Fourth Industrial Revolution: Deep tech innovation in smart connected technologies

2022

5 mins

The European Patent Office (EPO) and the European Investment Bank (EIB) have teamed up for the first time to issue a joint study that offers key insights into small and medium-sized enterprises that invest in the development of new technologies linked to the Fourth Industrial Revolution (4IR).

Technologies linked to the 4IR are described as blurring the lines between the physical and digital spheres, altering the way we live, work and interact. They include technologies such as the Internet of Things (IoT), cloud computing, 5G and artificial intelligence (AI), spanning sectors such as healthcare, transport and cleantech, as well as data analytics.

Report findings

While the US may lead the way globally, the UK leads the way in Europe

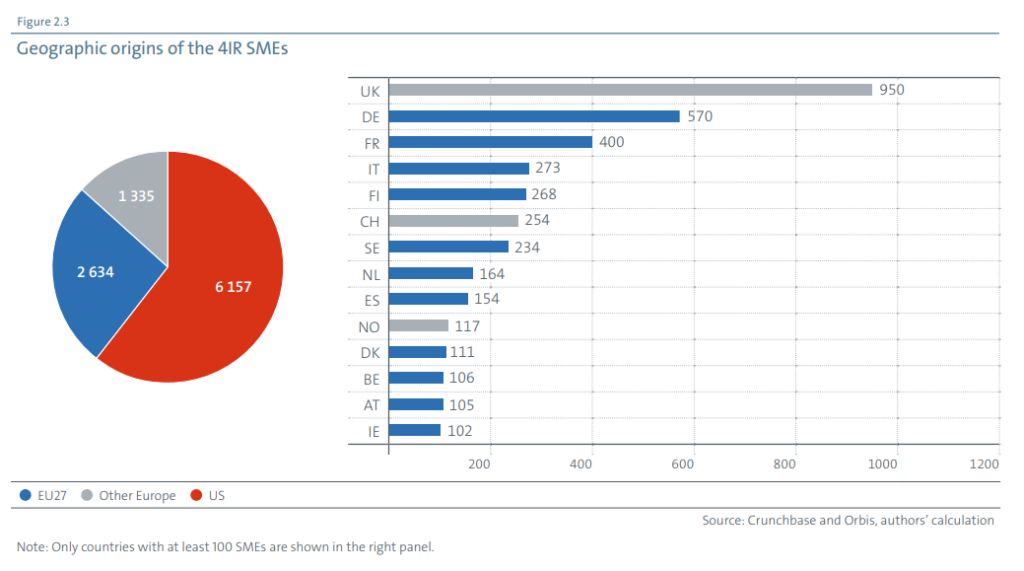

The report finds that US SMEs make a higher contribution to innovation in 4IR technologies than SMEs in the EU. This is also compounded by the fact that they also file more patents on average: the report identifies that while European SME owns 1.8 4IR international patent families (IPFs) on average, their US counterparts own 2.5 IPFs.

However, outside the EU, encouragingly the UK has the largest number of 4IR SMEs (950).

Between 2010 and 2018, almost 200 000 4IR inventions were submitted for international patent protection globally. In 2018, they represented more than one tenth of IPFs in all technologies. The US was the strongest contributor with 31% of all 4IR IPFs, followed by Japan (18%) and Europe (15% for the EU27 and 19% for the 38 EPC countries). R. Korea (12%) and P.R. China (11%) have been catching up quickly over the last decade.

European deep tech businesses involved in technologies linked to 4IR have a higher level of investment

The report recognises that patents and IP are important assets, enabling technology SMEs to raise capital and finance innovation. They allow enterprises to obtain funding at more favourable conditions. Since they are publicly disclosed, patents help investors assess the quality of the firm’s technological capabilities, reducing asymmetric information between them and the company.

The report found that EU 4IR SMEs received significantly higher funding than other EU SMEs and show a higher investment intensity, with up to 70% of total investment targeted at 4IR innovations among young 4IR SMEs. Perhaps this reflects that realisation that while deep tech innovators typically have a strong disruptive potential, they face specific issues such as higher development costs and market and technological risks which therefore need to be protected with strong IP rights such as patents.

On average, 4IR SMEs listed on Crunchbase received substantially greater funding than a benchmark group of SMEs, especially during the build and growth stages. The report notes that the higher investment intensity of 4IR SMEs is driven by greater investments in intangibles and, more specifically, research and development (R&D), which highlights the high technological nature of these companies.

Importance of patents in deep tech businesses

Interestingly the report also identifies that many businesses recognise that patents are important to their business for a number of reasons:

- supporting the company’s reputation;

- obtaining freedom to operate the invention;

- facilitating business partnerships and co-operations;

- prevents imitation/copying;

- secures finance (IP may also be used as collateral for loans or to back equity investments*); and

- increases company revenue.

*In fact, over half of 4IR SMEs in the EU27 and 63% of 4IR SMEs from the three other European countries (UK, CH and NO) reported that IP was considered collateral by investors.

Exit

The report also identifies that there is a strong acquisition demand among 4IR SMEs, which translates into a strong incentive for investors to invest in high-growth firms from an early stage. It also increases their willingness to invest large sums in these firms and invest more “patiently” which is extremely important to deep tech businesses which are very R&D intensive and therefore have relatively long lead times before the technology can be implemented commercially. This follows the logic that, where there is higher acquisition demand, investors know that there is a good chance that their investee firms will ultimately be acquired by a deep-pocketed corporate, allowing them to exit their investments successfully.

Written by: Andrew White