Partners Martin MacLean and Anna Gregson have been featured in ‘Global vaccine patents rise, as data reveals shift in Big Pharma strategy’ in LSIPR, ‘Global vaccine patents up 7% in a year despite US government’s stance’ in Manufacturing Chemist and ‘Vaccine patent applications hit record high, new data reveals’ in Drug Discovery World.

In the articles, Martin and Anna provide commentary on how, despite anti-vaccine rhetoric stemming from parts of the new US administration, the number of vaccine patent applications being filed are still rising steadily after the post-COVID spike, highlighting that traditional vaccine technologies are making way for safer methods following the success of the COVID-19 mRNA vaccine.

Read the extended press release below.

Global vaccine patents applications grew by 7% in the year to June 2025, rising to 1220 from 1135 the previous year, says intellectual property (IP) law firm Mathys & Squire.

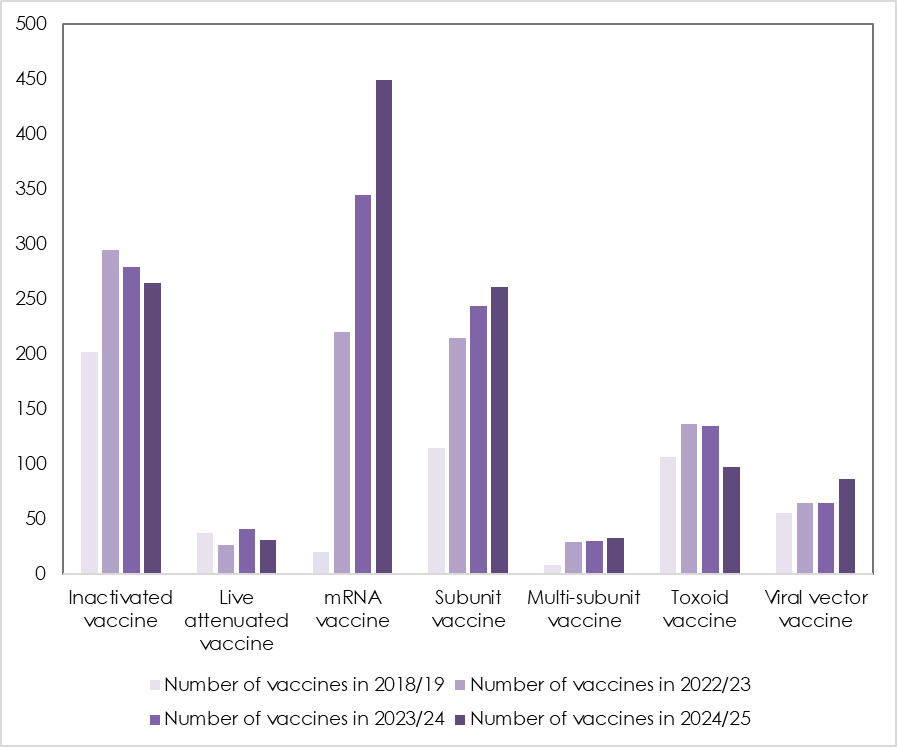

Vaccine patent applications increased sharply after the COVID pandemic with 15% growth recorded in 2023/24, when patents applications increased from 983 to 1,135. Even so, the volume of applications is still up 129% compared with 2018/19, when there were just 542.

What is interesting to note is the very clear shift in vaccine strategy that has been adopted by pharmaceutical companies, and in such a short period of time. Traditional vaccine technologies such as toxoid vaccines and attenuated vaccines are being replaced by safer, more agile technologies such as mRNA vaccines.

Patent applications for RNA vaccines now dominate the evolving patent thicket, increasing 31% to 449 in 2024/25, up from 344 the previous year and only 20 in the year 2018/19. RNA vaccines deliver a small immune triggering part of the virus directly into a cell.

Mathys & Squire says vaccine technology is moving away from traditional vaccines to more advanced technologies like DNA and RNA vaccines. Traditional vaccines include ‘toxoid’ vaccine types, which use inactive toxins to prompt an immune response, like the tetanus vaccine, and subunit vaccines use proteins to trigger an immune response.

Consistent with this shift to new technologies, toxoid vaccines saw the sharpest drop in patent applications, with filings down 28% to 97 in 2024/25, from 134 the previous year. Inactivated vaccines saw a 5% drop to 264, from 279 in 2023/24.

Mathys & Squire says the success of the Covid mRNA vaccine shows that using these newer, more agile technologies can deliver effective protection at a lower cost than conventional vaccines. There are also significant safety benefits to the newer technologies.

Traditional vaccines, such as live attenuated vaccines or toxoid vaccines often require the culture of large quantities of the microbes. This requires expensive equipment and reagents and can be associated with safety and containment concerns.

On the other hand, the genetic material used in RNA vaccines is comparatively cheap and easy to produce. Additionally, since RNA vaccines do not contain a pathogen (either active or inactive) they are not infectious, making them safer for patients, clinicians and those involved in their manufacture, says Martin MacLean, Partner at Mathys & Squire.

Anti-vaccine comments from parts of the new US administration may further slow development of vaccines.

Mathys & Squire warns that recent anti-vaccine comments from some US Government officials risks adding to a slowdown in vaccine R&D.

Martin MacLean says: “Vaccine development is an expensive process. Mixed messaging from the Government could deter new investment – and therefore limit the number of new vaccines that can be developed and patented.”

RNA patents boom, and are now the largest number of new patent filings.

* Year end 30 June 2024. Figures are based on international vaccine patent applications published under the Patent Cooperation Treaty (PCT) during the 12 months to June 2019, 2023, 2024 and 2025, classified by type: inactivated (264), live attenuated (31), mRNA (449), subunit (261), multi-subunit (32), toxoid (97), viral vector (86).