The EPO’s new Rules of Procedure of the Boards of Appeal (RPBA) came into force on 1 January 2020. One notable change was to Article 11 RPBA, which concerns when a Board of Appeal should remit a case to the department of first instance for further prosecution, and when it should decide on the entire case itself.

Article 111 (1) EPC states that a Board may either exercise any power within the competence of the department which was responsible for the decision appealed, or remit the case to that department for further prosecution. The EPC thus gives the Boards of Appeal discretion as to whether or not a case should be remitted to the department of first instance. In exercising this discretion, the practice of the Boards of Appeal has generally been to remit cases where issues that were important to patentability were not the subject of the first instance decision. For example, if a Board overturned a first instance decision to revoke a patent for lack of sufficient disclosure, it would normally remit the case to the Opposition Division for further examination of the remaining grounds of opposition.

Article 11 of the new RPBA states that the Board shall not remit a case to the department whose decision was appealed for further prosecution, unless special reasons present themselves for doing so, and that as a rule, fundamental deficiencies which are apparent in the first instance proceedings constitute special reasons. This wording leaves open the question of what constitutes ‘special reasons’ (other than ‘fundamental deficiencies’), and, in particular, whether a case could still be remitted for the sole reason that the first instance decision did not address important issues still to be decided.

Some recent decisions from the Boards in early 2020 indicate that remittal is likely to remain common under the new rules. These decisions also provide some direction as to what may constitute ‘special reasons’.

Decision T1627/17

This relates to a case in which the Opposition Division found that the invention was not sufficiently disclosed, but no decision was taken regarding the other grounds of opposition (lack of novelty and inventive step). The Board overturned the Opposition Division’s decision regarding sufficiency of disclosure, and, in accordance with the requests of both parties, decided to remit the case to the Opposition Division for further examination of novelty and inventive step. The Board commented that it is well recognised that any party may be given the opportunity of two readings of the important elements of a case; that the essential function of an appeal is to consider whether the decision issued by the first-instance department is correct; and that a case is normally remitted if essential questions regarding patentability have not yet been examined. The Board then commented that the circumstances of this case, including the request by both parties for remittal, are ‘special reasons’ for remittal in the sense of Article 11 of the new Rules of Procedure.

Decision T 1966/16

In this decision, the Board overturned the Examining Division’s decision and found that the claimed invention involved an inventive step, but identified various other deficiencies in the claims which had been identified by the Examining Division, but which had not been the subject of the first instance decision. The Board decided to remit the case for further examination, commenting that ‘special reasons’ for remittal were apparent because the Examining Division has not taken an appealable decision on essential outstanding issues with respect to sufficiency of disclosure, clarity and added matter.

Other recent decisions

Similar conclusions have been reached in various other decisions, including T 1964/17, T 2172/15, T 0297/17, T 1508/17, T 0986/16, T 1265/15, T 2024/15, T 0731/17, T 1077/17, T 2496/17, T 1159/15, T 2676/16, T 0658/17, T 0275/15, T 1900/17, T 1621/17 and T 0702/17.

In conclusion, from these recent decisions, it appears that requisite ‘special reasons’ for remittal under the new rules of procedure include many scenarios that occur reasonably often, such as when there is no first instance decision on essential outstanding issues. It therefore appears that remittal to the department of first instance is likely to remain a common outcome in EPO appeal proceedings.

In this article for Open Access Government, Mathys & Squire managing associate Laura Clews highlights recent innovations in recycling and replacing plastics, to mark Global Recycling Day 2020.

Global Recycling Day, which took place this year on 18 March 2020, was set up by the Global Recycling Foundation to help recognise, and celebrate, the importance of recycling in securing precious primary resources, reducing pollution and preserving biodiversity for future generations.

Overall, efforts to increase recycling have improved over the last 10 years. In the UK alone, based on figures recorded in 2017, the UK recycling rate for household waste was 45.7%, a 0.5% increase from 2016, but the EU has set a target to boost this figure to 50% by 2020(1).

Since 2018, there has been a shift in how waste is recycled. Previously, countries around the world exported recyclable materials (accounting for almost half of all global recycling) to countries in the east, such as China, for reuse in their recycling programs, as this was more economical than developing national recycling programmes. When China announced its ban on importing waste (including plastics) in 2018, many countries – including the UK – had to begin work on developing economical recycling facilities. The alternative would be to use landfill sites, which is of course only a short-term fix limited by the amount of land which can be assigned to such facilities. Given that plastics may take several hundreds of years to decompose, landfill sites in the UK would quickly reach capacity.

Furthermore, landfill sites are known to present a serious risk to the contamination of groundwater, which can cause detrimental effects to the surrounding environment and its inhabitants(2). In addition, just in the UK alone, more than 1,200 coastal landfill sites are in danger of spilling their waste contents into the sea.

In light of awareness campaigns such as Global Environmental Day and through the campaigning of individuals in the media spotlight, including David Attenborough and Greta Thunberg, the environmental impact of day-to-day life – and specifically waste material – has been brought to the forefront of societal concerns. In particular, consumers are showing more of an interest in and awareness around recycled goods and more environmentally friendly alternatives to single-use plastics.

In response to consumer concerns, the UK government has pledged to focus on steering the UK towards a greener future, as highlighted in the recent Budget announcement(3). Innovative companies in the green technology space are also funding intensive research to find environmentally friendly and economically viable methods of recycling plastic and/or suitable alternative packaging materials.

Recycling plastics

One company looking to find more effective and environmentally friendly methods of recycling plastics is Green Lizard Technologies (GLT). The method of recycling waste polyethylene terephthalate (PET) developed by this company uses proprietary catalyst systems to break down the PET polymer chain to its raw materials (BHET – bis(hydroxyethyl)terephthalate). Once PET has been broken down to BHET, it can then be reused to form other plastics or alternative polymeric materials.

It has been reported that this process produces recycled materials which are essentially free from contaminants, and therefore can be reused to produce packaging in sectors governed by strict regulations relating the use of recycled plastics, i.e. the food and drink industry, where consumers are rightfully concerned about the materials used for the packaging of products they will ingest. Perhaps one of the more challenging areas within the food and drink industry is the manufacture of water bottles from recycled materials. As recycled plastics can appear cloudier than virgin plastic materials, some manufacturers are concerned that the resulting product may be less appealing to consumers. However, the recycling process produced by GLT has now successfully produced clear recycled plastics.

In a report published in January 2020 by Green Alliance, titled ‘Plastic promises: What the grocery sector is really doing about packaging’, research has been carried out to consider the kneejerk reaction by many retailers and suppliers to replace single-use plastics with other materials which are considered to be ‘more environmentally friendly’ in response to growing pressures from the public. The report highlights that often single-use plastic packaging is simply replaced with alternative single-use materials, such as glass, paper, wood and biodegradable materials, without undertaking a rigorous analysis of the environmental impact of such materials compared to single-use plastics.

Worryingly, many reports have found that due to factors such as the manufacturing process, the number of times consumers are likely to reuse these materials and the availability of recycling schemes, these alternative materials can in fact be more damaging to the environment than single-use plastics. For example, a study for the Northern Ireland Assembly in 2011 found that paper bags generally require four times more energy to manufacture compared to plastic bags.

Turning food waste into environmentally friendly materials

As well as recycling plastics, some companies have focused their attention on recycling food and drink-related waste products – or more specifically, as in this example, coffee. In modern society, coffee is not simply a drink choice for most adults, but an essential for day-to-day life. In fact, it has been reported that in the UK 95 million cups of coffee are consumed a day, which produces around 500,000 tonnes of used coffee grounds every year, most of which simply ends up on landfill sites (see ‘Put Your Coffee Waste to Work’, by Bio-bean).

Fortunately, Berlin-based company, Kaffeeform, has found a way to repurpose this waste product, turning coffee grounds (and other plant-based resources) into durable cups that are hardened with biopolymers.

In addition, New York-based biotech company, Ecovative Design, has produced a new environmentally friendly material made from mushrooms. The material has been used to form surfboard blanks to replace those previously used which were formed from expanded polystyrene or polyurethane foam with a fibreglass coating.

The blanks, which are entirely biodegradable, are made from a material called Myco foam which is formed from mycelium (the white, glue-like, branching part of fungus referred to as hyphae) and organic farm waste, such as corn husks, straw and lentil pods. During manufacture, the mycelium grows, feeding on the organic waste, and forms long entangled fibres. This new material has been an immediate success, and not only in the surfing world. Ecovatve Design has now branched out into making faux-leather materials, packaging and skincare products, forming partnerships with well-known companies such as Bolt Threads, IKEA and DELL.

This article was originally published in Open Access Government in April 2020.

Is your business innovating during these worrying and economically challenging times? Make sure your IP strategy is up-to-date and prepared for when the economy improves again. Here are our top five hints and tips.

1. Perform an IP audit and update it regularly

Understanding exactly what intellectual property (IP) your business has is critical. Registered (or registrable) and unregistered rights can be equally important, and it is essential to map those rights to the commercial value of the associated parts of the business. Your IP portfolio and strategy should be regularly reviewed and updated to match your business goals as they progress and change. Ensure that your largest revenue streams are the most tightly protected: it is the associated IP in these areas of the business that can enhance their value to the extent that, not only does it help to stop your competitors from copying you and taking some of your market share, but it can also act as surety and security for investment and borrowing to help fund the growth of your business.

2. Be smart about your IP budget

Cash flow is of most concern to many businesses at this economically challenging time, and it is tempting to halt escalating IP costs indiscriminately without really considering the longer term impact. Instead, take the time to consider what is essential in order to protect your key business goals, and then get the timing right: it may not be necessary to do everything immediately; by prioritising key rights and using grace periods and extensions of time strategically, costs can be staggered and cash flow can be managed without undermining your potential head start as we come out of these uncertain times.

3. Don’t forget about your unregistered IP rights

Not all IP is, or has to be, registered to add value to your business. In fact, for some businesses, unregistered IP rights, such as copyright, trade secrets and know-how, may provide more powerful protection for an innovation than registered rights. These types of rights come into being automatically but, in order to be effective, you first need to identify them, and then ensure that your IP strategy includes policies for using them to their full advantage, as well as adequately safeguarding them in the longer term.

4. Understand and exploit your commercial landscape

If you are using, or considering, innovation to drive your business forward as we emerge from the current crisis, it is important to understand what your competitors are, or have been, doing. Do you know who your main competitors are and where they have been concentrating their main R&D efforts in recent years? If not, you might want to consider including a landscape search and analysis in your IP strategy, which can help you, to not only understand where your business sits within the globally competing market, but also provide key insights into potential technical areas of growth and innovation for your own business.

5. Don’t overlook your global competition

It will be increasingly important to safeguard your overseas markets (or potential markets) against your global competitors, especially considering that some countries may be released from the current ‘lockdown’ restrictions before the UK. Overseas IP protection can be a bit daunting, especially in terms of the cost implications at a time when cash flow may be of paramount concern; but failing to secure your overseas revenue streams could prove to be even more expensive in the longer term. There are lots of different ways to put overseas IP protection in place, while ensuring that the associated cost matches the potential commercial value of the product or service it serves to protect and, if this is managed strategically, you can ensure that your innovation is properly protected as we begin to return to some kind of stability following COVID-19, without breaking the bank.

Mathys & Squire is delighted to be recognised and ranked in Legal Business’ top 20 list for London specialist law firms, based on client service.

The new research, carried out by Legalease (which is also responsible for The Legal 500 directory), is the world’s largest ever legal survey of its kind, compiling rankings of more than 1,000 law firms. Of these 1,000 law firms, the Mathys & Squire team came out in the top 20, based on analysis of over 60,000 UK clients which took part, rating their law firms’ services across a range of business-critical criteria.

Results from this ground-breaking survey revealed that boutique and specialist firms are outclassing larger rivals on quality of client service – evidencing the case that ‘bigger is not always better’. Such an analysis echoes the findings from Mathys & Squire’s own research into IP litigation (Trends in IP litigation), in which legal decision makers expressed the importance of engaging with a specialist IP firm when it comes to IP litigation.

As demonstrated by the data collated, boutique or specialist firms, including Mathys & Squire, are scoring an average of 1.5% above the benchmark for all other large firm categories, including the UK top 100, global elite and major US firms – with UK top 25 law firms scoring lowest when it comes to client service. The overall scores attributed to the top 20 London specialist firms were calculated by combining the ratings of the following three keys areas of business: lawyers/team quality; sector/industry knowledge; and billing and efficiency. Consistency of client feedback was also taken into consideration.

For the full results by Legalease, and for more information, read the full article via Legal Business Magazine here.

As part of the ‘Legal Focus: IP in innovation’ section of the April 2020 edition of FinTech Futures‘ Banking Technology magazine, Mathys & Squire partner Dani Kramer has provided his expert answers in response to a series of questions about the patent process for fintech startups.

Does your fintech need a patent? Does your invention need protection, or will you need something else?

Innovation drives the fintech industry, and the latest ideas often need protection. Whether it is from a potential competitor or a litigious corporation, fintechs must get to grips with intellectual property (IP) law at an early stage of their inception or risk endless legal battles.

FinTech Futures interviewed some legal eagles from fintech-focused law firms to find out more about the patent process for budding startups.

What is the procedure for obtaining a patent in the UK as a fintech company? Additionally, is it through legal statute or common case law precedent?

Dani Kramer, partner at IP firm Mathys & Squire: “The procedure for obtaining a patent in the UK for a fintech invention is the same as that for inventions in most other technological areas. Somewhat simplifying the process, the first step is filing a patent application – to obtain a UK patent, this can either be a UK patent application filed at the UK Intellectual Property Office (UKIPO), or a European patent application filed at the European Patent Office (EPO), which is notably separate from the EU (so unaffected by Brexit).

“Subsequently, the relevant patent office (UKIPO or EPO) performs a search to identify similar prior technology and examine the patent application. At this stage, the patent office would in most cases raise objections against the patent application, after which the applicant (the fintech typically represented by a patent attorney) and the patent office would go through one or more rounds of negotiation. Once all of the patent office’s objections are overcome, a European or UK patent is issued (to obtain a UK patent from a European patent, it needs to be validated in the UK).

“Both at the UKIPO and the EPO, the laws and regulations with regards patents and their application are governed by legal statutes – the Patents Act of 1977 for the UKIPO, and the European Patent Convention for the EPO. That said, case law precedent does influence how these legal statutes are applied by the patent offices.

How long does the procedure for obtaining a patent take and what are the average costs incurred?

Dani Kramer: “It usually takes about 18 months to three years from the date of the application to obtain a granted UK patent. However, this process can be expedited, if certain fees are paid early and if you respond promptly to letters from the UKIPO, down to as little as 12 months. Once a UK patent is granted, renewal fees need to be paid annually to keep it in force.

“As much of the cost of obtaining patent protection depends on the time taken by the patent attorney to draft and prosecute the patent application, the average costs incurred vary widely depending on the complexity of the invention and the objections raised by the patent office. The total costs from preparing and filing a UK patent application to grant are typically between £6,000 and £12,000 but can be higher or lower than this range.”

Have there been any disputes between a fintech and a large tech/bank in an innovation lab claiming that the product was theirs?

Dani Kramer: “Yes, there have. A notable case – USAA v Wells Fargo – was settled only earlier this year. This was the first fintech patent suit launched by a bank, and it ended in a $200 million damages order from Wells Fargo to the United States Automobile Association (USAA). This verdict may very well result in increased patent filing activity among financial institutions, as it demonstrates the need for building a ‘defensive’ portfolio (implying a threat of a countersuit) to protect yourself from patent suits from competitors.”

What kind of protection does each type of IP confer? Do certain kinds of inventions lend themselves better to patents, or to trade secrets?

Dani Kramer: “When protecting a given invention, the trick is usually to use a combination of both types of IP. Aspects of the invention that are likely to become, or are inherently, publicly available (such as client-side code in a web-based banking application) may not be suitable for trade secrets, and patents (as well as other forms of protection such as copyright) may be more appropriate.

“On the other hand, aspects that can be kept secret more easily (such as serverside code) and that may not be patentable (for example, that may fall entirely within the exclusions from patentability) may be better kept as ‘trade secrets’. A skilfully drafted patent application would describe and protect the innovative features that are inherently patentable, while keeping material that would likely be nonpatentable out of a patent application and maintained as trade secrets. This avoids, in effect, donating the non-patentable subject matter to the public and competitors, while keeping patenting costs down.”

This commentary was originally published in the April 2020 edition of Banking Technology, the FinTech Futures magazine. Click here to read the full article (pp. 22-23).

EPO case law update – T 1491/14

The EPO’s Technical Board of Appeal 3.3.01 in recent decision T 1491/14 has provided further insight into the criteria suitable for establishing novelty of second medical use claims based on the treatment of a purposively selected patient subgroup. In particular, this decision has affirmed that second medical use claims directed towards the treatment of a patient subgroup – selected based on its treatment history – with a known medicament is novel over the prior treatment of a broader patient group with the same medicament.

Previous EPO case law has established that the use of a known therapeutic compound in the treatment of the same disease as that disclosed in the prior art can nevertheless constitute a novel therapeutic application, provided that it is carried out on a new group of subjects. These subjects are required to be distinguished from the former group by either physiological or pathological status. In the earlier decision T 233/96, the EPO’s Technical Board of Appeal took the view that the claimed subgroup must not overlap with the previously treated group of patients, and the choice of patient subgroup must not be an arbitrary selection (i.e. there must be a functional relationship between the distinguishing physiological or pathological status of the new group and the therapeutic effect). Recently, in T 694/16, the Board departed from the ruling in T 233/96, and held that novelty could be established for a patient subgroup that overlaps with a larger population of previously treated patients if the identifying feature of the subgroup (in this case, biomarkers that are predictive of responsiveness to treatment) was not previously known in the art (and there is a functional relationship between this feature and the therapeutic effect). This approach has now been followed in the present decision T 1491/14, which provides further clarity to the criteria used to assess whether a patient subgroup represents a purposive selection that imparts novelty to a second medical use claim.

The decision in T 1491/14 concerns a medicament for treating depression, anxiety, abuse or chronic pain, in a patient who has previously ceased or reduced another medication for the treatment of the same disease due to sleep or sexually related adverse event. The Board had to assess whether this particular patient group was suitable to render the claimed therapeutic use novel.

In Appeal proceedings following Opposition, the Patentee put forward 3 criteria for assessing whether a group of patients renders a previously known therapeutic use novel. These criteria are as follows:

- The patient group is not disclosed in the relevant prior art.

- The patients belonging to the group can be distinguished from those of the prior art by their physiological or pathological status.

- There is a functional relationship between their characterising physiological or pathological status and the therapeutic treatment and thus the selection of the patients is not arbitrary.

The Board of Appeal agreed that a patient group fulfilling those three criteria would be suitable to meet the requirements of novelty, and considered each of these three criteria in turn.

On considering criterion (1), the Board of Appeal held this to be fulfilled because the new group of patients were undisclosed in the prior art, which described the treatment of patients who were suffering from depression, anxiety, abuse or chronic pain but did not specify the treatment history of the patients. Thus, even though the new subgroup of patients could have been embedded in or overlapped with the previous group of treated patients (which might have included patients who ceased another medicament due to side effects), the Board considered the subgroup to be novel, because the identifying feature of the subgroup (i.e. the treatment history) was not previously disclosed in the art. This is consistent with the ruling in T 694/16.

With respect to criterion (2), the Board held that the patients’ decision to continue, reduce, or cease medication due to adverse effects is not an arbitrary choice based on the patients’ free will but rather a technical decision comparable to that of a physician selecting the most suitable treatment for a patient. The Board took the view that the patients’ decision to cease the previous treatment due to the burden of the sleep or sexually related side effects represented a failure of the previous treatment that would affect the patients’ mental health and their attitude towards antidepressants and, as such, makes the new group of patients different from a pathological point of view. In this regard, the Board held that the treatment history of the patients of the new group makes them pathologically distinct from the prior art patients (whose treatment history was not known) and that criterion (2) is fulfilled.

Finally, with regard to criterion (3), the Board noted that the claimed treatment produces sleep and sexually related adverse events at (or close to) the level of placebo. As such, it is particularly suitable for treating depression, anxiety, abuse or chronic pain in patients who took the decision to reduce or cease a previous medication due to the occurrence of such adverse events. Therefore, it was held that the functional link between the pathological status of the patients and their therapeutic treatment is clear, and criterion (3) is fulfilled.

This decision thus provides a set of criteria that may be useful for assessing whether a patient subgroup represents a purposive selection that imparts novelty to a second medical use claim. These criteria allow novelty to be acknowledged even where there is an overlap between the new patient subgroup and a larger group of previously treated patients as long as the subgroup patients can be distinguished pathologically or physiologically from the prior art patients – consistent with the ruling in T 694/16. Furthermore, the decision paves the way for claims directed to the treatment of new patient subgroups in circumstances where a known treatment is found to be particularly beneficial for patients having a particular treatment history. The Board of Appeal’s decision in T 1491/14 thus re-affirms the EPO’s approach to allowing protection for a range of personalised healthcare inventions.

In this article for eeNews Europe, we consider the intellectual property (IP) issues in relation to likely developments in AI hardware.

In recent years, we have seen the use of artificial intelligence (AI) and machine learning (ML) expand into a more varied range of computer and mobile applications. Now, in a similar fashion to how the spread of low-cost graphics processing units (GPUs) enabled the deep learning revolution, it is hardware design (as opposed to algorithms) that is predicted to provide the foundations for the next big developments.

With companies – from large corporates to startups and SMEs – vying to establish the fundamental AI accelerator technology that will support the AI ecosystem, the protection of intangible assets, including IP, will come to the forefront as one of the key aspects for success in this sector.

A huge increase in the size of ML models (roughly doubling about every 3.5 months) has been one of the key driving forces in the growth of ML model accuracy over recent years. In order to maintain this almost Moore’s- law growth in complexity, there is a clear demand in the market for new types of AI accelerators that can support more advanced ML models, for both training and inference.

One area of AI that would particularly benefit from new AI chips is AI inference at the edge. This relatively recent trend of running AI inference on a device itself, rather than on a remote (typically cloud) server offers many potential benefits such as removing latency in processing and reducing data transmission and bandwidth, and it may also increase privacy and security. In light of these advantages, the growth of the edge AI chips market has been remarkable – the first commercially available enterprise edge AI chip only launched in 2017, yet Deloitte predicts that more than 750 million edge AI chips will be sold in 2020.

The global AI chip market as a whole was valued at $6.64bn in 2018, and is projected to grow substantially in upcoming years, to reach $91.19bn by 2025, increasing at compound annual growth rate of 45.2%. Understandably, a wide range of companies are, therefore, working to develop AI chips. However, the market is poised to go through a growth cycle similar to those seen in the CPU, GPU and baseband processor markets, ultimately maturing to be dominated by a few large players. IP, and patents in particular, have been key to the success of household names such as Intel, Qualcomm and ARM, and it will likely play a similarly prominent role in the AI chip arena.

The range of companies competing in the AI chips market spans from ‘chip giants’ such as Intel, Qualcomm, ARM or Nvidia, through to traditionally internet-focused tech companies (e.g. Alphabet or Baidu) and numerous niche entities including Graphcore, Mythic, or Wave Computing. Various large corporations that would normally seem like ‘outsiders’ in a chip market are also involved – for example, since the vast majority of edge AI chips (90%) currently go into consumer devices, many smartphone manufacturers have not missed this opportunity and developed their own AI accelerators (e.g. Apple’s eight-core Neural Engine used in its iPhone range).

The race currently remains open as to who may dominate. Both technical specialists and investors will be looking closely at which companies’ technology shows most promise, and the field will inevitably evolve through investment, acquisitions and failures. Within the next few years, we can expect to see the market leaders emerge. Who will become to AI chips what Intel has become to CPUs (77% market share), and what Qualcomm is to baseband processors (43% market share)?

The current frontrunners appear to be Intel and Nvidia. According to Reuters, Intel’s processors currently dominate the market for AI inference, while Nvidia dominates the AI training chip market. Neither Intel nor Nvidia are resting on their laurels, as showcased by their recent acquisitions and product releases that seem to be aimed at ‘dethroning’ one another. Just in December 2019, Intel acquired Habana Labs, an Israel-based developer of deep learning accelerators, for $2bn.

Habana’s Goya and Gaudi accelerators include a number of technical innovations such as support for Remote Direct Memory Access (RDMA) – direct memory access from one computer’s memory to that of another without using either computer’s operating system – a feature particularly useful for massively parallel computer clusters and thus for the training of complex models on the cloud (where Nvidia currently dominates). Nvidia, on the other hand, recently released its Jetson Xavier NX edge AI chip with an impressive up to 21 TOPS of accelerated computing, directed in particular at AI inference.

Several smaller entities also look exciting, such as Bristol-based Graphcore, or Mythic based in the US. Graphcore recently partnered up with Microsoft, raising $150mat a $1.95bn valuation. Their flagship product – the Intelligence Processing Unit (IPU) – has impressive performance metrics and an interesting architecture – e.g. the IPU holds the entire ML model inside the processor using In-Processor Memory to minimise latency and maximise memory bandwidth. Mythic’s architecture is equally noteworthy, and combines hardware technologies such as computing-in-memory (removing the need to build a cache hierarchy), a dataflow architecture (particularly useful for graph-based applications such as inference), and analog computing (computing neural network matrix operations directly inside the memory itself by using the memory elements as tunable resistors). Mythic is not lagging behind Graphcore in commercial aspects either – it added $30m in funding in June 2019 from household investors such as Softbank.

At this stage it is unclear who will eventually dominate the AI chips market, but a key lesson from historical developments, such as in the fields of CPUs and baseband processors, is that IP rights play a big role in who comes out on top, and who survives in the long run.

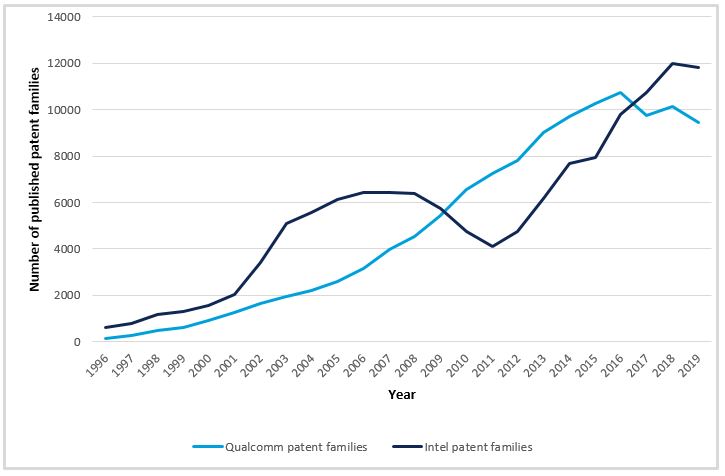

The importance of a strong patent portfolio for commercial success in chips markets is demonstrated by the number of patent filings of companies such as Intel or Qualcomm. These have been increasing since 1996 and now sit at about 10,000 published patent families per year. Considering the inherent possibility of reverse engineering a chip design and the common use of the fabless model in the industry, it is difficult for any entity to protect their IP without a patent portfolio, complemented by other forms of protection such as trade secrets (or ‘know-how’).

A number of market leaders in the chip industry have built their business model around patent licensing. Notable examples include Qualcomm and ARM Holdings. Although Qualcomm derives most of its revenue from chip-making, the bulk of its profit comes from its patent licensing businesses. Qualcomm’s licensing business may have suffered over the past two years, but this was largely due to a dispute with Apple, which has now been resolved with a one-time settlement of $4.5bn from Apple to Qualcomm, and a six year licensing deal between the two companies going forward.

ARM goes one step further, generating practically all its revenue from IP licensing, without ever selling its own chips. Patent licensing has been very profitable for Qualcomm and ARM, and it will likely be equally profitable for companies who build a strong patent portfolio in the AI chips area. ARM’s business model will present an attractive option for startups not having the resources to get involved in chip manufacturing, and the incentive to mitigate risk by remaining fabless will remain strong even as smaller companies grow.

For startups that may be minded towards being acquired, there is little doubt that IP is vital for the strongest valuations. It is unlikely that Intel would have acquired Habana in late 2019 for $2bn if it weren’t for Habana’s patent portfolio stretching back to 2016, or that Graphcore would have partnered-up with Microsoft and obtained its current valuation of $1.95bn if they didn’t have over 60 patent families (groups of patents sharing the same initial patent filing) to their name. Investor exit strategies, therefore, continue to dictate the need for a sound IP strategy.

Another key lesson from related sectors is the very large risk and reward associated with patent infringement. As recently as January 2020, Apple and Broadcom were ordered to pay $1.1bn in damages for infringing Cal Tech patents on Wi-Fi technology, which the court ruled was used in Broadcom’s wireless chips. According to Qualcomm and Intel patent families Bloomberg, this was the sixth largest patent-related verdict ever. The need for companies to build their own patent portfolios for both offensive and defensive purposes (a ‘defensive’ portfolio implying a threat of a countersuit thereby protecting from patent suits by competitors), therefore, remains clear.

Companies are not overlooking IP issues, with records showing that there are already more than 2,000 patent families in the field of AI chips. The filing of new patent applications is increasing rapidly – Intel alone has filed 160 patent applications for AI chips in the last five years. Existing market leaders as well as new entrants should, therefore, take note of Intel’s approach and be mindful not to miss the importance of IP protection for their inventions, particularly during the early stages.

The legal environment surrounding IP, and in particular patent law, has changed considerably over the last two decades. It is also the case that the ever increasing volume of historical patents and technical publications continues to intensify demands on both patent offices and patent owners seeking to maintain patent quality. However, there can be no doubt that IP will once again prove crucial in this emerging industry. Experienced technologists and IP practitioners will use lessons from the past to refine their strategies, and those companies with the right approach will succeed not just on the merits of their technology but on leveraging their IP to best advantage.

This article was first published in eeNews Europe in March 2020.

In this article written by Managing IP, Mathys & Squire partner Martin MacLean provides his expert opinion on vaccine development during the midst of the COVID-19 global pandemic.

Martin explains that vaccine development in the midst of a global pandemic is difficult because by the time scientists have marketing authorisation for their vaccine, the virus might have already swept through a population.

In that event, companies would have invested millions of dollars and have little guarantee for a return on their investment.

Speaking to Managing IP, Martin comments: “The patent application process takes several years to complete, and one can only enforce a granted patent. Heaven knows how one would optimally enforce a vaccine patent during a pandemic such as coronavirus.”

“In such scenarios, governments may need rapid access to the patented technology and can’t be held to ransom. As a result, licence negotiations would become a second order consideration, and might not conclude as favourably as they would in a freely negotiated environment.”

To read the full article by Managing IP, please click here (login required).

In this article for Managing IP, Mathys & Squire partner Anna Gregson explains why early adoption of a robust patent strategy in the search for a COVID-19 vaccine is crucial, particularly as the volume of published research increases by the day.

In the COVID-19 global health crisis, the now-official pandemic is making news headlines around the world. While the global health challenges of combating COVID-19 are rightly the primary concern of scientists and public health organisations, the particular circumstances around the development of a cure for this strain of the virus raise specific issues in relation to obtaining patent protection for related innovations.

According to the World Health Organization (WHO)’s epidemic experts, there are no set definitions for a pandemic. The US Centers for Disease Control and Prevention identifies three criteria for a pandemic: (i) a disease has killed people; (ii) it demonstrates sustained person-to-person spread; and (iii) it has spread worldwide. Yesterday, March 11, WHO classified COVID-19 as a pandemic.

The advent of modern medicine means that more recent pandemics have not been as deadly as some historic examples, such as the Black Death in the mid-14th century and the 1918 Spanish flu pandemic, where it is estimated that one third of the world population was infected, with 50 million deaths. However, globalisation and urbanisation increase the risk of transmission, making it more difficult to stop the spread of disease. Further, even more recent pandemics have the potential to cause significant mortality, for example, a 2009 WHO-sponsored study estimated that the 2009 H1N1 (swine flu) pandemic killed between 123,000 and 203,000 people.

History teaches us that it is possible to contain outbreaks and prevent pandemics. In 2003, the global health community was able to slow the transmission rate of SARS-CoV sufficiently that the chain of transmission was broken. Individual SARS epidemics were kept localised and did not develop into a pandemic. Whether that will be possible with COVID-19 is not yet known.

Search for a vaccine

Unsurprisingly, therefore, COVID-19 is a public health priority, and a massive amount of research into the virus, potential treatments and vaccines is underway. Millions, if not billions of US dollars have been pledged by governments and funding bodies around the world. The UK Department for Health and Social Care issued two rapid response calls in February 2020 totalling £20 million ($26.1 million) and China has reportedly allocated almost $16 billion.

There are over 20 potential COVID-19 vaccines in development. A number of pharmaceutical companies, such as GSK and Sanofi, are working on vaccines. Regeneron is developing new antibody candidates and Fujifilm’s flu drug has been mentioned by the Japanese government as a possible therapy. In addition, scientists at many academic institutions and public sector organisations all around the world are working on COVID-19 treatments.

This frenzy of scientific research has the potential to generate many patentable innovations. All the usual reasons and considerations in relation to patenting innovations still apply. However, the extreme level of global interest, the sheer volume of research activity and the rapid spread of the disease present unique challenges for patenting inventions in relation to pathogens responsible for global health crises.

Given the number of researchers actively investigating COVID-19, the volume of published research is increasing daily. Each published document is potentially relevant prior art against later filed patent applications. Therefore, with each day that passes, the risk of a novelty-destroying document, or documents that render an invention obvious, increases. This is the case for any new innovation, but what differs in the COVID-19 crisis is the sheer number of publications. According to the WHO’s COVID-19 publication database, in 2020 to date, there have been 1,143 separate publications on COVID-19. In contrast, in the same period, there have been only 29 publications on HIV. Clearly, the number and rate of publications on COVID-19 is a strong motivation for researchers and innovators to file patent applications as early as possible.

At the same time, the applicant must still include enough information in their patent specification to render it plausible that the claimed invention would work. For claims directed to a medical use, the breadth of a patent claim and the amount of supporting data can be relevant to both sufficiency and inventiveness of the claimed subject matter. In relation to sufficiency, the question is whether the invention could be carried out across the scope claimed. For the inventive step, the question is whether the underlying technical effect or advantage is achieved across the whole of the scope claimed.

Under European practice, if an invention relies on a technical effect, which is neither self-evident nor predictable nor based on a conclusive theoretical concept, at least some technical evidence is required to show that a technical problem has been solved. The UK courts have held that, while data is not strictly required, an application must provide a “reasonable prospect” that the assertion will prove to be true, based on “a direct effect on a metabolic mechanism specifically involved in the disease”. Although not required, supporting data certainly strengthens an application, which may lead to delays in filing while data is generated and analysed prior to drafting a patent specification.

Therefore, while there is always a balance to be struck between filing early to improve an applicant’s position over prior art and delaying filing to generate sufficient evidence (particularly data) to establish plausibility, this is driven to the extreme for innovations relating to active pandemics or global health crises just short of this classification, such as COVID-19. In such circumstances especially, it is critical to seek good advice on filing strategy.

Further challenges

Also of particular relevance in the context of global health threats are the ethical implications of patenting. The tension between public good and private interest has existed for as long as the patent system, particularly in the field of healthcare, and nowhere more than where the public good is public health. This is the reason why, historically, some countries did not permit pharmaceuticals to be patented, or else limited the scope of the granted monopoly.

However, in modern drug discovery, research and development (R&D) is a hugely expensive, time-consuming and risky task. A blanket exclusion on new pharmaceuticals from patent protection disincentivises research into new pharmaceutical agents, as companies are unlikely to recover their R&D costs without exclusivity, and will look for alternative areas of research with more profitable outcomes.

The importance of enabling protection for new pharmaceutical products was considered by the World Trade Organization (WTO) when drafting the TRIPS Agreement, which sets out minimum standards of patent protection. While the TRIPS Agreement allows a permissible exception from patentability in order to protect human health, this exception is only available if the commercial exploitation of such subject matter is also prohibited. As a result, pharmaceutical products per se are usually not excluded from patentability, at least in WTO member states. Patent monopolies give innovators spending vast sums on new drug development the best chance of recovering costs and providing for future R&D.

Furthermore, most jurisdictions already have provisions which provide public access to innovations to address immediate public health crises, such as COVID-19. For example, the UK has both compulsory licence and ‘Crown use’ provisions. These provisions allow the government to act in the public interest by allowing important patented technology to be exploited, such as to address the COVID-19 threat and to provide a balance between the interests of innovators and the benefit to public health.

This article was first published in Managing IP – click here to read (login required).

Chancellor Rishi Sunak delivered his first Budget in the House of Commons yesterday (11 March). One of the key focus areas for the 2020 Budget, in line with consumer concerns relating to sustainability in recent years, is on helping to steer the UK towards a greener future. The Chancellor announced a range of policies put in place to reduce emissions; protect the environment; build a resilience to climate change; and generate green economic opportunities across the UK.

One of such clean energy measures proposed by the Chancellor is ‘to tackle the scourge of plastic waste by introducing a Plastic Packaging Tax, as well as providing further funding to encourage producers to make their packaging more recyclable’.

The Budget states that ‘[i]ncreasing the UK’s use of clean energy is a vital part of reducing carbon emissions and putting the nation at the forefront of new innovative industries’ – something that is fundamental to all of Mathys & Squire’s clean-tech sector clients when developing innovative technologies to solve environmentally challenging issues.

Green Lizard Technologies Ltd (GLT), a longstanding client of Mathys & Squire, has been developing commercially effective and environmentally friendly methods of recycling plastics. In November 2019, Poseidon Plastics Ltd (a joint venture between GLT, Panima Capital & Abundia Industries) partnered with the world’s leading differentiated producer of PET and PEN polyester films, DuPoint Teijin Films, in order to develop this unique polyester recycling technology. The process is unique in that it produces recycled material which is essentially free from contaminants, and therefore can be reused to produce food and drink packaging, such as PET recycled water bottles.

The new tax announced by the Chancellor – which kicks in from April 2022 – of £200 per tonne for manufacturers producing plastic items containing less than 30% recycled plastic, comes as welcome news to innovative companies such as Poseidon Plastics, and will create a huge incentive for manufacturers to explore and invest in PET recycling technologies.

Martin Atkins, CEO of GLT and Poseidon Plastics, comments: “The changes announced in the Budget today by the Chancellor mark an important milestone for plastics recyclers everywhere, and for pioneering companies like ours, a welcome boost to the importance of plastics recycling in the grand scheme of reducing environmental issues. This marks a major step forward in recognising the importance of plastics in our daily lives, e.g. increasing the shelf life of foods and minimising the impact of packaging costs in the value chain.”

Commenting on the announcement, Mathys & Squire partner Chris Hamer, who acts for GLT, said: “This could be a real turning point for businesses who have been investing in green technologies. With consumer attention being drawn to the effects of single-use plastics so significantly in the last few years, it’s great to see the government taking the issue seriously and incentivising real investment to tackle the issue. We look forward to seeing the beneficial impact of the tax as companies prepare for April 2022.”

In addition to the plastic packaging tax, the Chancellor has pledged to invest over £900 million to ensure UK businesses are leading the way in high-potential technologies, ranging from nuclear fusion to electric vehicles and life sciences – with part of this fund contributing to a wider investment of up to £1 billion to develop UK supply chains for the large-scale production of electric vehicles.

As the automotive industry races to increase sales of electric vehicles in order to phase out petrol/diesel models by 2040, the 2020 Budget emphasises the government’s efforts to provide a boost to innovative businesses to develop greener technologies and help lower vehicles emissions in the UK.

Matt Boyle OBE, former CEO of Sevcon Inc which is now a division of BorgWarner, and Challenge Director of Driving the Electric Revolution, is presently engaged in growing a UK manufacturing capability for the electrification of transport. Reacting to the Chancellor’s pledge of a £900 million fund for research into nuclear fusion, space and electric vehicles, Matt said: “Focusing this investment on bringing these technologies to market will mean we are providers of solutions rather than simply consumers. We will lead the world rather than follow.”

Sean Leach, a partner at Mathys & Squire who worked with Sevcon Inc prior to its successful acquisition by BorgWarner, added: “British engineers lead innovation in battery technology, electric motors, and drives. This is a massive opportunity to advance that lead. To gain most from it will require a proactive new approach to protecting British intellectual property, and a shift in our engineering culture to put more emphasis on IP, just as our successful German counterparts always have done.”

While clean-tech innovators such as Martin Atkins and Matt Boyle OBE are pleased with aspects of the Budget proposal which encourage greener technology, the announced cut to the so-called entrepreneurs’ tax relief is viewed by some as the Chancellor stifling entrepreneurialism.

Andrew White, who has many years’ experience of providing IP advice and guidance to startups and SMEs looking for funding or growth, comments: “All it really means is that the incentive for UK founders to base their companies in the UK is reduced. The relief is still high enough to incentivise the creation of innovative startups.

“Perhaps more interesting is the increase in the R&D tax credit rate from 12 to 13%. This will be a welcome bonus to hundreds of our clients claiming these tax credits and using them to plough capital back into their business and fund further R&D.” Reflecting on the 2020 Budget, what does stand out is that there has never been a better time for innovation in the green sectors, with significant funding being announced for green transport solutions and other green endeavours.

This article has was published in Cleantech Business News.

A version of this article, specifically relating to plastic recycling in the food and drink industry, was published in Food and Drink Network UK in April 2020 – click here to read in full.