In this article for Intellectual Property Magazine, Partner Chris Hamer and Associate Matthew Morton explore the bright future of plastic recycling technologies and the IP trends set to accelerate a greener environment.

Plastics are an increasingly important material, used across the world in sectors such as packaging, building and construction, the automotive sector and in electronics. The European Commission estimates that global production of plastics had increased to 322m tonnes by 2015, and expects that number to double in the next two decades.

The chemical stability of most plastic materials is one of the many properties that makes these materials so attractive, particularly in sectors such as packaging, where plastic is an ideal material for sealing and preserving foods or medicines for example.

Plastic packaging accounts for around 40% of plastic waste generated and it is difficult to imagine this is going to change in the future, as abandoning plastic in packaging would have serious consequences for the storage and supply of perishable resources worldwide.

The stability of plastic that has contributed to its success is now, however, becoming one of its principle weaknesses. The disposal of large amounts of waste plastic into natural environments, where its stability in many cases allows it to persist for hundreds of years, can lead to increasing build up of plastic waste in these environments. This issue is increasingly one of public concern, although it is likely that any solution to the problem will need to come from economic incentives driving industry towards recycling.

Plastics have been recycled since the 1970s, and such recycling has historically focused on the processing and reuse of plastics in much the same form as the plastic products they were recycled from. However, in some cases such recycled plastics can have inferior properties in comparison to new, so-called ‘virgin plastics’, and as a result, particularly when producing new plastic is relatively cheap, the economic incentives for recycling are not always obvious. Nonetheless, if plastic waste can be repurposed to fill a demand for other chemical products rather than trying to compete with virgin plastic, then this can offer an opportunity to change what is often simply treated as a waste stream into a valuable resource. Higher costs for plastic disposal could up the economic incentives for trying to generate profit from waste plastic in the near future.

Repurposed plastics

One way that certain plastics can be usefully recycled is by pyrolysis, by which plastics are heated to high temperatures in the absence of oxygen, thereby breaking the plastic down into simpler hydrocarbon products without combustion. These hydrocarbon pyrolysis products can then be used to replace, or blended with, hydrocarbon materials obtained by refining petroleum feedstocks. Hydrocarbon pyrolysis products can be used to blend with transportation fuels or can find use in lubricant base oils.

Lubricant base oils are typically combined with additives to tailor their properties to produce lubricating compositions such as motor oils or lubricants for use in industrial processes such as metalworking. Lubricant base oils are graded into different groups according to American Petroleum Institute standards, based on their composition and purity. Higher classification oils are traditionally obtained by carrying out treatments of mineral oil stocks, including hydrotreating to remove non-carbon impurities (Group I), further hydrocracking to reduce the size of hydrocarbon molecules in the oil and further improve purity (Group II) and hydroisomerisation to alter the structure of the hydrocarbon molecules to improve oil properties such as pour point and viscosity (Group III). While the ‘higher’ groups of oil can give improved performance, the steps to upgrade base mineral oils incur additional energy costs and increase capex to provide specialised treatment units. Synthetic oils are also produced to give tailored high-quality lubricant oils without using mineral oil feedstocks.

While the slow transition to electric powered vehicles, which do not require the same motor oils as internal combustion powered vehicles, could reduce lubricant demand, given the expense and lack of practical infrastructure for electric vehicles, it seems unlikely that demand for automotive lubricants will significantly decline in the short term. Electric cars nonetheless do need greases for lubricating their high-torque moving parts, which could potentially be supplemented by plastic-derived products. In addition, lubricants also find use in areas outside of the automotive sector and it has been suggested that despite movement towards electric cars, the opportunities for growth in the lubricants sector remain.

Polyolefin polymers such as polyethylene and polypropylene are made from very long chains of saturated hydrocarbons that in terms of molecular structure and overall composition are very similar to mineral oils, and by breaking down the hydrocarbon chains of the plastic into smaller parts, oils and waxes having similar properties to refined mineral oils can be obtained. Processed pyrolysis products can have very low sulfur, nitrogen and aromatics content compared to mineral oil sources, and so offer the potential for providing cleaner fuels. Oils and waxes obtained from plastics can also be used to provide feedstocks that can be refined and blended with existing products to produce high quality base oils. Other plastics that contain aromatic hydrocarbon rings, such as polyethylene terephthalate (PET) and polystyrene can also be decomposed to give liquid products containing aromatic hydrocarbons that have the potential for use in chemical industries. Polyvinyl chloride (PVC) poses some additional challenges when treated by pyrolysis due to formation of hydrochloric acid from the chlorine in the polymer, which can lead to corrosion of equipment.

Of course, a constant issue with all recycling technologies has been the feed material available, which tends to be unsorted and comprises a mix of different plastics. However, Professor Martin Atkins, chief executive of Green Lizard Technologies, who is involved in a planned 200,000 tonne waste plastic recycling plant in the US and a 50,000 tonne plant in the UK, states that recent technological developments have helped to address this particular issue.

Patent landscape

Growing interest in processes for repurposing plastic waste into higher value materials, such as oils and waxes for lubricants, can be monitored by observing patent filing trends in the area. Figure 1 shows numbers of international PCT applications found in a basic search for patent applications mentioning pyrolysis of plastics. While the number of applications appears to have remained relatively constant in recent years, it has roughly doubled over the past decade, increasing fourfold in the last 20 years.

Figure 1: Number of PCT applications and granted European applications by publication year that mention pyrolysis of plastics

One different way to look at the sector through patent trends is to look at how many patents are being granted each year. Taking a patent application from filing through to grant requires commitment on top of the cost of an initial filing, and so the number of patents going through to grant could better reflect the level of active commercial interest in the area. Figure 1, which also shows granted European patents, illustrates a sharp increase in the number of patents being granted the last few years. While it is not possible to say for certain what the reason for this is, it suggests an increasing desire for granted and enforceable patent protection in what seems to be a growing market.

Looking at the top filing entities in the field, many patent filings relating to plastic pyrolysis have historically come from large corporations such as Toshiba and Chevron, as well as BASF, who have recently announced a scheme to convert waste plastics into chemical feedstocks (Figure 2). In addition to large corporations, in recent times much of the activity in the plastic recycling field has come from relatively newer companies such as Trifol Resources, Recycling technologies and

Greenmantra Technologies.

Figure 2: Number of PCT patent filings by applicant (Search Output provided by Coller IP)

The trends in patent filings and the increased public interest in dealing with plastic waste in a more ‘green’ way point to a bright future for plastic recycling technologies.

For applicants filing patent applications at the UK Intellectual Property Office, it is also worth bearing in mind that technologies in this area will likely qualify for accelerated processing of patent applications via the free Green Channel programme.

This article was first published in the June 2019 edition of Intellectual Property Magazine.

On 10th April 2019, the UK and the EU agreed on a second delay to Brexit until 31st October 2019. However, it is possible that there may be an agreement for an earlier date to leave the EU. There is also not yet any clarity on the form Brexit will take. Thus, there is still much uncertainty around the timing of Brexit and what implications it may have on the economy and businesses.

In light of the ongoing stalemate with Brexit negotiations, the Mathys & Squire trade mark and designs team are offering exclusive discounts and fixed fees on EU & UK trade mark and design filing packages.

What we are offering…

EU & UK Trade Mark Filing Package

Filing in both the EU and the UK (one class) at a discounted, fixed fee. This fee will cover all costs up to the issuance of the registration certificate, with the exception of official objections or third-party opposition. Additional class fees will then carry a 20% discount.

EU & UK Design Filing Package

Filing in both the EU and the UK at a discounted, fixed fee. This fee will cover all costs up to and including the issuance of the registration certificate. This fixed fee assumes we receive the drawings in a ready to file format and excludes the cost of any official objections. Additional designs in a filing will also carry a discount.

To find out more about these exclusive offers and discounted fees, contact our Brexit team who will be happy to discuss them with you.

A waiver which allows EU generic and biosimilar manufacturers to export and stockpile SPC-protected medicines will apply where the SPCs come into force after July 1st, 2019.

A transitional period means that, for certain SPCs, the waiver will not apply until July 2nd, 2022. Those looking to file SPC applications which could benefit from the transitional period should consider filing them before the end of June 2019.

In a recent article for Managing Intellectual Property, Mathys & Squire Partner Stephen Garner has commented on the news, explaining that ‘the main advice he would offer his patent-holder clients is to ensure that they are in a position to file for an SPC before the end of the month.’ Click here to read Stephen’s further comments and the MIP article in full.

Further details can be found via our SPC ‘Manufacturing Waiver’ for Export and Stockpiling download – click here to read more.

In this article for Intellectual Property Magazine, Partner Martin MacLean and Trainee Patent Attorney Lionel Newton explain how innovators are responding to the increased demand for clean tech solutions, as well as understanding the importance of seeking protection for their innovations.

Chemical pesticides have been used for decades by commercial growers and home gardeners alike. By way of example, use of DDT (an insecticide) and 2,4-D (a broadleaf herbicide) date back to the 1950s, whereas use of glyphosate (a broad-spectrum herbicide) dates back to the 1970s.

Indeed, increasing commercial and domestic demand for chemical pesticides has seen several proprietary brands achieve household recognition (eg, Fly Jinx for DDT, Weedone for 2,4-D, and Roundup for glyphosate).

The environmental concerns over DDT and 2,4-D are well documented, and flow from greater awareness and understanding of how these chemical entities behave in terms of half-life and toxicity profiles when released into the ecosystem. Indeed, the history of DDT could hardly be more spectacular: a Nobel prize in 1948 followed by a global ban in 2004.

DDT has an estimated half-life of up to 150 years, and due to its lipophilic properties will accumulate in fat (bodyfat of animals). With regard to 2,4-D, ester (more potent) versions have been banned in the US and Europe for more than 20 years, whereas less potent versions have more general approval. The estimated half-life for 2,4-D is in the region of up to one year. More recently, glyphosate has been linked with potential carcinogenicity issues. Glyphosate has an estimated half-life of up to 200 days.

Whether we like it or not, we are now part of a growing eco-conscious population, which is becoming more risk-averse to the use of chemical pesticides. In parallel, regulatory control over the use of pesticides has become much tighter.

Keeping up with this ever-shifting mindset, governments and companies globally are promoting, investing in and protecting ‘green innovation’ with a view to creating economic growth around the technologies that help protect and sustain the environment. Widely known as clean technology, such green innovations are designed to reduce pollution, truncate the production of hazardous waste substances, and encourage renewable energy generation (moving us away from a dependency on fossil fuels).

Green innovators: protecting the environment and their innovations

In a well-known case providing a successful environmentally friendly (green) pesticide, Iowa State University (Iowa) discovered and patented a 100% natural corn gluten meal (CGM) composition (a recycled by-product of corn milling) for use as a green ‘pre-emergent’ herbicide, setting an early example for others to follow. Iowa received large exposure from this in the 1990s, and CGM continues to be a widely marketed pre-emergent herbicide. This demonstrates the commercial success of a green pesticide originating from more than two decades ago.

To track filing trends in this area since then, we performed a limited ‘google patents’ search for Patent Cooperation Treaty (PCT) applications describing ‘environmentally safe’ or ‘eco-friendly’ pesticides/herbicides, which returns greater than 1,000 published PCT applications. Identified applications are directed to both compositions of matter (demonstrating the fundamental R&D efforts of many companies to manufacture new pesticide products) and methods of pesticide control (often through the re-purposing of components known to be environmentally compatible, such as natural oils).

The results of this search suggest that, while there was an appreciable amount of relevant patent activity in the ‘90s, the turn of the millennium was a key period for green pesticide patents, with a noticeable ‘jump’ in PCT filings describing green pesticides occurring in the period between 2001 and 2003. Consistent with this jump, the number of relevant filings appears to have been increasing virtually year-on-year ever since.

Key players (applicants) include Syngenta (Syngenta Participations Ag) and Du Pont (EI Du Pont De Nemours And Company), having a 21% and 3.4% share of the identified applications, respectively. Interestingly, Monsanto (the makers of Roundup, and generally considered more interested in the chemical pesticide market) is the proprietor of a number of the identified applications.

Case studies

Case study 1 – Neudorff

W Neudorff GmbH KG (‘Neudorff’) is a manufacturer of natural/green pesticides and provides products for both commercial agriculture and home garden use. A broad patent estate has enabled Neudorff to establish products such as Sluggo (a biodegradable slug killer) and Fiesta (a selective herbicide, comprising a safe form of iron as a key active ingredient). They did this as market leaders in territories such as North America, Europe, Japan and Australia, were bringing their green pesticides toe-to-toe with the chemical/recalcitrant pesticides manufactured by giants such as Monsanto and BASF.

For example, patent no WO2007031561 is directed to an environmentally safe, non-phytotoxic insecticidal and miticidal composition comprising an admixture of spinosyns (organic insecticides derived from naturally occurring soil fungi) and organic fatty acid. This application has led to patents in Canada, Europe and the US, and helped pave the way for the commercial success of Spinosad, an OMRI-listed insecticide product approved for organic gardening.

Patent no WO2003073856 is directed to an environmentally safe, selective weed killer comprising a transition metal (iron) chelate as a key active ingredient and has been central to the success of Neudorff’s Fiesta weedkiller for lawns. The underlying invention is based on an eco-friendly iron chelate (previously used as a fertiliser), which provides a selective (for weeds) herbicidal effect when applied at a defined (herbicidal) rate. An enhanced version of the products/methods described in WO’856 is encompassed by patent no WO2018041916, which describes use of salts for enhancing said selective herbicidal effect of an iron chelate.

Noting the success for Iowa around their CGM patents, a drawback for CGM compositions has been their relatively low efficacy, requiring large amounts to be applied to the ground to achieve the desired pre-emergent herbicidal effect. Addressing this, patent no WO2018041916 (Neudorff) describes an improved CGM composition having (significantly) enhanced pre-emergent herbicidal activity due to the presence of a transition metal chelate – the composition has greater efficacy, and thus can be used in lower amounts (thus reducing the packaging and transport burden of CGM).

These published patents/applications owned by Neudorrf are indicative of their success in generating new and improved pesticides based on ‘re-purposing’ natural/organic agents known to be safe for people and the environment, and by significantly improving the efficacy of green pesticides, thus overcoming certain drawbacks (in terms of effectiveness) of green pesticides over the harsh chemical pesticides.

Case study 2 – Evolution Biotech

Representing earlier stage companies developing new eco-friendly ways to combat pests, UK-based Evolution Biotechnologies (Evolution Biotech) has developed a 100% natural product for combating the ubiquitous house dust mite (HDM), which is widely recognised as a major source of the allergens responsible for asthma.

Patent no WO2017025732 encompasses methods (and products for use in the same) for treating and preventing HDM infestations with a transmissible (replicating) natural agent, which is transmitted from mite-to-mite within an infestation before biodegrading upon eradication of the infestation. This invention will contribute to reducing our reliance on recalcitrant chemical anti-HDM agents (such as organophosphates and carbamates), the importance of which was highlighted by a large-scale recall of a major chemical anti-HDM product after the US Environmental Protection Agency (EPA) documented more than 400 cases of adverse side effects among users. Evolution Biotech already has a granted European patent for this invention.

Accelerated prosecution

Naturally, the speedy implementation of green technology requires support and commercial incentives, which is something recognised by many patent offices around the world who have developed bespoke ‘fast-track’ prosecution programmes for green applications to reach grant quicker. In more detail, seven of the major intellectual property offices around the world have implemented programmes to accelerate the prosecution of ‘green’ patent applications (i.e. in Australia, Canada, Israel, Japan, Korea, the UK, and the US), and a recent study reported that, over the period of 2010-2013, more than 5,000 patent applications requested accelerated examination under the various programmes.

The Green Channel was the first of the major green fast-track schemes set up in May 2009. Since then, 20% of the average annual number of green UK applications were filed with a request for accelerated prosecution, with Green Channel applications enjoying a 75% reduction in time-to-grant (3.3 years on average for regular examination v 0.8 years on average for fast-track applications). A glance at the directory of published Green Channel patent applications shows that the number of publications has reached the impressive number of 2,116 at the time of writing. Demonstrating the increasing popularity of the scheme, the number of applications requesting entry into the Green Channel more than doubled from 107 in its year of inception, to 273 in 2017.

While only a proportion of the total number of green patents have undergone accelerated prosecution by request (likely driven by alternative incentives to keep applications in the prosecution process for longer), the green fast track programmes are generally considered to have been a success, and a powerful commercial tool for green innovators.

The future

Driven by heightened awareness of the inherent dangers of recalcitrant chemical pesticides, the willingness to keep using these will likely continue to decrease, with a concomitant increase in the need for green

alternatives. Based on our analysis, green innovators are responding to this increased demand and understand well the importance of seeking protection for their innovations. In light of this, we can confidently say the future is looking bright green!

This article was first published in the June 2019 edition of Intellectual Property Magazine.

Mathys & Squire Associate Alexander Robinson and Partner Stephen Garner explore some of the regulatory issues in the life sciences and pharmaceutical sectors that are likely to be affected by Brexit.

The UK’s withdrawal from the European Union presents legal and administrative challenges on an unprecedented scale, and will have a significant impact on anyone carrying out business at a pan-European or global level. This is especially true for companies in the life sciences and pharmaceutical sectors, which operate within a highly-regulated environment and which currently rely on a high degree of harmonisation between the UK and other EU countries.

Deal or no deal?

At the time of writing, the UK Government has failed to gain the approval of the House of Commons for the Withdrawal Agreement (WA) which has been negotiated with the EU. While further attempts to obtain Parliamentary approval for the current WA or a different agreement cannot be ruled out, the prospect of the UK leaving the EU without a deal should not be discounted either.

In the event that the WA does pass Parliament, the UK will leave the EU on Exit Day (currently set as October 31 2019) but will immediately enter a two-year standstill transition period during which the UK will remain subject to most EU law and the jurisdiction of the CJEU, essentially as though it were still an EU member. The regulatory landscape will therefore remain unchanged for most purposes during this period, subject to some exceptions mentioned below. The future relationship between the UK and the EU will then be subject to further negotiations during the transition period. It is unknown what the UK’s objectives might be in such negotiations.

In the event that the WA does not pass Parliament, the UK could – whether by design or by accident – end up leaving the EU without any agreements in place regarding transitional or future arrangements. In this no-deal scenario, the UK’s formal links with the EU’s legal and regulatory framework would be severed overnight. However, Parliament has passed legislation which will, in effect, transpose all existing EU legislation into domestic legislation on Exit Day, even in a no-deal situation. The legal and regulatory landscape within the UK would then mirror the existing EU provisions, subject to any necessary amendments (e.g. to replace references to European regulatory bodies with references to their UK counterparts). However, in the absence of any formal agreements with the EU, some UK-EU asymmetries would inevitably arise.

Marketing Authorisations (MAs) for medicinal products

MAs for medicinal products are currently granted both by the European Medicines Agency (EMA) and by domestic regulators in individual EU Member States, such as the UK’s Medicines and Healthcare products Regulatory Authority (MHRA).

Certain types of product, including new active substances indicated for the treatment of AIDS, cancer, and neurodegenerative disorders, as well as orphan medicinal products and certain types of biotechnological products, must be authorised by the EMA via the Centralised Procedure, in which the EMA carries out the necessary regulatory assessments in consultation with national regulators. An MA granted by the EMA is then valid for all EU and EEA Member States.

For other products there is a choice between the use of the Centralised Procedure or the Mutual Recognition or Decentralised Procedures. In these latter two procedures, one EU Member State is nominated as the Reference Member State (RMS) which performs regulatory assessments while the other designated Member States will then each grant their own national MA, subject to the grant of a national MA by the RMS.

MAs if the Withdrawal Agreement is approved

If the UK leaves the EU under the terms of the WA, it will remain in the current regulatory system (including the Centralised, Decentralised and Mutual Recognition authorisation routes) during the transition period. Any MA granted in the UK or in any EU Member State via the Decentralised or Mutual Recognition routes prior to the end of the transition period will continue to be valid after the transition period, and any MA granted via the Centralised Procedure will continue to be valid in both the UK and EU after the transition period (subject to conversion of the Centralised MA into a UK MA, in common with the no-deal scenario discussed below).

An important exception to note is that the UK will not be able to act as the RMS for applications made via the Decentralised or Mutual Recognition Procedures during the transition period. It is uncertain how MA applications designating the UK as RMS will be handled in the EU if these are still pending upon entry into the transition period.

Applicants should therefore consider whether to nominate an RMS other than the UK, even in the case of MA applications filed before Exit Day, if it is likely that the application will still be pending at the start of the transition period. It may also be worthwhile attempting to accelerate any pending MA applications which designate the UK as RMS to try to ensure that these are finalised prior to Exit Day (see UK government guidance).

The fate of applications which remain pending at the end of the transition period, whether filed via the Centralised, Decentralised or Mutual Recognition route, remains to be determined in future negotiations. However, it seems probable that the UK will treat these at least in line with the corresponding no-deal provisions.

MAs in a no-deal scenario

In a no-deal scenario, it will be necessary to apply separately for MAs in the UK and in the EU. EU MA holders and applicants must be based in the EU or EEA, and therefore the ownership of any granted or pending MAs covering EU countries will need to be transferred to an EEA-based entity prior to Exit Day (see the EMA’s recent Q&A document and “Notice to Stakeholders”).

The MHRA will replace the EMA as the regulator for all types of medicinal product in the UK. Any MA granted in the UK via the Decentralised or Mutual Recognition Procedures prior to Exit Day will remain in force. The UK is currently legislating for transitional provisions which will convert MAs granted via the Centralised Procedure into UK MAs on Exit Day; holders of Centralised MAs will also be able to opt out of such conversion during a limited period. The MHRA intends to write to MA holders setting out the conversion and opt-out procedures in further detail ahead of Exit Day.

Where MA applications are still pending on Exit Day in a no-deal scenario, the approach taken by the MHRA will depend on the stage of assessment which has been reached. In short, it currently appears that the MHRA intends to follow or take into account any opinions or decisions which may have been reached as part of the assessment procedure. However, in some circumstances the MHRA may need to perform a fully independent assessment and may also diverge from the decisions of the relevant EU bodies (e.g. by granting a UK MA where the corresponding MA within the EU has been refused).

If a Centralised MA application is still pending at Exit Day, applicants will in most cases need to submit supporting data to the MHRA (e.g. data corresponding to the dossier held by the EMA) to support conversion of the application into a corresponding UK MA application (see MHRA guidance note).

One notable feature of the no-deal preparations is that the MHRA intends to introduce several new fast-track routes of assessment in the UK for certain types of product such as new active substances and biological and/or biosimilar active agents. A “rolling review” procedure has also been proposed for new active substances, which intends to provide ongoing feedback to avoid certain regulatory barriers to the grant of an MA during research and development. Details of these new routes are still under development.

Despite the new fast-track routes which are proposed, the increased workload for the MHRA in a no-deal situation is likely to lead to slower authorisation overall, while the loss of the MHRA’s capabilities from the European regulatory framework could also lead to delays in the corresponding European authorisation procedures.

Supplementary Protection Certificates (SPCs)

At present it appears that the EU Regulations concerning SPCs will be transposed directly into domestic law on Exit Day, meaning that SPCs will continue to be available in the UK via essentially the same system as at present whether or not a deal is agreed.

In a no-deal situation, some discrepancies between the UK and EU SPC regimes would arise nevertheless. For example, the duration of an SPC is calculated based on the date of the first MA to place the authorised product on the market in the EU or EEA, and this provision will be retained in the UK. Where the earliest MA in respect of a product is an EU or EEA authorisation, both the UK SPC and any corresponding EU SPCs will therefore have the same term. By contrast, however, where the earliest MA is a UK authorisation, the UK SPC will have a shorter term than any corresponding EU SPCs, as EU Member States will not take account of the UK authorisation in the absence of a reciprocal agreement.

After Brexit, and in the absence of any deal to the contrary, courts in the UK will not be bound by the case law of the CJEU. The UK Supreme Court will be the final arbiter on SPC matters, and will be permitted to diverge from past CJEU decisions if it sees fit. The perceived deficiencies in the SPC Regulations have given rise to a large body of references to the CJEU in recent years, and the resulting CJEU decisions have been criticised for a lack of clarity.

Brexit may therefore provide an opportunity for the Supreme Court to diverge from the CJEU’s interpretation of the SPC legislation, for example with regard to determining whether a product is “protected by” a basic patent, or in deciding whether to allow SPCs for medical devices. It is too early to say how far the UK may seek to diverge from the EU, although the Swiss SPC system may provide an interesting precedent for SPC legislation and jurisprudence outside the EEA.

Regulatory data protection

The grant of an MA provides a period of eight years of data protection, preventing MA applications for generic versions of authorised products from relying on the data submitted in support of the earlier MA. A further two years of market exclusivity (extendable by one year in some circumstances) are also provided, barring entry of generics onto the market.

The UK intends to retain these provisions after Brexit, with the data and marketing exclusivity periods being calculated based on whichever is the earlier of a UK or EU MA. As with SPCs, this would create a discrepancy between the exclusivity periods available in the UK and EU in a no-deal situation as EU states would not take account of an earlier UK MA.

The UK government intends to review the Regulatory Data Protection provisions within two years of Brexit to ensure that the UK remains competitive, and therefore changes to these provisions cannot be ruled out. However, it is too early to say what alterations, if any, might be made.

Conclusion

MAs, SPCs and regulatory data protection are among the key regulatory matters which life sciences IP practitioners and their clients will be concerned about due to Brexit. Other issues to consider include orphan designations, parallel imports, the conduct of clinical trials, and pharmacovigilance. In many cases, the relevant legislation preparing the UK for life after Brexit is still in draft form, and MHRA guidelines are still being developed. Companies in the life sciences and pharmaceutical sectors, and IP practitioners, should therefore keep a close eye on any further announcements as Brexit approaches.

This article was first published in Managing Intellectual Property Magazine’s IP Stars in June 2019.

Mathys & Squire is thrilled to be once again a recommended firm in the latest edition of IAM Patent 1000. Four of our partners were this year singled out as recommended individuals in the firm – Chris Hamer, Craig Titmus and Martin MacLean.

The IAM Patent 1000 features 48 country-specific chapters analysing local patent professional services markets and detailing the firms and individuals identified as leaders in their respective fields. The tables and accompanying detailed editorial reflect the depth of expertise, market presence and levels of work on which firms are typically instructed. The publication therefore serves as a one-stop reference source for anyone seeking patent services.

Interest in cell-cultured meat has been steadily gaining momentum since the first laboratory-grown burger was unveiled in 2013 by scientists from Maastricht University in the Netherlands.

In general, the process for producing cell-cultured meat requires a few ‘satellite’ cells, which can be obtained from a muscle sample taken from a living animal. These cells can then be transferred to a bioreactor containing a scaffold upon which the cells can attach and grow in a nutrient-rich (and preferably animal-free) medium. The scaffold provides structural support for the cells and promotes muscle fusion, creating ‘strips’ of muscle fibres. The fibres can be mechanically stretched to increase size and protein content and the resulting tissue is harvested and processed into a boneless meat product.

A significant amount of research relating to cell-cultured meat has focused on the formation of processed meat (such as hamburgers and meatballs) and formulation of an economical manufacturing process. In order to effectively scale up production, a suitable scaffold (which is cost effective and preferably edible) to support the growing cells is required. To date, progress in manufacturing such products is advancing beyond all expectations, and slaughter-free meat could be in our shopping trollies sooner than expected. For example, JUST Inc (with laboratories in San Francisco) aims to sell its first cell-cultured meat products this year, whilst Mosa Meat and US-based Memphis Meats aim to have their products on supermarket shelves by 2021.

This focus on producing processed cell-cultured meat is due, at least in part, to the complexity of unprocessed meat, which includes bone, blood vessels and connective tissues, making this structure difficult to replicate. An appropriate scaffold that aids cell alignment will be required to develop unprocessed cell-cultured meat. A significant amount of research and ‘out of the box’ thinking will be needed before we can expect to enjoy a cell-cultured steak or rack of lamb.

In the race to provide a suitable solution to this problem, varied approaches have been taken by companies and research groups within this sector and some are seeking patent protection for new inventions. Some examples of scaffolds being trialled for forming either processed or unprocessed meat are discussed below.

Starch fibre mats

Researchers from Pennsylvania State University and the University of Alabama have collaborated to produce a method of forming edible starch fibre mats using a cost effective wet-electrospinning technique. Starch has the benefit of being one of the least expensive natural fibres.

The wet-electrospinning technique typically comprises a polymer solution, a syringe with a metal needle, a coagulation bath and a grounded collector. The polymers required to form the scaffold are first dissolved in a solution, which is placed inside the syringe and subsequently forced through the needle at a constant flow rate. At the same time a high voltage is applied to the solution. The electric charge draws and stretches the jet of the polymer solution as it is directed to a coagulation bath containing ethanol and water, which precipitates the polymer fibres from solution. The resulting polymer fibres are collected on a rotating drum submerged in the coagulation bath. The thin starch fibres provide a high surface area scaffold upon which cells can adhere and grow to form a structured meat product.

The electrical field that forms between the nozzle and a rotating collection drum draws the starch into long threads.

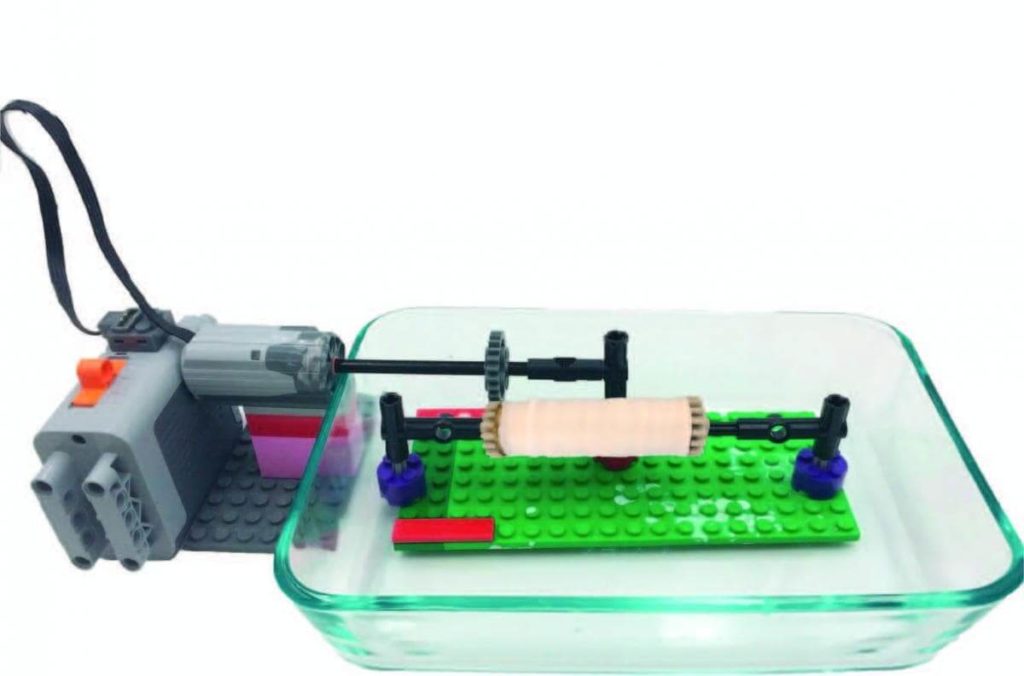

In a study recently published in Food Hydrocolloids, the researchers built an inexpensive electrospinning device partially using the children’s toy, Lego® to form the rotating drum collector (shown in Figure 1).

The research found that the formation of suitable starch fibres was dependent on the speed of the rotating drum and the amount of ethanol in the electrospinning bath used to collect the fibres.

Figure 1 – ‘Aligned wet-electrospun starch fibre mats’

Porous protein scaffold

Israeli company, Aleph Farms, announced that it had produced the first prototype of a cell-cultured steak in December 2018, with thin strips of steak costing around $50 to produce. The company admits that the size and flavour of the steak requires some further research before the product is ready for commercialisation. It has collaborated with the Technion – Israel Institute of Technology, Haifa, to develop the manufacturing method, which includes a bio-engineering platform and innovative approaches to an animal-free growth medium to nourish the cells.

Aleph Farms is reported to use a combination of six technologies, which provide a more economical manufacturing method.

These techniques include innovative approaches relating to an animal-free growth medium to nourish the cells, and bioreactors (the tanks in which the tissue grows). Little information on the specifics of these technologies seems to be publically available.

However, a recent patent application by Technion Research & Development Foundation Ltd published in January 2019 (WO 2019/016795), discloses a method of forming cell-cultured meat on a porous scaffold. The method comprises the steps of incubating a three-dimensional porous scaffold formed from a textured protein, such as a soy protein, and a plurality of cell types including myoblasts (muscle cells) and at least one extra cellular matrix (ECM)- secreting cell type.

The ECM-secreting cells may be adipocytes (fat cells), fibroblasts (which produce the structural framework of animal tissues), progenitor cells (satellite cells), or endothelial cells (cells which line the interior surface of vessels). Once the porous scaffold has been incubated with the different cells, they are allowed to expand on the scaffold. Muscle cell fibres are then formed through the fusion of myoblasts into multi-nucleated fibres (myotubes).

Grass as a scaffold

A research group at the University of Bath in the Department of Chemical Engineering has come up with an alternative method to formulating a suitable scaffold for cell-cultured meat. Dr Marianne Ellis, working with a multidisciplinary team with expertise in biochemical engineering, biology and biomaterials, has focused on scaling-up the manufacturing process of cultured meat.

The researchers used stem cells extracted from an animal, which are fed a mixture of glucose, vitamins, minerals and amino acids. The cells are then transferred to a bioreactor containing grass as a scaffold, on which they can attach and grow. To date, the team has used rodent cells to test the effectiveness of this scaffold, as they are cheaper and easier to use compared to stem cells extracted from cows or pigs, for example.

At the present time, it is unclear whether a grass scaffold would be suitable for producing the complex structure of unprocessed meat. This would require a system containing multiple cell types growing in an organised manner and a structure that will need a replicated blood vessel network. A more simplistic and near-term goal is to produce a muscle protein ingredient based on muscle cells alone.

Decellularised spinach leaves

A method that uses decellularised spinach leaves (i.e. spinach leaves in which the cellular material has been removed) to produce a scaffold for tissue engineering has been developed by Glenn R. Gaudette, a professor of Biomedical Engineering at Worcester Polytechnic Institute in Massachusetts.

A patent detailing the decellularisation method (WO 2017/160862) was published in September 2017. This work is based on the similarities in the vascular structure of plant and animal tissues (Figure 2).

Figure 2 – Crossing kingdoms: using decellularised plants as perfusable tissue engineering scaffolds

The method first decellularises spinach leaves by applying a solution containing 10% sodium dodecyl sulphate (SDS) in deionised water for five days. After this, a clearing solution (0.1% TritonX100, 10% sodium chlorite in deionised water) was applied to the leaves for two days. The resultant leaves were colourless and translucent, forming an acellular scaffold consisting of extracellular matrix (ECM), preserving an intact vascular network (Figure 3).

Gaudette, is collaborating with Dr Marianne Ellis of the University of Bath to assess the potential of this technique to develop muscle cells from the stem cells of a cow. If successful, spinach leaves could provide a low cost and edible scaffold for producing more complex meat structures.

Figure 3 – A cellular scaffold consisting of extracellular matrix

Conclusions

Cell-cultured meat has the potential to reduce the amount of land, water and antibiotics required for traditional farming practices. This field is moving rapidly with some processed cultured meat products already poised to enter the marketplace. Unprocessed meat products represent a more elusive target, but research is underway to develop scaffolds that allow the formation of the characteristic texture of a T-bone steak.

This article was first published in The Journal of the Institute of Food Science & Technology in May 2019.

Will you be attending the 2019 AIPPI World Congress? If so, Mathys & Squire would like to invite you to join us for drinks with a view at our London office in The Shard to celebrate!

AIPPI is the world’s leading international organisation dedicated to the development and improvement of laws for the protection of intellectual property. Based in Switzerland, the organisation has over 9,000 members representing 125 countries and its World Congress meeting open to all members is held annually. The 2019 Congress takes place at the Queen Elizabeth II Centre and Central Hall Westminster from 15-18th September.

To mark the start of the London Congress, Mathys & Squire’s event will take place on Sunday, September 15th 2019, where you can expect cocktails, canapés, live music, stunning panoramic views of the City and the chance to meet other AIPPI members.

For more information and to RSVP, click here or contact [email protected].

*N.B. This event is for international delegates only and not UK IP firms or law firms. For more information about this, please contact the Mathys & Squire Marketing team here.

Mathys & Squire will once again be sponsoring and exhibiting at the flagship event for London Tech Week, TechXLR8, which brings together seven of the biggest technology conferences with over 15,000 attendees, 300 exhibitors and 600 speakers.

From 12th-13th June at the ExCeL Centre, London, our team of patent, trade mark and design experts will be based in the Startup Elevate hub at stand S104 ready to discuss all intellectual property related matters including protection, strategy and valuation for startup businesses.

Managing Associate Andrew White will be a judge at the ‘Pitch off’ session on Security and Connectivity from 14:20 – 15:20 on 13th June.

For further details and a copy of the full agenda, click here.

Mathys & Squire LLP has promoted Hazel Ford and Posy Drywood to the partnership. The firm now has 27 partners and 10 offices across the UK and Europe.

Hazel Ford has nearly 20 years’ experience in the patent profession and joined Mathys & Squire from the London office of a leading US IP law firm. She advises clients on all aspects of patent strategy, and handles patent prosecution, EPO opposition and appeal proceedings. She specialises in biotechnology and pharmaceuticals including antibodies, vaccines, genes and proteins, drug formulations and diagnostics. Hazel has a PhD from the University of Cambridge and is qualified as a Chartered and European Patent Attorney and a Patent Attorney Litigator.

Posy joined the chemistry group at Mathys & Squire in 2009. She drafts and prosecutes patent applications for her clients, as well as managing global portfolios on their behalf. Posy is experienced in opposition and appeal proceedings before the European Patent Office, and has coordinated the filing and prosecution of Supplementary Protection Certificates across Europe. As part of the chemistry group, Posy is particularly familiar with inventions in the fields of pharmaceuticals, oil and gas, batteries and green technology. Her clients range from large multi-national companies to SMEs and universities. Posy has a master’s degree in natural sciences, specialising in chemistry, from the University of Cambridge.

Commenting on the firm’s new promotions, partner Chris Hamer said: “We are delighted that Posy and Hazel are joining the partnership to augment our high-level skills in their specialist chemistry and biology sectors and to service our clients across these global industries. It has been a very successful year for Mathys & Squire and these promotions highlight the firm’s continued growth and strength in the marketplace, as well as our dedication to nurturing and progressing talented individuals in the business. We wish them the best of luck in their careers as partners in Mathys & Squire!”