical devices team.

Chancellor Jeremy Hunt delivered his Spring Budget in the House of Commons on Wednesday, 15 March 2023, with a target of rebuilding a strong economy by tackling inflation and the cost of living crisis. Of particular interest to us is the government’s focus on carbon capture, tax boosts to smaller businesses, and the future of the nuclear energy and artificial intelligence (AI) sectors.

Investment allowance increase and further tax boost for small businesses

Reinforcing the attempts to grow the economy, Hunt announced that the Annual Investment Allowance has been increased to £1m for small businesses. Considering 99% of the UK economy is made up of small and medium-sized enterprises (SMEs), all of them will be able to deduct the full value of their investment from that year’s taxable profits. In addition to supporting the burgeoning startup community by increasing the tax-deductible amount spent on investment, the Chancellor has also introduced a tax boost to further promote spending. SMEs will be able to claim £27 for every £100 spent, as long as they spend 40% or more of their total expenditure on research and development (R&D). Introduced measures should see SMEs investing and researching, with a goal of growing the business and thus the UK economy.

Financial support for the development of carbon capture technologies

As anticipated, the chancellor has confirmed a budget of up to £20bn to support the development of carbon capture methods, as well as its storage and usage technologies. Not only is it expected to help capture 20-30 million tonnes of CO2 per year by 2030, but it will also support up to 50,000 jobs and attract further private sector investment. This area of cleantech is already a hot bed of innovation, however, the extra funding available is likely to enhance the speed and quality of new solutions brought to market.

Confirmation of the classification of nuclear power as environmentally sustainable

The clear-cut validation of nuclear power as “environmentally sustainable” gives it access to same investment incentives as any other renewable energy. Along with the confirmation and in line with Britain’s goal of energy independence, Jeremy Hunt has also launched “Great British Nuclear”, looking to support the industry by providing better opportunities and lower costs to produce nuclear power. The chancellor went a step further and announced a competition for small modular reactors. If the technology is found to be viable, the government promises to co-fund the technology. With such clear government backing, we expect the rate of innovation in the nuclear power sector to go up significantly.

Encouragement and prizes for groundbreaking artificial intelligence research

The already rapidly expanding sector of AI has been promised a prize of £1m every year for the next 10 years “to the person or team that does the most groundbreaking AI research.” The current rate of R&D in the sector is astonishing as it is, and £10m worth of prizes available will only spark the competitiveness and drive amongst innovators.

Looking ahead

The budget highlights the government’s trust in the rate and direction of innovation driven by the SME community, as well as cleantech and AI inventors. As a follow-on effect, increased innovation will likely result in a spike in filings of intellectual property rights in a bid to help commercialise the technology in question. We look forward to seeing how the introduced policies and measures will affect the technology and science space.

The fashion industry is a major contributor to the global plastic pollution crisis. The production of polyester, which is a synthetic fabric widely used in manufacturing clothing, requires the use of oil. The United Nations estimate that the fashion industry uses around 70 million barrels of oil every year to produce polyester. This dependence on oil for synthetic fabric production is a major contributor to the depletion of fossil fuels and climate change.

Additionally, polyester is responsible for releasing a significant amount of microplastics into the world’s oceans, with the European Environment Agency estimating that the synthetic clothing is responsible for 35% of its total. During the washing process, synthetic fabrics shed microfibers into the water supply, harming aquatic life and even ending up in the food chain.

To address this issue, it is crucial for the fashion industry to adopt sustainable practices that reduce its reliance on synthetic fabrics. One effective strategy is to use recycled materials, which involves converting waste materials into new textiles. This reduces the amount of waste in landfills and the environmental impact of textile production. Additionally, inventing new manufacturing technologies is another way to reduce the negative footprint. For example, there are now textile production methods that require less water and energy, or that use natural dyes instead of synthetic ones.

Promoting circularity by reusing and recycling materials is also an effective strategy for reducing the environmental impact of the fashion industry. This involves designing products with the intention of prolonging their life and encouraging consumers to return used products for recycling or repurposing. By promoting circularity, the fashion industry can significantly reduce the amount of waste it generates.

Overall, the fashion industry has a significant impact on the environment, and reducing its reliance on synthetic fabrics, particularly polyester, is crucial for promoting sustainability. By using recycled materials, investing in new textile production technologies, and promoting circularity, the fashion sector can significantly reduce its environmental impact and contribute to a more sustainable future.

In a bid to combat the environmental impacts of fashion, Radiant Matter has invented BioSequins®, which are made from plant-based cellulose, as opposed to petroleum-based plastics and toxic coatings, which are harmful to the environment and human health. The change in materials used makes BioSequins® free from plastics, metals, minerals, and synthetic pigments, as well as making them non-toxic and biodegradable, meaning they do not leave harmful residues or pollutants behind after serving their purpose. By creating a material that is both sustainable and non-toxic, Radiant Matter is promoting the health of people and the planet.

Mathys & Squire is proud to have helped London-based startup, Radiant Matter, draft their patent application for BioSequins®, the next step in sustainable high-fashion. The world’s first garment crafted from BioSequins® has been used by luxury lifestyle brand Stella McCartney to create a jumpsuit, now gracing the April 2023 cover story of American Vogue, being worn by model and eco-activist Cara Delevingne.

Although the BioSequin® jumpsuit is not yet available for purchase, it represents a significant step forward in sustainable fashion. By developing new materials that are both fashionable and eco-friendly, businesses like Radiant Matter are demonstrating that it is possible to create products that are profitable, whilst also being beneficial to the environment. As more companies begin to adopt sustainable practices, it is likely that we will see more innovations, like BioSequins®, that have the potential to revolutionise the fashion industry.

New decision T 3097/19 from the European Patent Office (EPO) Board of Appeal adds to the body of conflicting case law on the need for the description of a patent application to be adapted for conformance with allowed claims during the examination procedure.

At the EPO, once the claims of a patent application are considered allowable by an Examining Division, it is typical practice that the description of the patent application must be adapted to be in line with the allowed claims. Common amendments that are made include amending the description to remove inconsistencies between the description and allowed claims (such as where the originally filed description describes a feature of the allowed independent claims as only optional). Amendments are also typically required where the originally filed description describes as embodiments of the invention subject matter that is no longer covered by the allowed claims.

In the latter of these scenarios, for many years, practice at the EPO was largely settled. Where the description of an application referred to embodiments of the invention that were not covered by the allowed claims, the description could typically be amended by simply removing explicit reference to the embodiment forming part of the invention. For example, the statement ‘in an embodiment of the invention’ could be replaced with ‘in an instance of the disclosure.’

This practice changed with the coming into force of updated EPO Guidelines for Examination in 2021. The Guidelines for Examination reflect EPO practice and should be followed by Examining Divisions. The updated guidelines brought in more stringent requirements for adapting the description. In particular, for disclosed embodiments not covered by the allowed claims, the updated guidelines only allowed these embodiments to be retained in the description if they were useful for highlighting specific aspects of the allowed claims. Furthermore, the updated guidelines required each of these embodiments (if retained) to be explicitly labelled as not being part of the claimed invention. The more stringent requirements are controversial and have attracted criticism both within the EPO and in the patent attorney profession. As a result of the updated guidelines, a greater number of, typically more complex, amendments to the description are generally required which can increase the costs for applicants of prosecuting an application to grant.

The rationale for updating the guidelines was to follow various decisions of the EPO Boards of Appeal (such as decision T 1808/06). Most of these decisions make reference to the requirements of Article 84 EPC, second sentence, which states that the claims should be supported by the description. According to these decisions, for this requirement to be met, embodiments not covered by allowed claims should normally be excised from the description, and if retained, prominently indicated as not being part of the claimed invention.

Despite these decisions and the updated guidelines, certain recent EPO Board of Appeal decisions have gone against what is stated in the updated guidelines reflecting the disagreement within the EPO and controversy associated with this matter. For example, decision T 1989/18 (Reason 13) stated that neither Article 84 EPC, nor any other EPC provision, can lead to the requirement that embodiments disclosed in the description that are more general in nature than the subject matter of an independent claim must necessarily constitute subject matter dependent upon that of the independent claim (i.e. be necessarily according to the invention defined in the claims). Similarly, recent decision T 2194/19 found that if the description mentions embodiments outside the scope of allowed claims, the description does not need amending to remove said ‘embodiments’ or to highlight them as not being according to the invention. This decision also found that the ‘invention’ is not necessarily always to be equated with the ‘invention claimed.’

In stark contrast to these decisions (and indeed explicitly disagreeing with them), recent decision T 3097/19 found the opposite and agreed with the approach taken in the current EPO Guidelines for Examination. In the decision, in addition to making reference to Article 84 EPC, the Board also made extensive reference to Article 69 EPC and the extent of protection conferred by a patent.

In the view of the Board, an elementary requirement of a patent is that its extent of protection can be determined precisely. In the Board’s view, the clarity requirements for the claims of Article 84 EPC serve that purpose but are not sufficient to ensure it. According to the Board, the function of the claims, as defined in Article 84 EPC, is only achieved when the extent of protection can be precisely determined, and this can only be done if the claims are consistent with the definition of the invention provided in the description. If this were not the case, then the application for grant of the patent would be self-contradictory. The Board goes on to state that consistency between the claims and description is necessary for legal certainty, and that the skilled person must not be confronted with contradictory statements when reading a patent application since this might cast doubt on what the invention is for which protection is sought.

The Board goes on to provide additional comments on clarity and interpretation of claims. The Board acknowledges that its findings in the decision may be in tension with the requirement often expressed in case law that the claims must be clear “from the wording of the claims alone.” The Board states that it does not agree with a verbatim reading of this requirement and instead concurs with the statement in the Guidelines for Examination that “the meaning of the terms of a claim must, as far as possible, be clear for the skilled person from the wording of the claim alone”, which the Board considers is an expression of desire, in the interest of legal certainty, that divergence of post-grant jurisprudence be limited. The Board again then highlights its opinion that the requirement of Article 84 EPC that claims be clear is different from the purpose of Article 84 EPC which is that it must be possible to precisely determine the scope of protection.

T 3097/19 is an interesting decision since it makes an explicit link between the need to adapt the description so as to be in line with the allowed claims and the determination of the extent of protection as prescribed by Article 69 EPC which the Board considers to be the purpose of Article 84 EPC. The decision also adds to the body of conflicting case law on the need to adapt the description so as to be in line with allowed claims.

It is quite possible that at some point the conflict in the case law will generate a referral to the Enlarged Board of Appeal to answer the question of to what extent the description is required to be amended so as to be in line with allowed claims during examination of a European patent application. If such a referral takes place, it is hoped that the Enlarged Board will take a pragmatic approach to adaption of the description and not impose overly stringent requirements on applicants with regard to what amendments are necessary, which can add considerable costs to the pre-grant examination process.

Building an innovative technology business is very challenging due to the unpredictable nature of science, the capital requirements, but also due to the different hurdles along the commercialisation path, including technology development, prototyping, pilot scale testing, choosing the right pricing and business model, as well as regulatory requirements.

To add to all these challenges, valuing the initial intellectual property (IP), usually involving patents (and/or copyright in software inventions), is very difficult as the future income and market valuing methods require information that does not exist yet, or in the case of the cost methods, they do not account for the potential of the technology. Market comparables also neglect the future income generating potential of the IP portfolio in question.

As challenging as it seems, it is not impossible. Innovative technologies just require a lot more research for the data required as input in the models. The best way to approach this is holistically, by combining all the comparable market data found on the early technology with a future income model and allowing for broader sensitivity analysis of the main parameters. However, it is worth noting that the results are only as good as the data you use for the calculations.

Worked example

The valuation process requires careful consideration of various internal and external factors, regardless of the maturity of the technology area. However, early-stage innovation hotbeds are particularly sensitive to the impact of said considerations and therefore necessitate extra analysis.

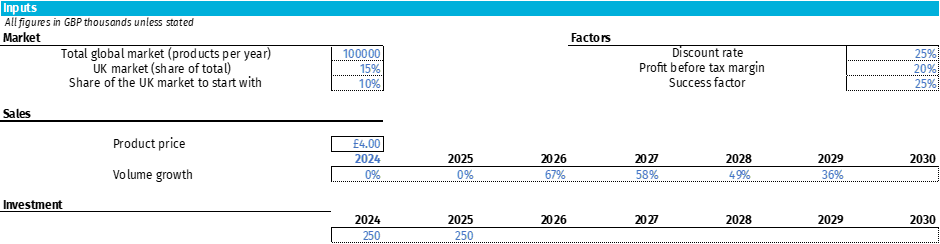

The best way to visualise the process and its intricacies is through a worked example. Considering the drawbacks of the market and cost methods being inadequate for early-stage technology valuations, the discounted cashflow method on potential future earnings is the best way forward.

As with most inventions, before any income can be generated, a lot of time and money is required to develop it, so for the first few years, the cashflow is going to be negative. First hurdle in the valuation journey is assessing how much it will cost to develop the technology. In one instance, if the product is not very complex, we can make a development plan and add up the costs (at a premium as there usually is some additional unexpected spending). An alternative would be to analyse companies already in the field and find out how much money they have raised and how long it took them to get their product to market. Investment information is not usually freely available but can be found on platforms such a Pitchbook or CrunchBase.

For the purpose of the example, we will work under the assumption of a £500,000 investment requirement and two years of development. For the ease of calculation, we will assume the cost to be spread equally over the years.

Now that we have our commercial product, we need to understand our potential future revenues, sale quantities, pricing and the year-on-year sales growth. How many products we would sell depends a lot on how many players there are in the field, their market share, and the industry itself. The competitive advantage that we might have over competing products will dictate the price premium that we could charge for the product, whilst the growth rate will be based on what growth rates other early-stage companies have.

Again, for the purpose of our calculations, we will work under an assumption that our total global addressable market is 100,000 products per year, with 15,000 products per year in the UK alone, but we forecast that we start with a 10% penetration rate and then we expand with certain growth rates (67% in Year 1, 58% in Year 2, 49% in Year 3, 36% in Year 4). A good benchmark to use is to review financial filings of a public company in the same industry and use them as a proxy (as an early-stage business is not likely to have the reputation and established client base to guarantee such rates).

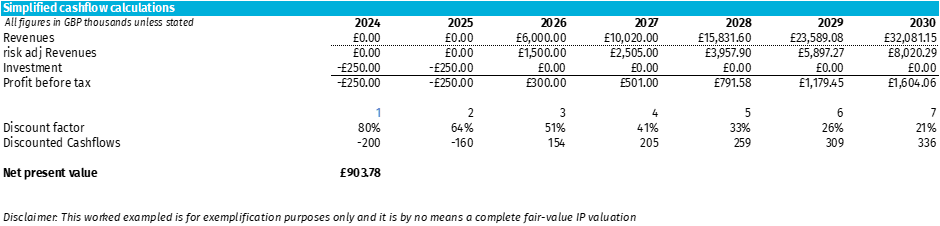

Lastly, by analysing the market and the competitors in the UK, we settle to price the product at £4,000, thanks to which we can now forecast the revenues for the first five years after the launch. To be able to use the discounted cashflow method, we can apply a percentage (in line with the industry – 20% for the purposes of this worked example) of the revenues to be the profit before tax. At this stage, we can now forecast the cashflows for the first five years of commercialisation.

Disclaimer: profit before tax is not exactly cashflow, but it is used as a proxy for exemplification purposes.

However, in order to calculate the net present value of the technology, we would need a discount rate to account for the time value of money. £100 today is worth more than £100 in one year due to inflation and the opportunity cost of the investment’s money-making potential. In our current crazy inflationary environment, £100 today will be worth at most £91.74 in one year, assuming a 9% inflation rate.

There are many formal ways of assessing the discount rate, but there are also certain ballpark figures we can refer to. The current state of the economy has a significant impact on them, but as an indication, we can assume 10-25% for established businesses, 20-35% for scaling businesses, 30-40% for companies reaching product market fit, and 35% all the way to 80% for early-stage startup companies. Risk is also usually accounted for in the discount rate. The higher the risk, the higher the discount rate. The downside of using a large discount rate is that it is almost disregarding later forecasted years.

A way around using a very large discount rate of 70-80% is to add another factor to the mix to account for the risk separately. This success factor considers all the risks associated with the technology realising the forecasted revenues. The success factor can be further decomposed into technical, legal, commercial, regulatory, scaleup risks. Assigning a percentage between 1 to 100% for each category and then multiplying them will give you an overall success factor that can be applied to your revenues, which will lower the cashflows. After the application of the success factor, we are now ready to do the final calculations.

We have created a simple modelling tool which can be used by stakeholders involved in early-stage technology development in order to gain an indication of the ballpark value of their technology. Having obtained all the individual sets of data, we can now complete our valuation exercise. Thanks to the interactive tool, we can input the data and see what value we get for our fictive example – see figures 1 and 2.

Disclaimer: Many steps have been simplified for the purpose of this exemplification. A comprehensive valuation of technologies involves taking into consideration many other factors not accounted here.

If you want to try out the interactive valuation tool yourself, click here.

Whilst it is not easy to carry out an IP valuation of an early-stage technology, it allows investors, universities, and companies to understand the key factors affecting the value of their IP. Also, it leads to a more informed decision making regarding which technology to invest in at the expense of another. Mathys & Squire Consulting has significant experience in valuing deep tech early-stage technologies in various technical fields. Please get in touch with any IP valuation inquiries you might have.

International Women’s Day is a globally recognised day that celebrates the social, economic, cultural, and political achievements of women. This day also serves as a call to action for gender equality and to raise awareness of the struggles and challenges that women face worldwide. In the context of innovation and intellectual property (IP), women have made significant contributions and advancements in various fields.

However, the representation of women in these industries remains disproportionately low. This year, Mathys & Squire is celebrating International Women’s Day by highlighting the experiences of women in the IP profession, as well as looking at their idols, inspirations and motivators behind their success.

Alex Stacey – Technical Assistant

“My decision to pursue a career in patent law is driven by the desire to continue learning about how the world functions, the same reason that I chose to pursue undergraduate and postgraduate study in physics.

As a Technical Assistant, I am fortunate to spend most of my time at work learning – either by teaching myself about new inventions or being taught how to apply the law to help inventors and businesses use their legal right to stop others practicing inventions that belong to others.

My role models are Rosalind Franklin and Marie Curie. Rosalind is an idol of mine for the work that she contributed to understanding the structure of DNA, despite being unacknowledged during her lifetime, and Marie Curie who was the first woman to be awarded a Nobel Prize, the first person to be awarded two Nobel prizes, and so far, still the only person to have won Nobel prizes in more than one field.

Marie worked in science throughout her life, not only for the pursuit of knowledge, but also applying her work to provide real life benefits during World War I. Radiological cars nicknamed ‘petites Curies’ provided X-rays to soldiers and Marie Curie visited the front line more than 30 times over the course of the war.”

Caroline Warren – Partner

“I’m a physicist by training – I studied physics because I wanted to learn about why the world works as it does. I now work with technologies ranging from computer networking to medical devices via green technologies and consumer products.

My science idol is Maggie Aderin-Pocock. I love the fact that, after a career at the top levels of research in astrophysics, she is so passionate about communicating science and inspiring young people.”

Jessie Harrison – Technical Assistant

“I was attracted to study material science and engineering by a desire to learn about the ‘stuff’ our world is made from, and how we can engineer a better future through smarter materials.

Now in a career in IP, I am driven by helping entrepreneurs and startups protect their ideas. British female entrepreneur, Mandy Haberman, is a particular inspiration. Haberman developed the Anywayup® cup, the world’s first totally non-spill toddler cup. Through a series of high-profile ‘David and Goliath’-style court cases, she successfully defended her intellectual property and received great commercial success. I hope to help many other entrepreneurs protect their inventions and realise their potential.”

Lindsay Pike – Technical Assistant

“I studied biology because I was interested in the natural world and everything that lives in it. I later specialised in genetics – I was fascinated by how DNA results in the differences between species and individuals.

I chose to pursue a career in patents because I wanted to stay exposed to new discoveries and inventions across a broad spectrum of biological areas. I now work with new treatments for a range of medical conditions, including cancer, blood clots that may lead to strokes or heart attacks, and genetic disorders.

It’s hard to pick just one science idol but since I named my cat after her, I have to choose Cecelia Payne-Gaposchkin, the astronomer/astrophysicist who first discovered stars are made of hydrogen and helium. She faced a lot of opposition and difficulties because she was a woman, but she continued in science nonetheless.”

Nayna Chunilal – Technical Assistant

“I feel very fortunate to have worked alongside some brilliant women throughout my career. They are passionate and successful lawyers, scientists, communicators, engineers, mathematicians. They are also mothers, daughters, sisters, friends. They’re inspiring, creating and breaking barriers every day. I’m proud to say that some of those women are why I’m in IP today. As Eleanor Roosevelt once said, “well-behaved women rarely make history” and the same can be said for the women in IP helping to change the status quo.”

Sarah Le Mesurier-Edwards – Managing Associate

“I’m a materials scientist by training – I studied physical natural sciences, specialising in materials science, because I wanted to contribute to the innovation of life-changing technology. As a patent attorney, I enjoy being at the cutting edge of technological advances and seeing how they shape the world around us. I joined Mathys & Squire earlier this year and I am so grateful to be surrounded by a team of strong, successful women.

My science idol is Katherine Johnson who has a truly inspiring story. She overcame discrimination over her race and gender to fulfil a critical part of NASA’s first successful manned space mission.”

Eliz Huseyin – HR Administrator

“Let us choose for ourselves our path in life, and let us try to strew that path with flowers.” This quote, by French philosopher Emilie du Chatelet, resonated with me. Embracing that we are all individually unique with our own goals and dreams which takes us all in different directions of life. I’m proud to be working alongside strong women in IP who showcase hard work and determination.”

Susan Mutangadura – Paralegal

“My STEM idol Mae Jemison once said “Don’t let anyone rob you of your imagination, your creativity, or your curiosity. It’s your place in the world; it’s your life. Go on and do all you can with it, and make it the life you want to live.” This quote sits with me as it is a bold thing to listen to your imagination, lean into your creativity and forever be curious about the things in life. Mainly because, as we grow older such skills are hindered rather than natured due to life circumstances and the world that we live in.”

The above is just a small fraction of the many women that have helped shape Mathys & Squire, each an integral part of our team, and a testament to the hard work of women in IP. We would like you all to join us in wishing a happy International Women’s Day to all women around us!

The United Kingdom Intellectual Property Office (UKIPO) has announced an important Tribunal Practice Notice on 25 January 2023 concerning UK registered trade mark or design holders/representatives without a UK address for service (UK AFS).

This will predominantly affect owners of trade marks and registered designs who have designated the UK through an international registration filed through the World Intellectual Property Organisation (WIPO) and are subject to any opposition and cancellation proceedings. It is effective immediately.

For any inter partes trade mark invalidation, revocation, rectification and opposition proceedings, and registered design invalidation proceedings, the UKIPO will now seek a UK AFS before any formal serving of documents. Any non-UK addresses will not be accepted.

Invalidation, revocation and rectification

In the event of an application for invalidation, revocation, and/or rectification being filed against a UK designation of an international registration, the UKIPO will issue a preliminary letter directing that the affected right holder has one month to appoint a UK AFS, along with its intention to oppose the application for invalidation, revocation and/or rectification.

Failure to act will result in the UKIPO declaring the challenged trade mark or design registration as abandoned or invalid and being removed from the register.

Oppositions

In the event of opposition being filed against a UK designation of an international registration, the UKIPO will issue a notice of provisional refusal based on an opposition to WIPO, who will thereafter forward those grounds to the international registration holder, either applicant or representative.

The UKIPO will also issue a letter informing the applicant or representative, using the non-UK AFS, that there is a two month deadline to file a counterstatement in defence of the opposition and a UK AFS must be appointed.

Where a counterstatement has been provided but a UK AFS was not, the UKIPO will instruct the applicant to provide a UK AFS within one month.

Failure to act will result in the UKIPO treating the application as withdrawn in respect of those goods and services against which the opposition was directed.

Brexit – Filing new trade mark and design applications

From 1 January 2021 any new application for a trade mark or registered design filed at the UKIPO must have a UK AFS. This includes any UK trade mark or registered design applications filed within the first nine months following January 1, 2021, which claim the filing or priority date of an earlier EU trade mark (EUTM) or community design registration.

Brexit – cancellations or oppositions against Brexit clone registrations and comparable rights

Following the UK’s departure from the EU, the creation of existing rights (clone registrations) that are a result of existing EUTM or community design registration do not need a UK AFS. Many of these registrations retain a non-UK AFS.

UK opposition or cancellation proceedings commencing before 31 December 2020 will not be affected by the Tribunal Practice Notice 2/2023. The UKIPO will continue to use the non-UK AFS for the duration of the proceedings.

After 1 January 2024, this exemption will no longer apply, and a UK AFS will be required if the right is subject to any cancellation or opposition proceedings.

Key takeaways

It will only be required to designate a UK-based address for service if the UK designation of an international registration is the subject of an application for invalidation, revocation, rectification or opposition.

The Tribunal Practice Notice has clarified that this approach will only concern inter partes proceedings and has no impact or effect upon ex parte proceedings.

In response to this notice issued by the UKIPO, any non-UK holders of international trade marks or design registrations are strongly advised to appoint a UK-based AFS as soon as possible in order to reduce the possibility that crucial, time sensitive notices from the UKIPO will not be acted upon by the holder and result in the loss of rights. Holders should also ensure that all addresses are up to date.

Mathys & Squire can provide UK representation for international UK designations, and represent clients in trade mark opposition and cancellation, as well as design invalidity proceedings in the UK. The full details of the tribunal practice notice can be found here.