In this article for The Patent Lawyer Magazine, Partners Andrew White and Anna Gregson discuss the importance of protecting IP as an asset, even years before commercial use, in one of the largest growth opportunity markets: deep tech.

Deep tech is a term most frequently used in the investment community and tends to refer to businesses that are very research & development (R&D) intensive, using innovative and emerging technologies to solve a particular problem. Deep tech commonly refers to technologies such as advanced materials, synthetic biology, artificial intelligence (AI), or quantum technologies, although many deep tech startups today are combining these technologies – for example where AI and synthetic biology intersect, with 96% of deep tech ventures using at least two technologies. Deep tech companies are therefore very IP-rich, with about 70% of such ventures owning patents related to their products or services.

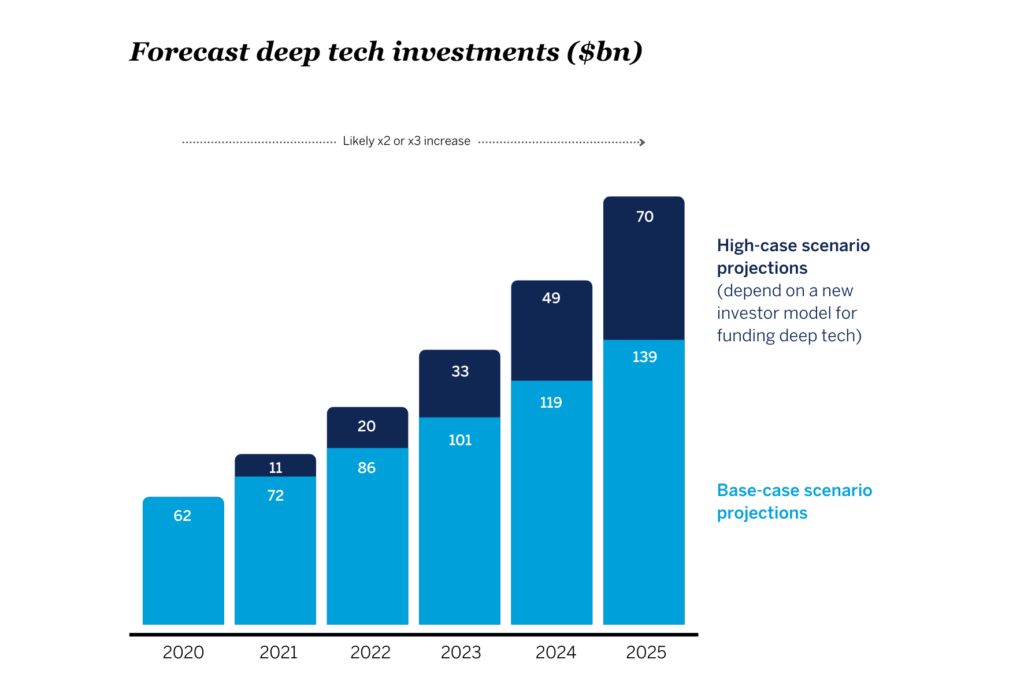

Deep tech is being seen increasingly as a massive growth opportunity. As shown in the figure below, the amount of capital put into this space has grown fourfold, from $15bn in 2016, to more than $60bn in 2020, and it is estimated that deep tech investments will grow to about $140bn by 2025, with investment in AI and synthetic biology attracting two-thirds of deep tech investment last year.

About 83% of deep tech ventures involve designing and building a physical product. Their digital proficiency is focused on using artificial intelligence, machine learning and advanced computation to explore frontiers in physics, chemistry and biology.

(Data taken from https://www.bcg.com/publications/2021/overcoming-challenges-investing-in-digital-technology)

Deep tech companies are likely to be disruptors; incumbent companies, particularly in industries like energy, chemicals and agriculture, will probably be disrupted by deep tech if they don’t engage with this community soon.

As can be seen in the chart below, deep tech companies can also be extremely lucrative, with companies such as Impossible Foods being valued at around $10bn this year:

(Data taken from https://www.bcg.com/publications/2021/overcoming-challenges-investing-in-digital-technology)

Pushing technological frontiers

Deep tech has the potential to reinvigorate established sectors, such as drug R&D, where costs to develop a new drug have doubled each decade for the last 70 years. By providing opportunities to apply tools and principles such as network data science and deep learning to overcome the ‘biology bottleneck’, deep tech has the potential to significantly reduce costs in drug development.

Deep tech also opens the commercial potential of newer sectors, such as synthetic biology, where the confluence of developments in IT, systems theory and biology enables synthetic biology to move beyond the laboratory into commercial use. Despite the emergent nature of synthetic biology, there are already examples demonstrating its scope and disruptive potential, such as designer bacteria capable of producing as diverse materials as precursors for anti-malarials, to spider silk proteins, biologically based logic gates and synthetic organelles.

Why do you need to protect your IP?

Because of their IP-rich and R&D heavy nature, it may be many years before a deep tech startup successfully commercialises its innovation and emerges from the infamous ‘valley of death’. IP may be the only real asset a deep tech startup has for a number of years, so protecting that IP and developing an effective IP strategy is therefore critical to its success.

Investors recognise this and many will want to see a robust IP strategy in place before investing. Deep tech startups need to engage with IP early and often, developing their own IP pipeline (including patents, trade secrets and other relevant IP) and also considering third party IP and freedom-to-operate. Particularly for products where lead times can be long, such as for new drugs that require regulatory approval, a strong pipeline with downstream IP is vital.

Exit strategy

Depending on its business goals, effectively protecting IP can dramatically affect the exit of a deep tech startup. For example, building up a strong and effective IP portfolio can drastically increase the value of the business, whether the exit is via acquisition or IPO. This may yield a higher return on investment for those early-stage investors, as well as the founding team. In the longer term, for many deep tech startups, a strong IP portfolio is also essential because they may be entering and disrupting a crowded and well-established market. Without strong IP in place, they may not be able to survive. If a startup has patents of their own, these can be used defensively; if sued by a well-established competitor, having patent rights of your own can present you with the option to cross-license rather than engage in costly and time-consuming litigation.

To patent or to keep secret?

A common question faced by many deep tech startups is whether to patent at all, or whether to keep their innovation secret in the form of a trade secret. For many, the question comes down to whether a third party is able to reverse-engineer or take apart their innovation and determine how it works. For example, can a user of a software platform understand how an AI algorithm works if all the user does is send some data to a cloud platform, and receive some answers in return? In such cases an effective trade secret policy may be sufficient. One benefit of a trade secret policy is that it doesn’t have to cost lots of money, and it can last indefinitely, provided the secret can be kept. The obvious downsides are that there may be leakage of your trade secrets over time, and by keeping your innovation a secret it doesn’t prevent a third party independently inventing and then patenting their own solution which may in turn limit your ability to work your invention, even if you had been using it prior to their patent filing.

Advantages of a patent are that it encourages investment, collaboration and joint development work, as the patent holder can freely disclose their invention in the knowledge that they are protected by the patent. Patents can also be an indicator of both ownership and technical credibility; they can be used to convince investors that you own the technology that you say you do and that what you are working on is truly innovative.

Partnerships with bigger players

By virtue of their complex and cross-disciplinary nature, many deep tech startups must collaborate to implement their solutions. This presents its own set of challenges and opportunities. For example, the ownership of any resulting IP (often referred to as foreground IP) needs to be established, and for many collaborators they will want a share in this foreground IP. This presents a challenge to the startup who may consider that they hold much of the original (background) IP that attracted the collaborator in the first place.

Deep tech startups should therefore be mindful not only to negotiate a strong and effective IP agreement, but should also consider filing patents before any work begins as part of the collaboration. Filing IP beforehand means it can be pushed into the background IP and therefore the startup can retain ownership of more of the IP in the space.

As with any field, deep tech startups should also be using non-disclosure agreements (NDAs) whenever they discuss any elements of the technology with a third party. However, even if you have an NDA, they are notoriously difficult to enforce and once your idea becomes public it can be very difficult to retain ownership of the innovation. Therefore, if a patent application can be filed even before discussions under an NDA have taken place, this will strengthen your IP position.

Opportunities and challenges

It therefore appears that there are plenty of opportunities for deep tech startups, and the volume of investment pouring in is only set to increase. It is also clear that startups in the deep tech space need to devise and implement a truly effective IP strategy if they are to survive and be successful. For more information on IP specifically relating to startup businesses, visit the Mathys & Squire Scaleup Quarter.

This article was published in The Patent Lawyer Magazine in February 2022.