(C) Naomi Korn Associates & Mathys & Squire 2022. Some Rights Reserved. These case studies are licensed for reuse under the terms of a Creative Commons Attribution Share Alike Licence.

The following case study has been taken from the “Implications of COVID-19 on SMEs – Reassessing the Role of IP in Multiple Sectors and Industries” report written by Naomi Korn Associates and Mathys & Squire Consulting, November 2021. This case study reviews the impact of the COVID-19 pandemic on SMEs (from early 2020 through to the first quarter of 2021). It focuses on the industries most affected by the crisis and whether intellectual property (IP) and IP management may have helped mitigate its impact through adaptation and change.

Sector overview

The logistics sector has been one of the worst affected industries by the COVID-19 pandemic and continues to suffer setbacks due to renewed lockdowns, travel limitations, and an overall decreased demand. This has required changes to be made by companies which are adapting to a significant consumer demand decrease. Some businesses had to adapt their business proposition and market strategy, to aid the move from physical stores to e-commerce platforms. This pandemic has seen a shift from a transport system focused on the movement of large workforces, to providing a service reducing physical contact, yet still capable of transporting food, personal protective equipment (PPE) and medical supplies.

Analysis

Following the spread of the coronavirus in early 2020, the logistics sector has been severely impacted, with notable reduction across ocean, land, and air freight. At the beginning of the pandemic, Chinese ocean freight saw a 10% reduction in cargo transportation journeys, while there was a 20% drop in air freight, largely due to a sharp drop-off in passenger flights, which often also carry cargo. It is notable that air travel has been heavily impacted due to the social distancing requirements in place and trying to reduce the transmission of the virus. An increase in blank sailing due to decreased demand, delays in air travel due to reduced capacity, and a parallel increase in air freight rates, have all contributed to an increased demand for land and rail freight instead. However, localised lockdowns and travel restrictions have also negatively impacted the feasibility of land freight travel [1].

Overall, these reductions have created cash flow problems for many in the logistics industry, with the continued presence of the virus resulting in tens of thousands of people losing their jobs or being placed on furlough, while planned investment in the industry has either been frozen or cancelled. A recent study has shown a 67%-77% drop in public spending on travel in the US, UK, and Germany in the first half of 2020 [2], with large airlines such as Virgin Australia and Flybe declaring bankruptcy in 2020 due to cash flow limitations from flight cancellations and a substantial drop in consumer demand.

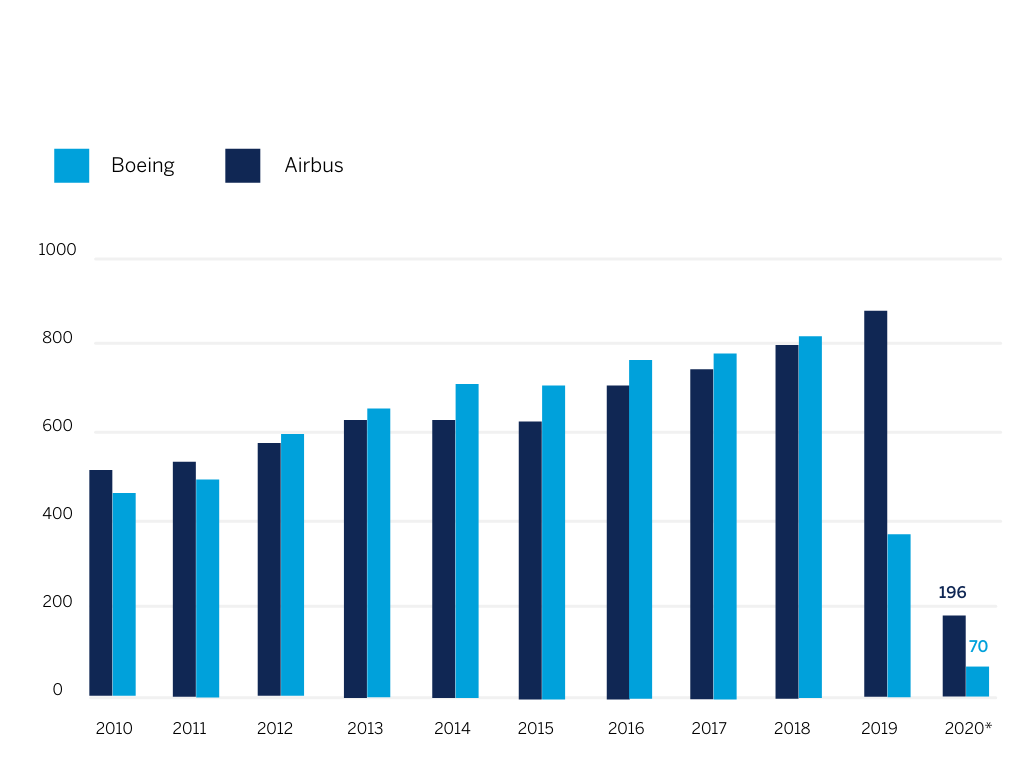

As indicated in Figure 1 below, aerospace manufacturers have also experienced a drastic reduction in demand for new aircrafts. This not only impacts large market players but also the entire supply chain, comprising SMEs from all over the world. The pandemic is expected to cause a contraction in the global air freight forwarding market of between 2%-4% [3]. However, it may also be the case that as normality returns after the pandemic, the aerospace industry starts to reallocate fleets to exclusively serve the air cargo demand, thereby reducing the number of mixed passenger/cargo flights, which are more susceptible to the effects of the pandemic [4].

Crisis critical products [5] such as medical supplies, disinfectant, PPE, and general groceries have seen a significant uptick, although not without challenges in procurement of supply and issues of quality earlier in the pandemic. There has been significant disruption to production value chains, in particular in Asia, as well as trade embargoes and restrictions on movement of certain goods. Consequently, this is likely to increase logistics costs across certain parts of the world for specific goods due to tight regulatory controls and concerns surrounding spreading of the virus.

Business models have also been forced to change, with suppliers increasingly turning to e-commerce platforms, an increased use of electronic cargo visibility and traceability platforms, as well as increased use of automation, robotics, drones and autonomous vehicles [6]. In the longer term, these changes are likely to significantly impact how businesses run and what innovation strategy they develop to further grow. In response to the pandemic and a change in consumer demand, the Chinese company JD developed an Emergency Resources Information Platform (ERIP) for intelligent demand planning, supply risk identification, and visualised tracking for production processes. The ERIP also offers IoT connected automated warehouse management systems and automated guided vehicles to improve efficiency for last-mile logistics, for instance to hospital staff and those under quarantine in Wuhan [7]. Similarly, US based Refraction AI is currently testing last-mile robotics delivery vehicles in Ann Arbor, with vehicles running on the roads, as opposed to footpaths, thereby increasing delivery speeds.

Regarding the response from the logistics industry, there are several lessons that can be learnt about IP management. Companies in the logistics industry have adapted to the digitalisation of the sector by innovating and improving their offering, to match current consumer demands. Thanks to their already existing IP portfolios, as well as new IP assets created through adaptation, companies in the logistics sector have been able to underpin new business and technology models for the protection and exploitation of these assets. Some of the inventions including remote inventory management systems, remote workforce management systems, track and trace systems and digital service delivery. These inventions are protected by copyright, trade secrets and in some cases patents, protecting the IP assets from being infringed on by competitors.

The pandemic has accelerated the digitalisation and generation of robust digital capabilities in the logistics sector and moving forward, these inventions will keep increasing efficiency and reducing costs. As the pandemic begins to come under control, it is the management and protection of these inventions, as well as their importance in contributing to revenues and building value, that management teams must understand.

The Intellectual Property Office of Singapore (IPOS) believes that IP assets and digitalisation go hand in hand and governments and businesses should be seeking to build an ecosystem, focusing on the protection and utilisation of these IP assets, arising from digitalisation. In this context, IPOS has launched an acceleration program designed to expedite the patent granting process to facilitate quicker commercial utilisation of those assets [8]. Recognition of the importance of intangible assets is growing in this sector with a 6.6% increase in transport related patent filings observed by the EPO in 2019, with digital technology and autonomous vehicles patents responsible for much of this growth. In this context, the Chinese logistics firm, JD Logistics has rolled out a fleet of 100 vehicles in Changsu for deliveries home, as well as to hospitals.

However, while the boom in e-commerce has led to significant growth, for many companies it has also led to a marked increase in cases of IP infringement. This raises additional questions surrounding IP responsibility within the logistics supply chain, where traditionally responsibility has been placed on the producer, rather than the retailer or shipper. Moving forward, where patent owners are unable or unwilling to pursue the infringing manufacturer, they may begin to pursue the end retailer or shipper, with significant impacts on the whole supply chain as a likely result. The outcome of current legal cases in the US in this context may potentially spark the revision of supplier agreements from the point of IP protection, as well as opening the supply chain for the analysis of IP risk, thereby having a significant impact on the retail and logistics sectors overall. There is also a need for governments around the world to review their IP enforcement regulations to assist struggling industries, like the logistics industry and support them to enable global economic recovery.

Naomi Korn Associates is one of the UK’s specialists in copyright, data protection and licensing support services.

Mathys & Squire Consulting is an intellectual property consulting team that can support all businesses in capitalising intangible assets.

Naomi Korn Associates and Mathys & Squire Consulting are working in partnership across multiple industries to provide innovative consultancy IP support services.

[1] World Bank Group (2020): The Impact of Covid-19 on Logistics, International Finance Corporation

[2] Statista (2020): Covid-19 Barometer 2020, Statista

[3] Transport Intelligence (2020) Global Freight Forwarding Market Sizing 2020 Covid-19 Impact Analysis, Transport Intelligence

[4] World Bank Group (2020)

[5] Tietze, Vimalnath, Aristodemou, & Molloy (2020): Crisis-Critical Intellectual Property: Findings from the Covid-19 Pandemic, University of Cambridge

[6] World Bank Group (2020)

[7] Capgemini (2020): How digital innovations enabled supply chains to remain operational during the COVID-19 outbreak

[8] IPOS (2021): Acceleration Programmes, https://www.ipos.gov.sg/protect-ip/apply-for-a-patent/accelerated-programmes